Something peculiar happened to me a month ago. I woke up on the 9th of November 2020 and found one of the companies in the Lumenary portfolio had rocketed overnight.

Properly rocketed.

I don’t mean a high single-digit jump usually seen when an institutional investor joins the party, I mean it spiked by 25%. To be clear, it was interesting to me, but not surprising because I had opened a position around May this year and saw huge potential in the company. I just didn’t expect this level of magnitude so suddenly.

How do I minimise regret?

The company in question, a European large-cap, dominates the continent in all things ticketing — sports, live music, and other concerts you name it. And if you know our fund, yes, it is founder-led. In short – no concerts, no crowds, means no revenues. But on 9 November, news of Pfizer’s vaccine spread and the +25% revaluation occurred overnight. It was as if the market hadn’t priced in the possibility of a vaccine. I bet a bunch of investors who missed the boat thought: why didn’t I see the vaccine coming? That familiar feeling of regret well-known to all investors.

I started thinking more about regret. Yes, it’s a part of life we can’t avoid. Yes, there’s always something you could have done better; a searing reminder of how to improve next time. But that’s exactly the point — we can make decisions now to minimise our regrets in the future. 10 years from now, how can we look back and say we’ve genuinely minimised our investment regrets?

Future self & present self

If you’ve ever experienced thoughts of why didn’t I see that coming? Or it was so obvious in hindsight, then you’ve learned a valuable investment lesson. What matters the most in investing is what happens in the future, not what is happening now or what has happened in the past. Sure, historical information should be used to gain background and context, but stock prices represent the present value of future cash flows, not historical.

Once you get that familiar feeling of regret, it’s too late to change anything. It’s too late to invest once news of the vaccine has already spread. Reactivity is not a great investment strategy.

Instead, your future self will thank you for the long-term investment decisions you implement now. The companies you invest in now should be those that will emerge as the great companies of the future. These companies should be on the edge of greatness.

In theory, this sounds simple, but in practice, our clarity is obscured by market noise and sentiment. Sometimes it becomes challenging to distinguish between companies genuinely on the edge of greatness or those that are just hype.

Truth always prevails over hype

There are plenty of companies receiving hype (many would classify these prospects as venture capital (‘VC’) investments) but to be clear, there is an entire world of innovative companies that aren’t start-ups. Investing in future-focused companies doesn’t just mean start-ups. My fund is an example of how you can find companies on the edge of greatness without investing in high-risk ventures.

The way I see through the hype is a systematic one. Faster. Better. Cheaper. These are the companies on the edge of greatness. At Lumenary, this is where we play. The key is to look for founders that aren’t inhibited by bureaucratic red tape. Companies that are creating new products and services that solve customers’ problems in a faster, better, or cheaper way than the incumbents. The era in which we live now favours these companies. Beware those institutionalised companies that purport to be innovative, but behind the scenes have one foot on the accelerator and one on the brake. They’re overly protective of their moat and not focusing on expanding the castle’s arsenal.

Changing your future today

If you start viewing investing as a way to minimise regret, as I do, you’ll start seeing opportunities that will play out into the future, not just the now. These are companies solving problems for their customers, enabling them to do things faster, better, and cheaper – exactly where we have been investing. Areas that might seem insignificant now, often grow to become key industries as human habits and behaviours evolve. How did social media come from nowhere 15 years ago to now dominate the advertising industry? In that vein, here are areas where I’m minimising my regrets.

Beyond video and music streaming

Most of us are familiar with music and video streaming services, but you may not have considered another form of entertainment that is currently being transformed; a segment at the heart of the content train. This is the area of digital comics, novels, and web cartoons. Traditionally, paper-based comics have been easy to consume on public transport, which is already a huge market in Japan. But with more and more readers now preferring mobile devices, digital comics/cartoon platforms present a better offering. They’re on-demand, have more variety, and lend well to train rides. This segment is experiencing a growth trajectory similar to the early days of music and video streaming.

The future of financial services

Imagine a fund platform (e.g. Netwealth) combined with a loan market platform. A place where consumers can transparently and easily browse all sorts of financial products ranging from managed funds, ETFs, loans, digital banking, brokerage – a truly complete financial marketplace. The platform brings ease of access and transparency, in return, they clip the ticket on each successful transaction. It’s faster, better and cheaper for the consumer to go direct. They get to bypass the myriad of middlemen that usually surround the industry. Watch this space. There are parts of the world already leading this area and with the advent of digital currencies over the next 10 years, we will see a truly digital financial services industry. Our fund is invested in this segment. Those that can’t evolve will be left behind.

Aggregated payment platforms

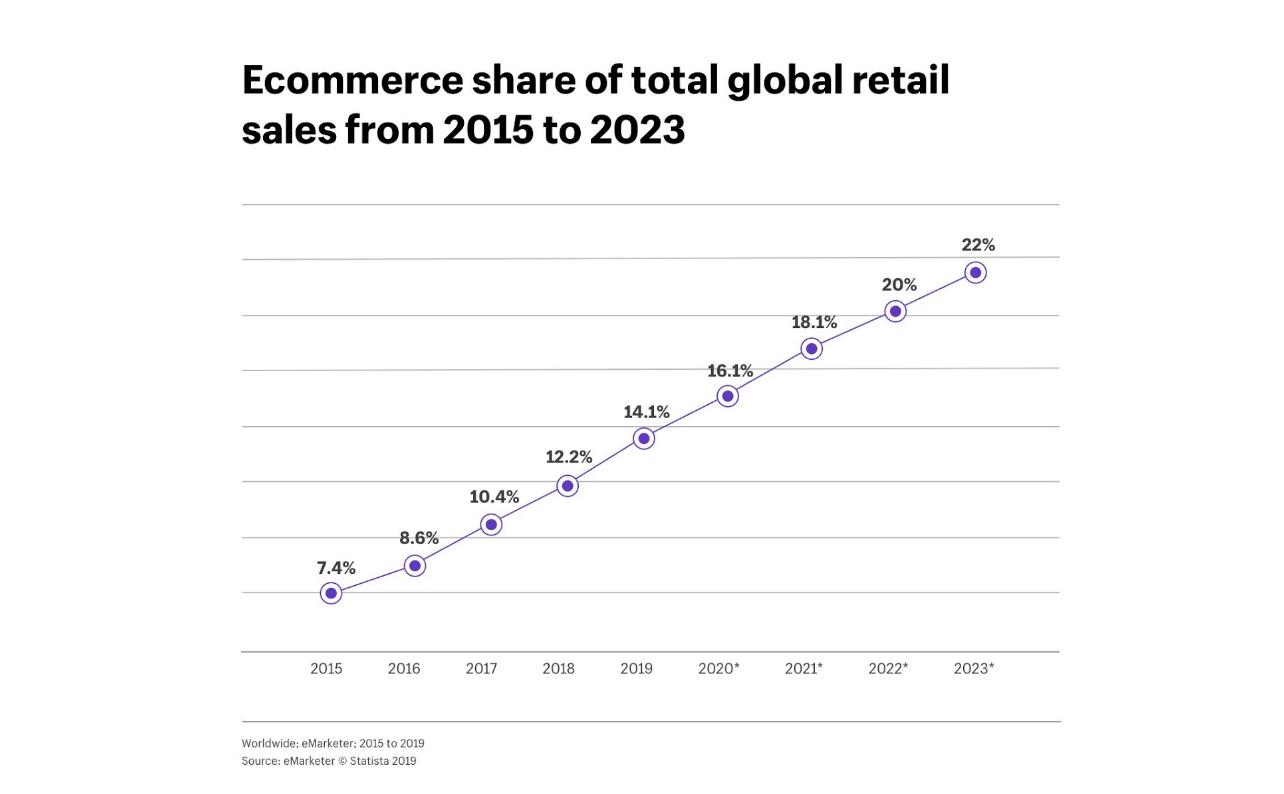

E-commerce transaction volumes are expected to double within the next three years and the pace at which e-commerce invades bricks-and-mortar retail will continue beyond the pandemic. Shopping online is faster (get rid of those long lines), better (more items to browse and more customisations available on a global scale) and cheaper (bring on Black Friday / Cyber Monday). As the marketplace for goods becomes global, big companies need to solve a problem – not all customers use Visa and Mastercard. They need to cater to all the possible payment methods customers might use. This is where aggregated payment platforms solve that issue. They do all the hard work aggregating global payment methods, so big corporates just need a single interface into their infrastructure. In return, these aggregated payment platforms take a slice of all physical and digital transactions that flow through the system. As the world becomes more global, solving the online payments issue becomes ever-pressing.

Happy compounding.