The Whitehaven Coal Ltd

(ASX: WHC) share price surged last week despite no obvious news or announcements from the company.

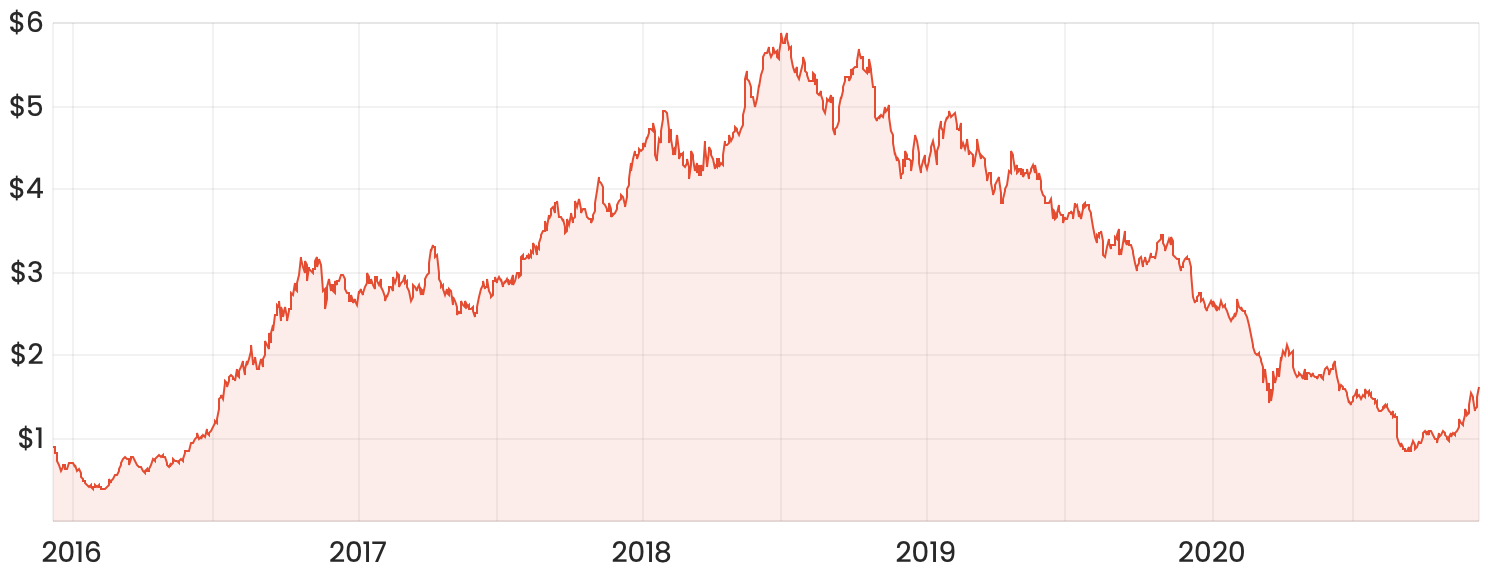

Whitehaven shares are up over 16% from the start of the month, although as you can see from the chart below, shares have been on a gradual decline for the last two and a half years.

WHC share price chart

Whitehaven Coal is Australia’s leading producer of premium thermal and metallurgical coal. It has five mines throughout New South Wales that employ over 2,000 people. Whitehaven has unfortunately been tied up in some ongoing issues surrounding coal import restrictions imposed by Chinese officials. However, it should be noted that just 1.6% of Whitehaven’s 2020 revenue was attributed to Chinese buyers, according to its reports to the ASX.

Australian coal imports have been subjected to informal bans and up until recently, it was unclear how the situation would be resolved. As a result, Whitehaven shares became an increasingly popular short position among ASX investors.

The recent surge in the Whitehaven share price could be the result of new evidence that demand from China may in fact increase over December, rather than fall like originally anticipated.

Is the Whitehaven share price a buy today?

I can partially see the appeal of holding Whitehaven shares in the short to medium term to potentially capture some upside as sentiment towards China improves. However, it’s not somewhere I’d typically invest for a couple of reasons.

Firstly, the tense relationship between our exporters and other countries is something we seem to be seeing more of recently. While issues might be resolved eventually, I do see this as an ongoing headwind.

Secondly, I also try and avoid price-taking businesses that rely on an underlying commodity price. Price-takers can often only succeed in certain market conditions, so it would really come down to your own view on future commodity prices, which is something I’m unsure of.

An alternative

One ASX share that isn’t exposed to international trade barriers and has qualities opposite to a price-taker is Transurban Group (ASX: TCL).

Transurban currently operates 21 toll roads across Sydney, Melbourne, Brisbane and North America.

Transurban has abnormally strong pricing power and most of its toll fees can be increased by either the annual inflation rate or 4% per year (whichever is higher).

I view this as a far more attractive investment proposition compared to industries that are up against an ongoing battle with regulators.

If you’d like to know more, click here to read my recent article on Transurban shares.