The Aussie Broadband (ASX: ABB) share price has skyrocketed since first listing on the ASX in October in a $40 million oversubscribed IPO.

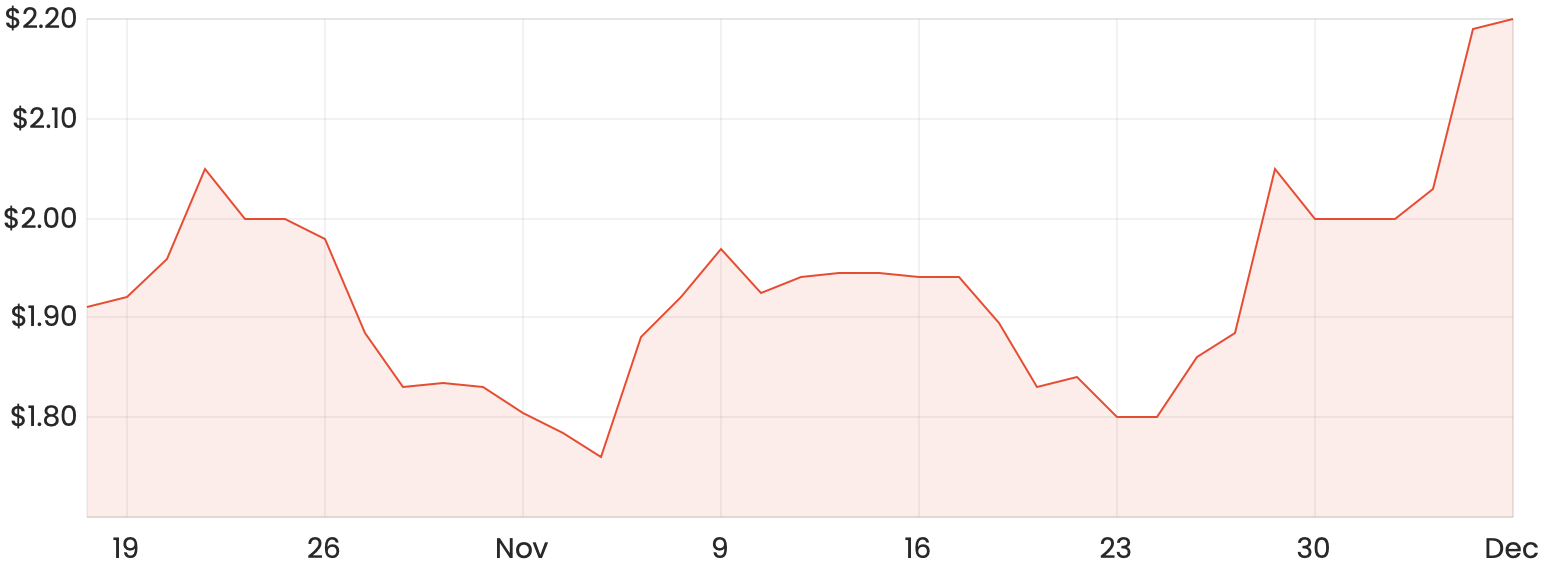

Aussie Broadband shares were initially offered to institutional investors and customers at $1 per share, but have since more than doubled to $2.19 at the time of writing.

ABB share price chart

Company background

Aussie Broadband is currently Australia’s fifth-biggest provider of NBN services with more than 300,000 residential and business customers across the country.

Its primary service is NBN retail, however, it also offers services across VoIP (Voice over Internet Protocol), mobile plans and entertainment bundles through a partnership with Fetch TV.

Why I prefer Aussie Broadband over competitors

In the Australian telco industry, other companies like Telstra Corporation Ltd (ASX: TLS) have had a monopoly in the past. This means that when new competitors enter such as Aussie Broadband, Telstra and other big players could struggle to retain their market share, and it would be even harder to increase their market share as the new entrant wins new customers.

What makes it hard for internet service providers (ISPs) that they all sell the same thing with limited ways to stand out from their competitors. As a unique selling point, ISPs can only really offer more competitive prices or a better customer experience than their rivals.

Aussie Broadband doesn’t offer better prices but in my view, the reasoning behind this makes sense. NBN retailing is typically quite low-margin, which is why many new telcos have failed in the past. Aussie Broadband actually charges higher than the average ISP and reduces its costs with efficiencies through its automation systems.

By far, Aussie Broadband’s unique selling point is its award-winning customer service experience. Without mentioning any names, customer service really does seem to be the number one complaint you hear regarding other service providers. I think the negative reputation amongst competitors could last a long time, which could create a pretty sustainable competitive advantage for Aussie Broadband at least in the short to medium term.

Summary

It’s interesting that this company has been able to stand out, but not because of offering the lowest prices. It really goes to show that customers are willing to spend more for a quality service.

In regards to the valuation, Aussie Broadband shares aren’t looking extremely cheap considering they were initially valued at 12.3x forecast earnings. Keep in mind this valuation applied when the company first listed and shares have since doubled.

Even at these levels, however, I’d be happy to pick up some Aussie Broadband shares as I like the direction this company is heading in and the reputation it has among its users.