Last week, Zip Co Ltd (ASX: Z1P) shares were the most traded on the ASX, just ahead of Creso Pharma Ltd (ASX: CPH) and Treasury Wine Estates Ltd (ASX: TWE).

Interestingly, buyers accounted for roughly 70% of trades, so it seems that some ASX investors are using this pullback as an opportunity to average down or start new positions in buy now, pay later (BNPL) shares.

Related video: SaaS metrics explained

What’s been happening to BNPL recently?

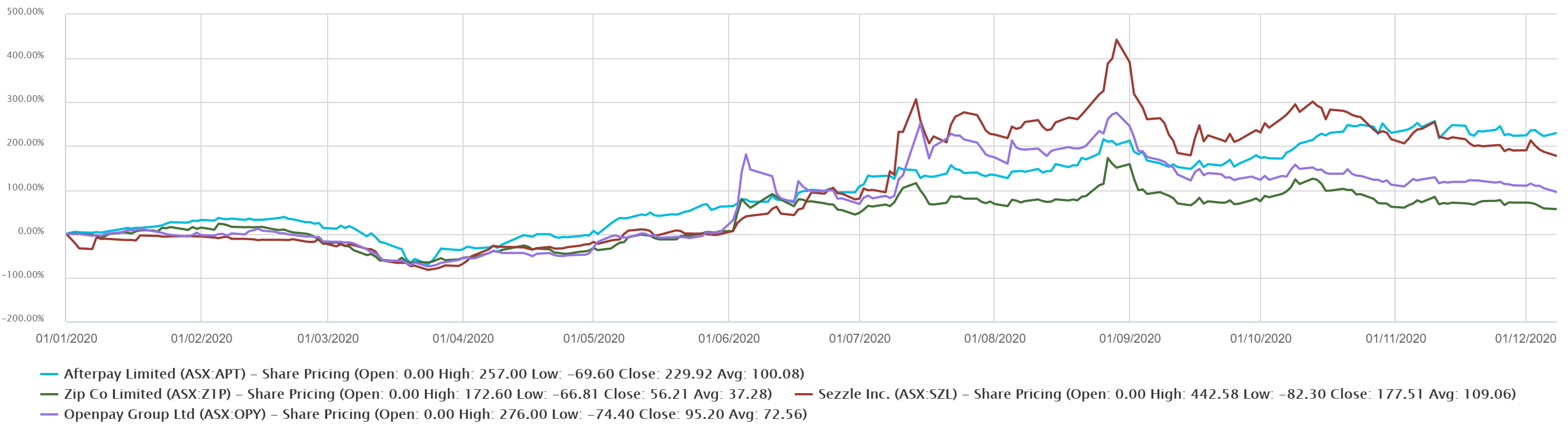

I’ve plotted the year-to-date (YTD) share price chart for Zip, Afterpay Ltd (ASX: APT), Sezzle Inc (ASX: SZL) and Openpay Group Ltd (ASX: OPY) below.

As you can see, it’s not just

Zip that seems to be falling recently. This pullback is affecting the broader BNPL sector, with the exception of Afterpay (light blue line).

Afterpay shares have hovered around the $95 mark for a while now and have somehow avoided this recent downward trend. The reason behind this is somewhat unclear, however. Companies like Zip have reported record growth in terms of transaction value and customer numbers, so I think it’s unlikely to be performance-related.

What’s more likely to me is that while we’ve seen the recent rotation out of COVID-19 beneficiaries such as BNPL stocks, investors are probably more likely to stick with the market leader rather than smaller rivals, so I think the sentiment around Afterpay is stronger at the moment as investors cling on to ASX shares that used to be the market darlings.

Does this mean smaller BNPL’s are a buy today?

That would depend on your overall sense of the value of these companies and whether you think you’re now picking up shares at an attractive discount to prior levels and true valuation.

I’m of the opinion that the vast majority of BNPL companies are significantly overvalued relative to their earnings/profit even after this recent pullback. For some number crunching, click here to read how I value Zip shares, but keep in mind that this actually applies to most BNPL stock valuations, not just Zip’s.

Is this the start of the end for BNPL?

To me, it seems unlikely that this is the beginning of the end for BNPL and I don’t think we’ll see Zip shares test their March lows around the $1-2 mark. I’m actually relatively bullish on BNPL as an industry, however, one of my main concerns is regarding the valuations.

BNPL was undoubtedly one of the hottest sectors in 2020 earlier this year, and during this time, I think valuation methods were somewhat disregarded.

This was partially understandable though, as valuing tech/growth companies is inherently difficult. If your valuation method assumes that the current share price is equal to the present value of all the company’s future cash flows, it is essentially impossible to exactly predict the earnings/revenue growth rates are also unknown.

I think the market could now be starting to realise that some of the market capitalisations attributed to some of these companies are too big to make sense relative to how much they earn at the moment.

Take Afterpay’s market capitalisation of $27 billion. Using a P/E ratio of 30x, it would need to have earnings and revenue of around $900 million and $9 billion, respectively, for its current valuation to make sense. Afterpay generated $450 million in revenue in FY20.

This isn’t to say that Afterpay won’t or can’t achieve these sorts of revenues at some point in the future. It may well happen, but based on its current results, these valuations seem a way off where they probably should be today.

Summary

Some BNPL companies could be several years away from being able to generate such high levels of revenue and earnings and therefore, I don’t think their valuation multiples are going to hold in the meantime.

At this point, the BNPL companies are not for me as I think the upside was significant a couple of years ago and also in March this year.

But now the level of growth needed to justify the current share prices is high. So to expect further upside in the share price from here would be to also to assume that these companies can grow even more on top of this.

There are plenty of other ASX shares that I believe have great prospects yet trade on more reasonable valuations. For some more ideas, here are 3 ASX shares that I’ve got my eyes on at the moment.