The last time I wrote about the Douugh Ltd (ASX: DOU) share price a couple of months ago, I labelled the company as an Australian-listed neobank. I would be wrong to place Douugh in the same category now though it seems.

Much of the attention Douugh has received recently has been concerning exactly what sort of business it actually is. From a legal standpoint in Australia, it may be misleading to the public to have “bank” in the name, when in fact the company may not be an authorised deposit-taking institution (ADI).

However, Douugh CEO Andy Taylor says that the company hasn’t broken any rules as it only currently operates in the US. Under US neobank definitions, Douugh does

in fall into this category, as it operates as a fintech using a partner banks’ licence.

For now, Douugh has ceased identifying itself as a neobank and is describing itself as a “capital-light, purpose-led fintech developing a financial wellness platform”.

So what does Douugh do?

Developing an in-depth understanding of how a business operates is the bread and butter of any fundamental investment analysis. This is important because while the other big four ASX banks are usually seen as fairly safe and stable investments, to label a riskier start-up with the same “bank” terminology might give off the wrong impression to some investors (especially those who might be new to investing).

To be clear, Douugh does not have many of the typical features of a commercial bank, in that Douugh itself doesn’t accept deposits and issue loans to customers.

At the moment, Douugh only offers a mobile app for Apple users (not Android) that claims to help customers better manage their money. A user can pay in their salary which can be then siphoned into different “wealth jars”, allowing customers to help save their money more effectively.

The money itself is held by Douugh’s partner, Choice Bank, which I assume has its own account with the Federal Reserve. All deposits are insured up to US$250,000 through the Federal Deposit Insurance Corporation (FDIC).

At the moment, Douugh earns money through a transaction fee for card purchases in the US. While the product has been launched in the US, it’s yet to be seen how many customers use the platform and how much revenue this is translating to.

Why else has the Douugh share price been going down?

At the beginning of the month, Douugh announced it would enter the buy now, pay later (BNPL) scene through a partnership with Humm Group Ltd (ASX: HUM). Douugh came under pressure when the ASX said that it should’ve been told first, rather than initially informing financial media outlets.

Under ASX requirements, listed companies must disclose information to the ASX if it’s reasonable to expect a material effect on the share price.

Douugh has also announced that it will enter into a distribution channel through a member-get-member incentive. Some market commentators have pointed out that this type of channel has similarities to Emerge Gaming Ltd (ASX: EM1) and its most recent subscriber incentive program. The program has been accused of generating new subscribers through a multi-level-marketing company, although it’s yet to be revealed the true circumstances of the customer onboarding process.

As an additional connection between the two companies, one of the directors of Emerge Gaming, Bert Mondello, is also a non-executive director of Douugh. There’s a lot of investor speculation weighing on the Douugh share price here, as not much has been confirmed or denied by management.

Is the Douugh share price a buy today?

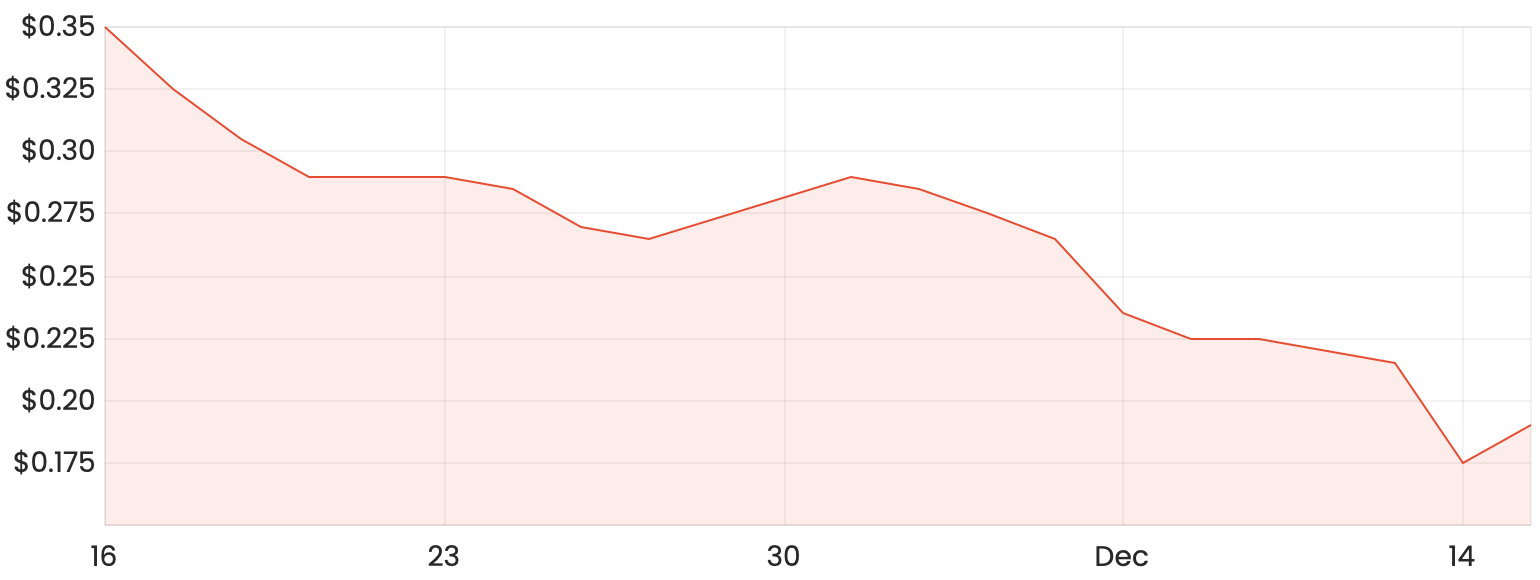

There’s been a series of events that have contributed to the recent downward trend in the Douugh share price.

It’s also important to keep in mind that shares rallied extremely hard at one point. While Douugh listed in early October at an offer price of 3 cents, the market then went on to value shares at around 35 cents at the height of the rally.

DOU share price chart

If you did buy shares closer to the top and you’re now wondering what the best thing to do now is… Consider why you decided to buy shares in the first place. If you had strong conviction towards the long-term prospects of the company, I’d say not that much has changed, despite the negative appearances in the financial media.

If your investment decision was more speculative in nature, consider if you’re willing to wait for the business to generate cash flows or potentially make more announcements.

Whatever your decision, I truly believe there’s nothing wrong with accepting a loss if you think there are better options elsewhere that will generate excess returns.

For more share ideas, click here to read: 3 ASX growth shares to add to your January 2021 watchlist.