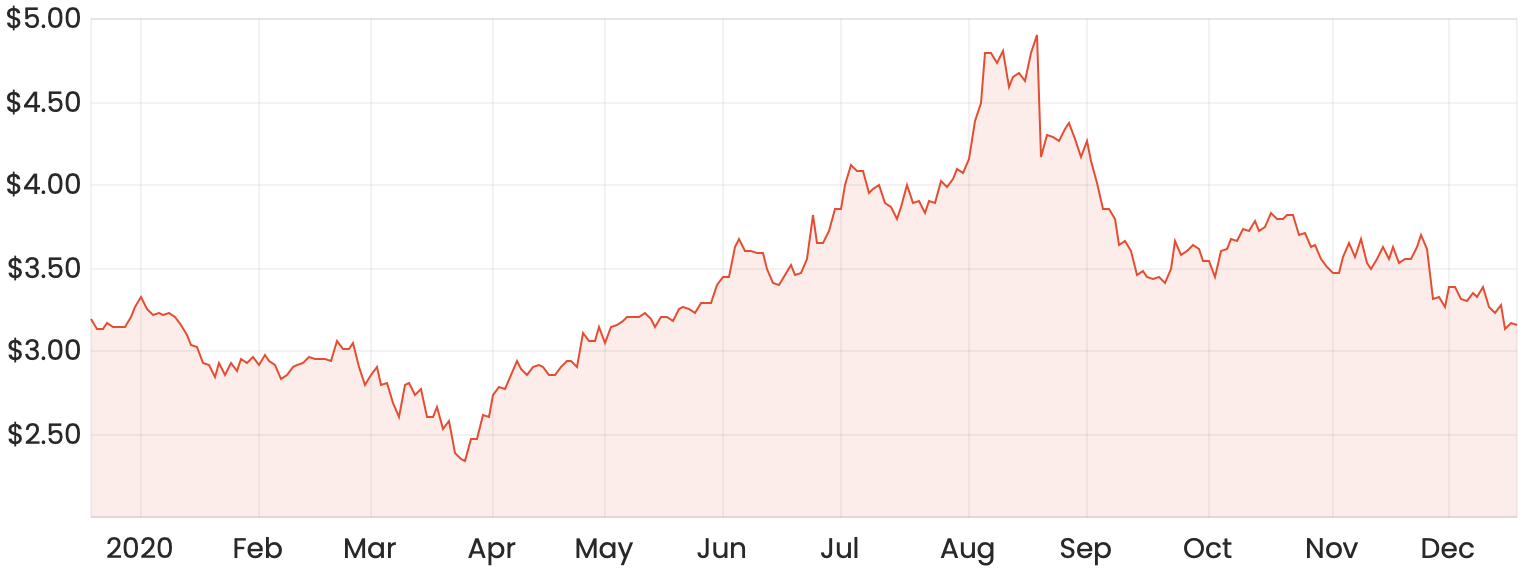

2020 has been a volatile year for shares in software company Integrated Research Limited (ASX: IRI). The downward trend started around August and since then, the IRI share price has tumbled roughly 38%.

Keep in mind however that IRI had a spectacular run leading up to August since the end of March, so shares are more or less trading at their pre-COVID levels today at around the $3 mark.

IRI share price chart

What does Integrated Research do?

Integrated Research has positioned itself as a global leader in developing enterprise software able to monitor and troubleshoot critical IT infrastructure, payments and communications systems. Around 95% of its revenue comes from overseas, reaching over 60 countries globally.

Its main customers are large organisations such as banks, credit card companies, stock exchanges and telecommunication carriers. The company’s suite of prognosis products can quickly identify the root-cause of problems, resulting in significant cost savings and avoiding downtime and outages.

Why has the IRI share price been going backwards?

I think the recent downwards trend can be narrowed down to a few main reasons.

Like many other companies, COVID-19 has presented itself as a significant headwind since the start of the year. Integrated Research’s suite of products are built for mission-critical applications, but even still, management has indicated that COVID has deferred many customers’ purchasing decisions. Additionally, the company relies on a sales team to distribute its products and the sales cycle has been slowed down due to complications from the pandemic.

Changes in foreign exchange rates have also contributed to the recent drop in 1H21 revenue and net profit. According to management, even just a one cent movement in the AUD/USD exchange rate can result in a $1 million change in revenue on an annualised basis.

Since March, the AUD has been appreciating against the greenback. Integrated Research receives the majority of its revenue in USD, which ultimately means it’s more expensive to buy AUD when converting back to our domestic currency.

It’s also important to note that the IRI share price shot up over 100% in the course of just five months since the start of March. Whether this rally was justified or not, I’m not completely sure, but it’s very common for high-quality companies to go through cycles of being undervalued and overvalued.

At the height of the rally in August, Integrated Research shares were trading at around 35x FY20 earnings, whereas now, they’re trading on a more attractive price-earnings multiple of around 20x. Given this, I’d be willing to say shares were just a little bit overvalued a few months ago and a pullback was fairly justified.

What’s to like about Integrated Research?

I can happily look past these recent share price movements and move my attention to the strong fundamentals of this company.

Integrated Research’s income statement over the last five years is everything I’d want to see in a potential investment, with revenue and net profit increasing in that perfect staircase figure year on year.

This business is extremely cash flow generative and achieves a very high net profit margin of around 22%.

Despite investing over 20% of annual revenue into research and development, it still maintains a consistent dividend of around 7.25 cents per share, which represents a yield of roughly 2.4%. Not bad considering these shares have been more than a ten-bagger at stages over the last 10 years as well.

Return on equity (ROE) is also very impressive at usually over 30%, and the company typically has a debt-free balance sheet.

What is going to drive further growth?

Here are a couple of things I’ve identified that could help Integrated Research on its upward trajectory.

Business model evolution

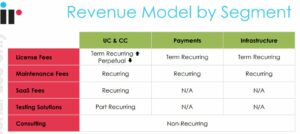

Integrated Research primarily generates revenue in the form of licence fees for its products. In this situation, revenue is recognised up-front but also on a recurring basis.

One of IR’s current objectives is introducing new Software-as-a-Service (SaaS) products that will recognise revenue over time. This addition is in line with the company’s strategy of building long-term recurring revenues. The below image shows IR’s revenue model by segment.

Structural shift to cloud and remote working

Management indicated at the recent AGM that 84% of banks globally are planning to move mission-critical systems to cloud-based solutions. Integrated Research should be in the perfect position to capitalise on this shift as it additionally moves its customers from an on-premise model to a hybrid model.

An estimated 500 million global workers will be operating remotely in calendar year 2021. This additionally ties into the shift to cloud-based software as on-premise models would pose a challenge from a home environment.

COVID-19 has brought on years of technology adoption, especially in the case of digital payments. This benefits IR because its Transact platform is designed to troubleshoot payment systems.

All of these structural shifts should allow Integrated Research to continuously grow its total addressable market (TAM), which is something I often look for in a quality business.

Summary

Despite the volatile price movements, Integrated Research is clearly a quality business in my eyes, with a few macro tailwinds working in its favour here.

If I bought shares at higher levels earlier in the year, I would personally see this pullback as an opportunity as I like the company’s future growth prospects.

For more share ideas, check out this article: 3 ASX share ideas for your 2021 watchlist.