The A2 Milk Company Ltd (ASX: A2M) share price finished up nearly 24% lower on Friday after releasing an announcement with updated FY21 guidance figures.

For an in-depth breakdown of the numbers, I’d encourage you to read Lachlan Buur-Jensen’s recent article: Here’s why the A2 Milk share price is tanking.

The purpose of this article is simply my own view of how I get a sense of value when it comes to a2 Milk shares.

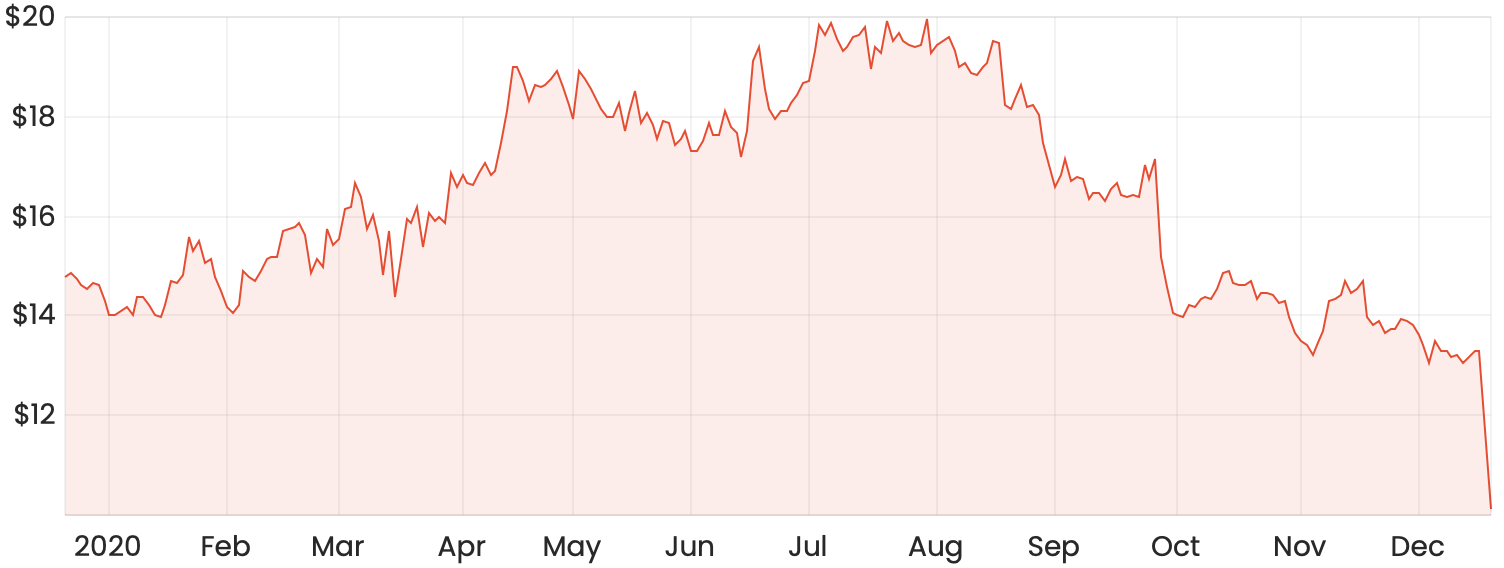

A2M share price

Quick recap

At a current price of $10.14 per share, this represents roughly a 50% discount to where a2 Milk shares were in July this year.

While typically viewed as a growth stock, I’m left wondering if these shares are attractive on the basis of value, with (hopefully) additional growth prospects in the future.

My valuation process

It would be fairly straightforward to use traditional valuation metrics such as price/earnings (P/E) or price/sales (P/S) ratios in order to get a rough sense of valuation here.

While this would be part of my process, the reality is, there are still so many unknown elements that could weigh in on the valuation. For this reason, I’d prefer to tackle this investment decision on a more qualitative basis, rather than just on numbers alone.

To illustrate my prior point, with a current market capitalisation of $7.6 billion, that puts a2 Milk shares on a forward P/S of around 5.5x based on these new guidance figures. Looks cheap right? Perhaps, but the market has valued a2 Milk shares at this level for a reason.

My point here is that it’s not enough (for me) to buy shares solely on the basis that they’re cheap, but to consider why they’re cheap, which will hopefully guide the investment decision process.

Things to consider

One of the most important aspects to me is the length of time it will take to see a recovery in parts of a2 Milk’s business.

I note from the recent update that management indicated COVID-19 will continue to have an effect on the reseller channel due to reduced travel between Australia and China through the remainder of FY21, with limited prospect of international students and tourists returning to Australia throughout this time.

This is clearly not what you want to read, but in saying that, it also seems unlikely that this is going to be an ongoing headwind in the future. It’s pretty much certain that international and leisure travel will resume at some stage and based on this logic, it also seems likely that the daigou channel will also make a recovery at some point.

Given that FY21 revenue is set to come in roughly 11% to 19% lower than the prior year, I wouldn’t expect the a2 Milk share price to move too dramatically upwards in the meantime, however.

Additional concern

I also think it would be wise to consider the ongoing trade war between Australia and China and how this affects your investment decision.

No Australian commodity seems to be safe recently, with coal, iron ore, seafood, wine, cotton and barley just to name a few that have come into trouble.

The way I see it, China’s ability to create trade disruptions would likely depend on how reliant they are on a2 Milk’s products and if they have additional substitutes if an outright ban were to be introduced.

Here’s one thing to consider though: with many other commodities that have been shadowbanned by Chinese authorities, many of the users of these products are businesses and it’s relatively easy for their government to issue directives to cancel the orders.

To a2 Milk’s advantage, it has a direct to consumer network through a daigou channel and as such, I think it’s much harder to discourage purchasing on a large scale. Plus, a2 Milk is a Kiwi company after all. This isn’t to say an official or unofficial ban couldn’t happen at some point, I’m just pointing out some differences between other commodities.

Is the a2 Milk share price a buy today?

Personally, I try to avoid thinking a share must be good value simply because it’s at a huge discount to where it once was.

Firstly, it might’ve been overvalued beforehand and in this case, there are many qualitative factors that I must consider that will weigh on the valuation.

To think about this from the opposite side, a2 Milk is an amazing growth story and its revenue and net profit trajectory over the last five years or so has been undeniably impressive.

I unfortunately can’t tell you if you should buy shares or not. This is just how I personally try and come to a rough sense of value.

This is a fairly high-risk investment (for me) and as such, I’d probably only be willing to include it as a small percentage of my overall portfolio.

I also probably wouldn’t rush into buying, as I wouldn’t expect the a2 Milk share price to move too quickly up in the short-term.

For some more share ideas that I consider to be less risky, click here to read: 3 ASX shares for dividend income in 2021.