Shares in audio technology company Audinate Group Ltd (ASX: AD8) had shot up nearly 15% at one point last week despite no obvious announcements from the company.

Since March, the Audinate share price has gone in the opposite direction to what I would’ve expected to be honest.

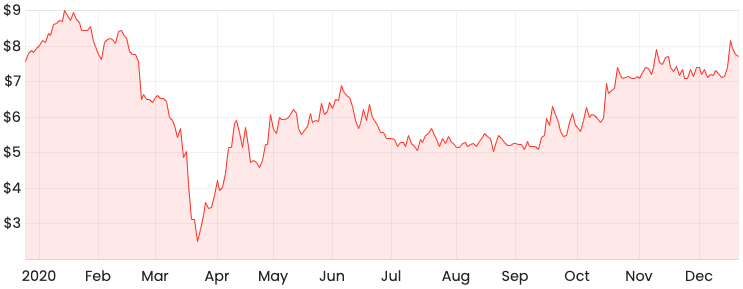

COVID-19 has crushed the gig economy, which Audinate relies on for the most part, yet the Audinate share price has recovered extremely well and is just slightly below its pre-COVID levels at around $7.44 per share.

AD8 share price chart

What does Audinate do?

Audinate is an Australian provider of professional digital audio networking technologies. Its flagship platform is called Dante, which enables the distribution of digital audio signals over local area networks (LAN). It essentially combines IT networking benefits to the professional audiovisual (AV) industry.

One typical use of Dante is in stadiums and other large music venues that are fitted out with new AV gear.

COVID-19 has obviously caused a lot of new construction to be either cancelled or delayed. As a result, Audinate hasn’t been able to sell as many Dante-enabled products throughout this year.

Does Audinate’s valuation make sense?

At the time of writing, Audinate has a market capitalisation of around $590 million and made $30 million of revenue and a net loss of $4 million in FY20.

Audinate shares are quite highly-priced for its current cash flows, but admittedly, this is an evolving growth story with some pretty significant upside if Audinate can successfully execute its growth strategy.

One attractive feature that Audinate’s products have are significant network effects.

By this I mean that the more Dante enabled products that exist, the more Dante establishes itself as the industry standard, meaning other manufacturers are almost forced into also making their own products capable of being integrated with Dante.

High risk, high reward

One thing to keep in mind is that technology in the AV world is constantly changing and evolving. While Dante is well established currently, you couldn’t say for certain that a new competitor might not create another similar product that’s perceived as superior.

I’m not an expert in this field, so it’s definitely hard to come to a well-educated opinion regarding how likely this is without extensive research into the topic.

I would also note that as Audinate is priced as a growth stock, there’s certainly a bit of optimism priced in that assumes the company will in fact be able to generate the cash flows to support its valuation.

This isn’t at all to say Audinate won’t be able to, I’m just pointing out that the valuation appears to be priced fairly high in my eyes, especially considering the COVID-19 situation.

Summary

I’ve recently added Audinate to my own watch list, but I’m not certain that I’d be a buyer at current levels.

The valuation seems stretched given the outlook of COVID-19. Additionally, the technology behind Dante is not extremely easy to understand and I’d feel more comfortable making an investment decision after conducting some further research.