Property investment company Charter Hall Group (ASX: CHC) has announced the acquisition of the David Jones flagship store on Elizabeth Street in Sydney.

Charter Hall shares traded relatively flat today despite the announcement and ended the day at $14.20 per share.

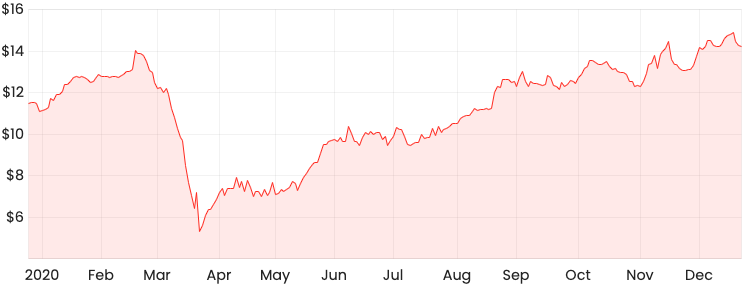

CHC share price chart

About Charter Hall

Charter Hall is a property manager and developer with three ASX-listed real estate investment trusts (REITs) as well as multiple unlisted property funds.

It owns property across multiple sectors including retail, office, industrial and social infrastructure. The group currently has over $45 billion funds under management.

What was the acquisition?

This type of acquisition is known as a sale and leaseback transaction.

Charter Hall will purchase the site for $510 million and then guarantee to lease it back to David Jones for the next 20 years with minimum annual rent increases of 2.5% over this period, as well as an additional component based on David Jones’ sales.

The site will be purchased through a consortia, which essentially means a group of different entities.

The consortia consists of a 50% interest held by Charter Hall’s Long WALE REIT (ASX: CLW), as well as a 25% interest held by the Charter Hall DVP Partnership

and 25% held by the Charter Hall Group.

Charter Hall management appears to be confident that the acquisition is in line with the business’ strategy by securing long-term leased assets that are considered to be high conviction prime real estate acquisitions.

Is Charter Hall a buy?

Investors could play this one a couple of ways. You could either buy shares in Charter Hall Group itself or choose to invest in one of its REITs.

Shares in the group itself have performed extremely well since their March lows, with the Charter Hall share price hitting an all-time high of $4.99 this month.

The group reported $731 million in revenue in FY20, up 38% on the prior year. Even prior to COVID-19, Charter Hall has had a fairly consistent track record of revenue and profit growth.

While the Long WALE REIT hasn’t had the same quick bounce back in the share price, shares currently trade on an annual dividend yield of around 6.10%.

Summary

I tend to prefer ASX growth shares over income/stability and for this reason, I’d probably rather invest in Charter Hall itself rather than one of its listed REITs.

That being said, I’m not sure if I’d be a buyer today. There are a lot of moving parts in a business such as this and it’s quite leveraged to the underlying property conditions. I’m not an expert in property, so I’m unsure if an investment like this is suited to me.

For some share ideas outside of real estate, click here to read: 3 ASX share ideas for your 2021 watchlist.