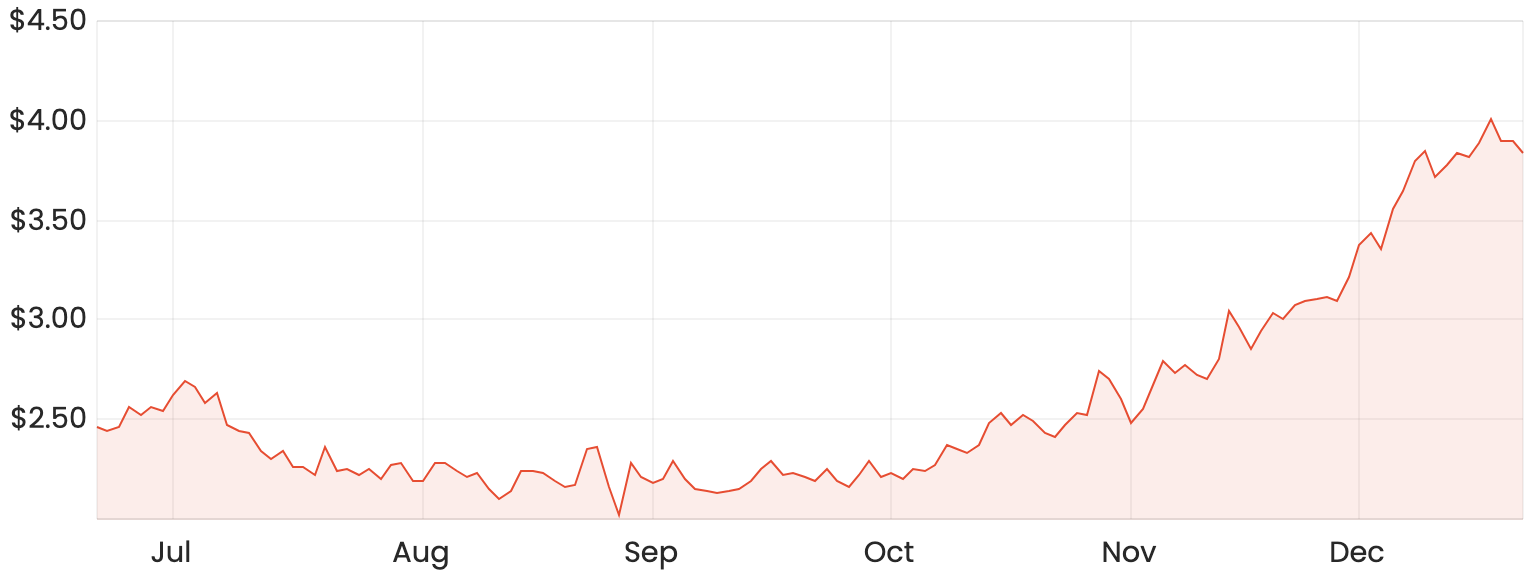

I wouldn’t typically expect shares in a company with a market capitalisation of $2 billion to rocket over 80% in just a few months.

I’m of course talking about medical technology company PolyNovo Ltd (ASX: PNV), a leader in wound care technologies that has gone on an absolute rampage since around September this year.

PNV share price chart

Mind you, it’s not as if shares were extremely cheap beforehand, as PolyNovo still carried a pretty lofty valuation prior to this recent run.

About PolyNovo

Originally a spin-off out of the CSIRO, PolyNovo’s flagship product NovoSorb BTM is used for serious burns victims and helps regenerate human tissue where it has been severely damaged.

BTM is currently approved in Australia under the Therapeutic Goods Administration, in the US under the Food and Drug Administration (FDA), and also in Europe.

BTM is made of synthetic material, which results in fewer complications compared to other biological applications.

Why has the PolyNovo share price surged?

I could try and narrow down PolyNovo’s recent run to a few reasons.

The company’s released a string of positive announcements recently, mainly relating to FDA approvals as well as expansions into new markets.

To touch on a few, PolyNovo has recently launched into Belgium, Netherlands, Luxembourg and Sweden through a partnership with PolyMedics Innovations (PMI) in Germany.

Earlier last month, PolyNovo announced the US FDA had approved the pivotal trial investigation device exemption (IDE). This means the BTM product is now approved for clinical studies and can be progressed to the patient recruitment stage, pending the approval of some hospital independent review boards (IRB).

In late October, the PolyNovo share price was also boosted after receiving Taiwan FDA approval for NovoSorb BTM.

Future expansion

PolyNovo has a bit of a leg up over some of the competition as it plans to expand into new markets such as a hernia treatment as well as breast implants.

However, its new hernia treatment Syntrel is still in the development process and the company hopes it will be available this time next year.

Are PolyNovo shares a buy today?

I probably wouldn’t sell shares in PolyNovo just yet, but I also don’t know if I’d be a buyer today either.

Even really great companies go through pullbacks after having a strong upwards run. This has partly been a sentiment-driven rally and personally, I’m not sure how much longer it can be sustained for.

Revenue from BTM came in at around $19 million in FY20, yet the company currently has a market capitalisation of around $2.5 billion.

This is going to come down to your own interpretation of whether you think shares represent good value or not.

I don’t think there’s a way to sugar-coat that this valuation seems rather high, but PolyNovo is an unfolding growth story that will ultimately determine if the valuation is justified.

For some other share ideas, click here to read: 3 ASX share ideas for your 2021 watchlist.