The Zip Co Limited (ASX: Z1P) share price was on watch today after announcing a share purchase plan (SPP) in order to raise additional capital to fuel further overseas growth.

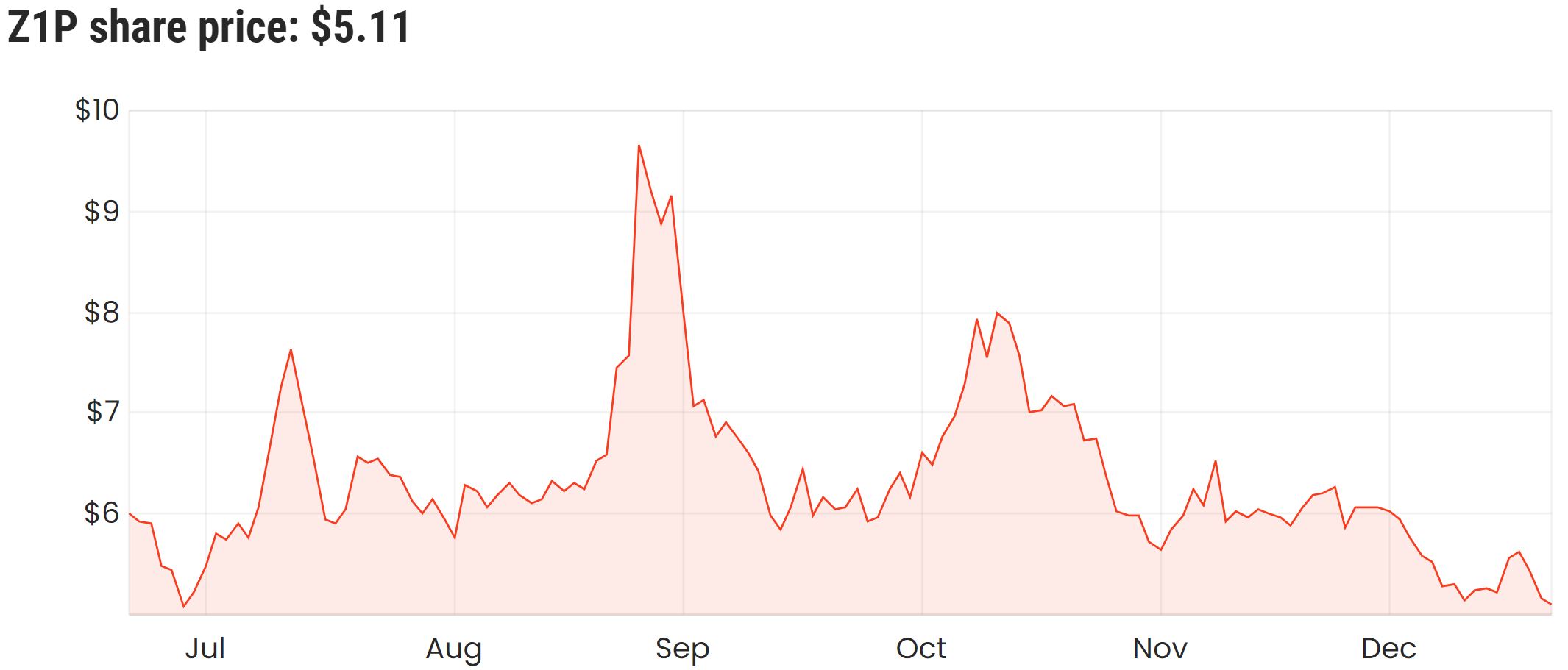

The announcement itself hasn’t been much to budge the share price too significantly, with shares trading at around $5.13 at the close.

The details

Zip has successfully raised $120 million (before costs) from a fully underwritten placement of new fully paid ordinary shares to institutional, sophisticated and professional investors at an issue price of $5.34 per share.

Additionally, if you were a Zip shareholder at 7:00 pm on Tuesday, 15 December, you will be given the opportunity to subscribe for up to $30,000 worth of new shares at the lesser of $5.34 or the volume-weighted average price in the five trading days up to and including 13 January 2021.

Use of funds

The company intends to use the proceeds from the placement and SPP to further drive growth in the US, UK, as well as here in Australia and New Zealand to expand Zip’s product range including continuing to scale Zip Biz.

I think the allocation makes quite a lot of sense given how large the potential opportunity is, especially in the US, so trying to capture the market share before competitors also seems like what most other buy-now-pay-later (BNPL) companies are trying to do.

Are Zip shares a buy?

I probably wouldn’t be a buyer just off this announcement. Zip shares have already had a great run this year and even better over the last few years.

I’ve written a few articles regarding the valuation of some of these BNPLs. If you’d like to learn more, click here to read: How I value Zip (ASX: Z1P) shares.

For now, I’m not going to cast aspersions on a company with a $2.7 billion market capitalisation that is yet to make a profit. The BNPL’s are an unfolding growth story that are attempting to tap into addressable markets worth trillions of dollars.

The goal isn’t to make a profit any time soon, but to have a strong presence in many different markets to stay ahead of the competition.

For me personally, I mostly try to find ASX companies that trade reasonably close to fair value.

Everyone’s investing style is different and you may prefer to invest in growth stocks that have been assigned a high value prior to the company earning the money to support the valuation – which is also fine.

For some other share ideas, click here to read: 3 ASX growth shares to add to your 2021 watchlist.