Despite being freshly listed on the ASX, just a couple of months ago, speciality retailer Dusk Group Ltd (ASX: DSK) has already delivered some impressive trading updates causing the DSK share price to surge over 10% in recent days.

Dusk’s initial public offering (IPO) saw 35 million shares issued at an offer price of $2 per share. However, like many IPOs, shares were priced lower by the market once trading commenced on the ASX.

At the time of writing, the current share price is slightly higher than the original offer price at around $2 per share.

What does Dusk do?

Dusk is a speciality retailer of home fragrance products with 115 physical stores as well as an online offering. The company runs a vertically integrated model and is responsible for the in-house design and development of candles, ultrasonic diffusers, reed diffusers and essential oils, as well as fragrance-related homewares.

The only business functions that have been outsourced are manufacturing and logistics operations. Prior to 2015, Dusk operated its own factory in Perth, however under the leadership of CEO Peter King¸ the company underwent a significant transformation where all manufacturing was outsourced to Chinese suppliers.

Dusk is a relatively large player in the Australian home fragrance market that is estimated to have a 22% market share in a total addressable market (TAM) worth around $461.5 million in FY20, which is expected to grow by 5.8% in FY21.

Past financial performance

While Dusk listed only recently, there’s still some publicly available financial information that dates back three or four years, which provides a relatively clear picture of the financial health of the company.

There’s no doubt that Dusk has been a COVID-19 beneficiary that has benefitted from consumers wanting to improve their homes during lockdowns and international travel restrictions.

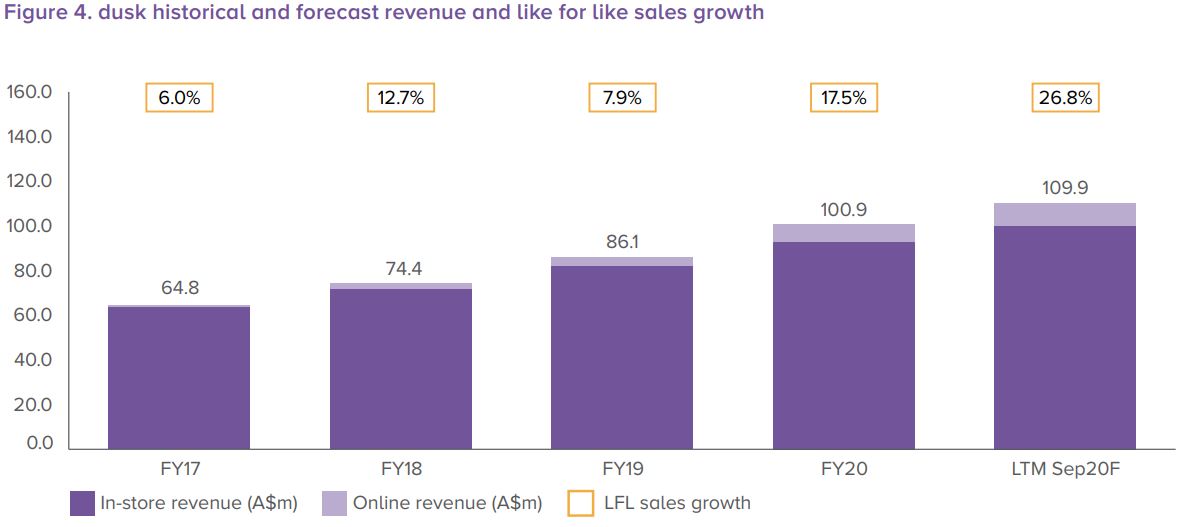

In saying this, by looking at the graph below, it’s good to see that COVID-19 doesn’t appear to have been a once-off boost to sales, as there’s a strong track record of revenue growth in both physical stores and through its online channel from FY17-FY20.

Additionally, Dusk boasts strong gross margins, consistently averaging around 65% each year. The company is profitable and has steadily grown its net profit figure in line with sales growth. FY20 revenue and net profit came in at $100.9 million and $8.9 million respectively, representing a net profit margin of 8.8%.

Future growth drivers

Dusk currently has 115 stores across the country, but management plans to grow its store network to around 160 stores by 2024.

International expansion is potentially on the cards, with New Zealand a likely expansion opportunity for both physical stores as well as an international website.

The company may also evaluate the potential launch of a wholesale or concession model in other English speaking countries such as the UK.

On a more fundamental level, there may be structural elements which could provide a tailwind for Dusk moving forward.

While I am not a large consumer of fragrance products myself, I have noticed the increasing interest in certain products such as essential oils and more technologically advanced items. Whether these trends are here to stay, I’m not completely certain. But it’s good to see that Dusk has proven to be able to keep up with current trends and continually expand its product range.

I also think Dusk’s customer composition is quite attractive as many of its customers are gifters. As more of an anecdotal piece of evidence, I have bought quite a few candles as gifts where I just wasn’t sure what else to buy.

Potential downside risks

I think many of the potential risks for an investment in Dusk would be applicable to retailers in general.

Most retailers aren’t extremely scalable as their costs roughly increase in line with their sales. Additionally, sales are also not guaranteed to be recurring and rely on customers returning as well as attracting new customers to further drive growth.

Retailers also generally have a low economic moat compared to some companies. With low barriers to entry, I can’t imagine it would take much for another company to replicate products that Dusk sells or think of something different that’s perceived as better by consumers.

In Dusk’s defence, its brand name does have a strong reputation amongst its customers, demonstrated by 54% of FY20 revenue coming from members of its loyalty program, Dusk Rewards.

Valuation and Summary

Management recently provided H1 FY21 guidance figures with sales and EBIT predicted to come in at around $90 million and $26 million, respectively.

I think it would be slightly too optimistic to simply double these figures to arrive at an annualised figure for FY21, for a couple of reasons.

Firstly, I think it’s fair to assume that some of these sales in the last 6 months might have been fuelled by superannuation withdrawals and other stimulus, which will gradually taper off next year. Secondly, I also think it’s fair to assume many of these recent sales were the result of gifts around this holiday/new year period, which isn’t going to happen in the next 6 months.

I’m going to arbitrarily assume that Dusk will generate slightly less revenue in the second half of FY21, around $70 million. This would work out to be annual revenue of $160 million. Assuming the same net profit margin of 8.8%, it would imply a net profit of $14.08 million in FY21.

Assuming the current trailing P/E of 14 holds, a market capitalisation of $196 million seems reasonable. With 62.3 million shares outstanding, it equates to a share price of around $3.14 per share.

Of course, there are a few assumptions in there, but the point is simply to get a rough sense of valuation.

Based on this basic analysis, shares seem relatively cheap in my opinion, but there are few potential risks that should be considered mainly regarding retail spending into next year.

For some other share ideas, click here to read: 3 ASX growth shares I’d buy for 2021.