The Tyro Payments Ltd (ASX: TYR) share price has surged more than 20% this morning after the digital payments company released an update in response to a recent short report published by Viceroy Research last week.

Tyro has also released transaction values up to the close of trading on Sunday, 17 January, which reflect the outage period as well as the impact from the Brisbane lockdowns.

Additionally, the company confirmed it’s received correspondence from a law firm advising of a potential class action against the company, however, no proceedings have commenced at this stage.

Tyro hits back

Viceroy’s recent report made multiple statements that essentially claimed Tyro’s terminal connectivity issue was much more widespread and severe than the company had originally disclosed.

Tyro’s shares subsequently went into a trading halt on Friday to prevent the supposedly false claims adding further downwards pressure on its share price.

In today’s ASX release, Tyro’s management has indicated that the statements made in Viceroy’s report are false. As part of the response, Tyro outlined the false claims made by Viceroy and provided a response to each claim.

Here are some of the key claims made by Viceroy, and Tyro’s corresponding response:

1. “Approximately 50% of Tyro’s merchant terminals are offline as of the date of writing”

Tyro’s response: “At no time have 50% of Tyro’s terminals been offline. As advised to the ASX today 15% of Tyro’s merchants remain impacted.”

2. “Tyro has no idea – and no way to determine – how many of its terminals are actually functional”

Tyro’s response: “Tyro has complete visibility of all its functional terminals – specifically these terminals are actively and continuously communicating with Tyro’s payment switch.”

3. “Customers had bricked terminals and had received no communications from Tyro”

Tyro’s response: “Tyro has sent the following incident communications to impacted merchants to the email addresses as notified by merchants – emails dated 7, 9, 10, 11 and 13 January 2021, together with 24/7 customer support by phone, Facebook and email. Tyro has also regularly kept merchants updated via its status page on its website.”

What else did Tyro announce?

In total, Tyro responded to 10 claims made by Viceroy, but the overall message was that it appears the issue isn’t as widespread and severe as Viceroy has made it out to be.

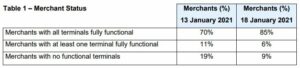

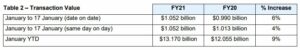

The images below show Tyro’s transaction value and merchant status, which provides some visibility into the impact of the terminal issue.

According to Tyro’s data, merchants with no functional terminals on 13 January and 18 January were 19% and 9%, respectively. While these figures are much lower than what Viceroy claimed, it’s no doubt this has resulted in some pretty unhappy customers.

Despite all this, it appears transaction values have been relatively unaffected, and have increased over the period while the outage was present compared to the prior year.

Is the Tyro price share price a buy?

From the information Tyro has provided, it does seem like the impact is less severe than Viceroy claimed. However, I don’t think I’d be buying shares too soon.

One thing I agree with from Viceroy’s report is that reputational damage from incidents such as this does stay around for quite some time.

Tyro has lost customers from this incident and the issue hasn’t been fully resolved yet, so I’d rather wait to see the extent of the outage.

There is also still the possibility of legal proceedings, so I’d rather wait for the outcome of that as well.

For some alternative share ideas, click here to read: 3 ASX tech shares to add to your 2021 watchlist.