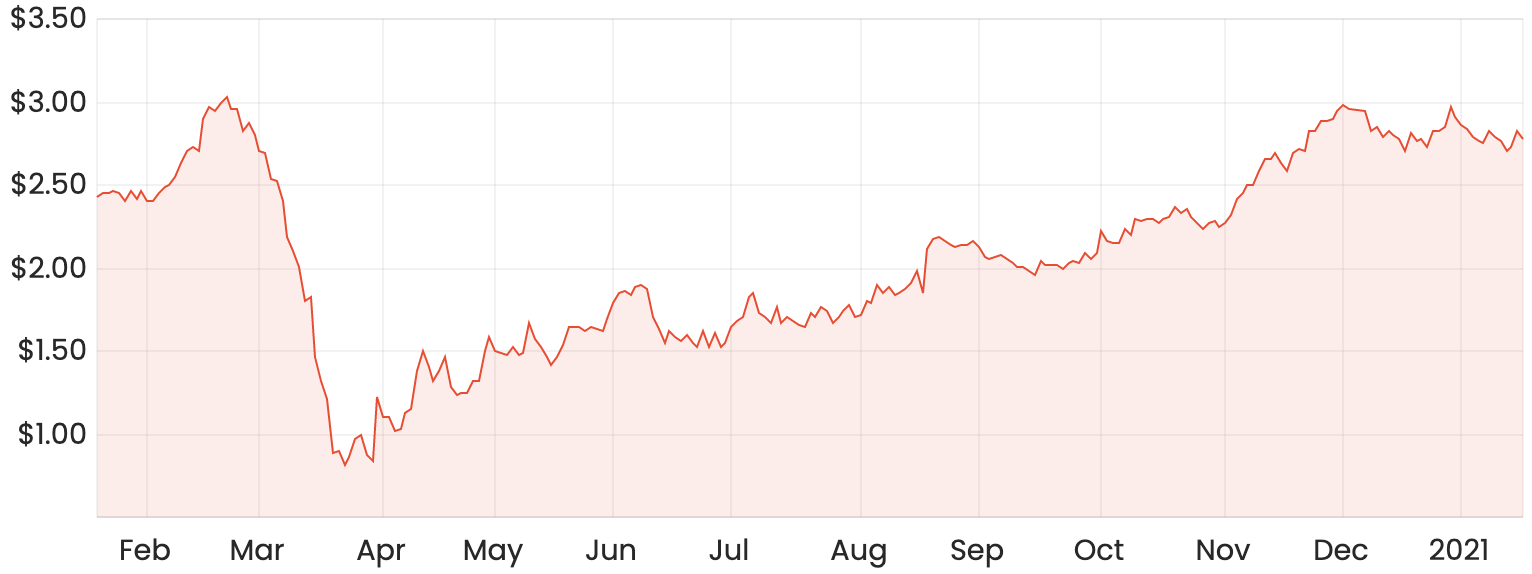

The share price of Money3 Corporation Limited (ASX: MNY) has consistently grown since the COVID outbreak in March 2020 but it has tapered off slightly in the last month.

Will the imminent acquisition of GMF Australia, a subsidiary of General Motors Financial Company Inc, generate some spark?

MNY share price chart

How does it make money?

Money3 is a provider of consumer finance for the purchase or maintenance of a vehicle and personal expenses in Australia and New Zealand. It targets customers that are under-serviced by mainstream banks. Money3 has a separate brand in each geographic location, being Money3 in Australia and Go Car Finance in New Zealand.

Money3 offers both secured and unsecured loans with various loan limits and terms to service the needs of its customer base. It finances customers across a range of risk profiles, which is reflected in the pricing range commencing at 9.95% per annum.

The company noted 32% of customers had returned in FY20 for a new loan or refinancing, demonstrating its ability to build strong and enduring relationships with its customers.

I think Money3’s ability to nurture its customer relationships is attributed to the flexibility offered to assist customers to repay their loans through the use of tools like; accepting reduced payments, reduced interest rates, payment holidays; and reselling vehicles.

It seems like Money3’s customer-oriented approach is reaping rewards and reminds me of the global success story of Walmart where management decided to pass on cost savings to its loyal customer base, which strengthened customer loyalty.

Is this the spark for Money3?

In Money3’s FY20 annual report, management also highlighted that accelerating growth through opportunistic acquisitions would be a key focus for FY21 and they certainly have not disappointed with another acquisition.

Money3 agreed to acquire GMF Australia, consisting of a portfolio of around 700 automotive loans for new vehicles.

The primary driver of revenue in the case of Money3 is the size of its loan book and it’s building some momentum in executing this strategy given the recent acquisition of Automotive Financial Services (AFS) that was completed a couple of weeks ago. The AFS acquisition added $48.8 million of gross loan book as of 1 January 2021 and GMF Australia will add around $23 million.

Money3’s managing director, Scott Baldwin said, “Money3 continues to leverage its strengths in collections with the acquisition of approximately 700 customers of prime credit quality that purchased a new vehicle through a Holden dealership. It demonstrates the group’s ability to acquire customers either organically or through portfolio acquisitions.”

“There are no staff or complicated transition processes needed for this acquisition as all outstanding commitments will roll into the existing Customer Care team deploying capital immediately with customer repayment patterns aligning nicely with the cash requirements of the business in 2021.”

Final thoughts

If Money3 continues to execute further acquisitions and maintain high levels of customer satisfaction, it may turn out to be a solid performer over the long run. There may also be a short-term tailwind in purchases of vehicles if borders remain closed as people are restricted to regional or interstate travel to let their hair down.

In saying that, I believe businesses that can grow organically and are customer-focused is a more lethal combination like Pushpay Holdings Ltd (ASX: PPH). If you’re curious about Pushpay, click here to read this article: 1 ASX growth share I’d buy today with $1,000.