Road toll operator Transurban Group (ASX: TCL) had a strong finish to yesterday’s trading day, with shares up 4% to $13.48 per share.

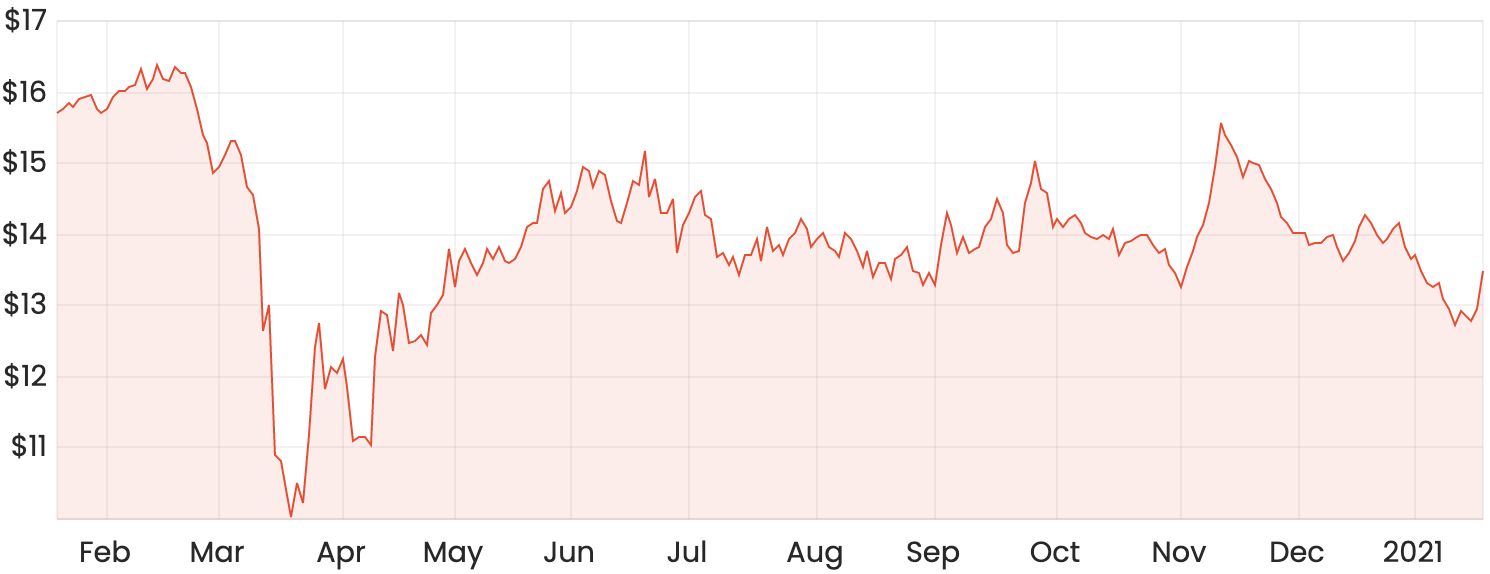

COVID-19 caused a fairly significant drop in average daily traffic in FY20 and as a result, the Transurban share price has been languishing around 15% below its pre-pandemic levels.

TCL share price chart

What’s driving the Transurban share price?

While Transurban hasn’t released any announcements itself, the recent positive sentiment may have been driven by an article out of The Australian Financial Review, which discusses the WestConnex road network and some notable valuations assigned to it by Macquarie analysts.

WestConnex is a partially completed road network located in Sydney that Transurban currently has a 51% stake in.

The remaining stake is owned by the NSW Government but according to the AFR, this stake is being put up for sale and Transurban may well be on the receiving end of the transaction.

Macquarie analysts have said that the remaining 49% stake may be worth between $10.8 billion to $12.6 billion.

What I like about Transurban

Transurban shares have some quality features that I think would make a solid addition to one’s portfolio.

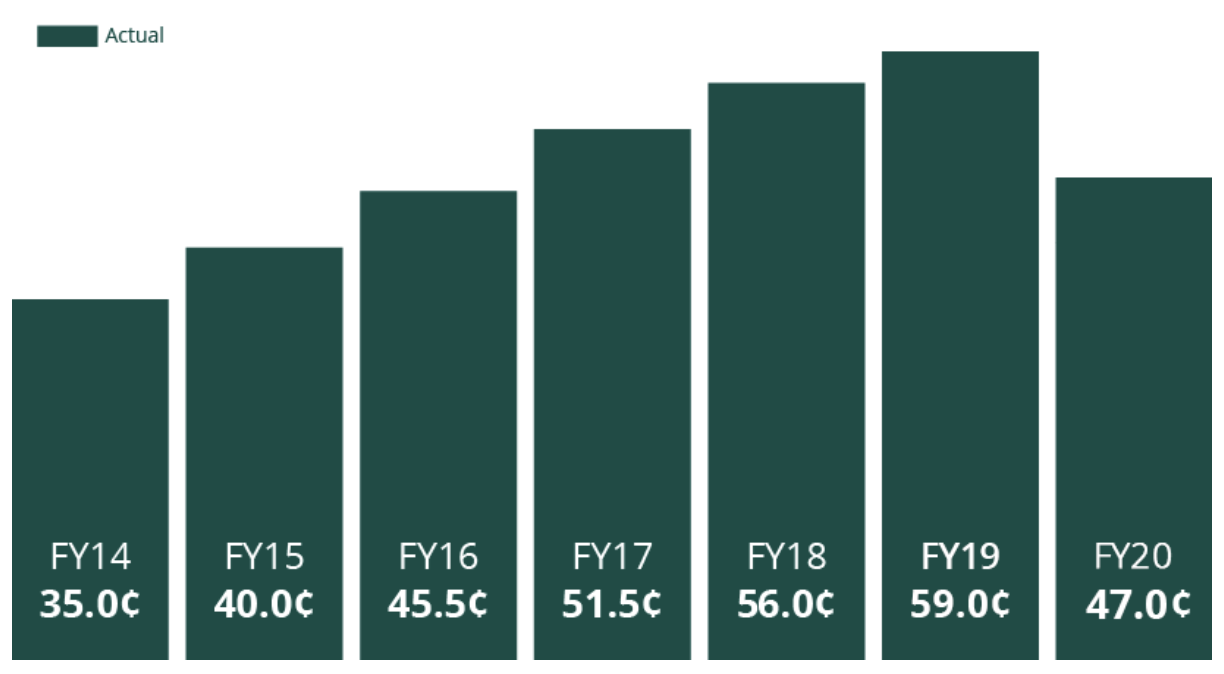

The company has relatively stable revenues and earnings and has also paid a fairly consistent dividend to shareholders over the last several years.

I’d consider the stock fairly defensive compared to others. It’s not completely recession-proof as evidenced by the effect of COVID-19 on its revenues, but in normal economic conditions, Transurban has been a relatively consistent performer.

Part of this stability comes from the large amount of pricing power it has. The fee structure differs across states, but many toll roads in NSW and Victoria can be increased by either the annual inflation rate or 4% per year (whichever is higher).

Fees cannot be reduced by deflation, so there’s a large amount of pricing power compared to other companies, such as energy retailers that are price takers.

Transurban already appears to have a monopoly in its current market, but if it does end up securing the remaining stake in WestConnex, I’d imagine it could firmly establish itself in that position.

Summary

These are just a few reasons why I think Transurban could be a fairly stable investment in the future.

That said, it’s hard to get a rough sense of valuation considering the company made a loss of $111 million in FY20 as a result of COVID-19.

If you’re looking for more dividend share ideas, check out this article: 3 ASX 200 shares to buy for income.