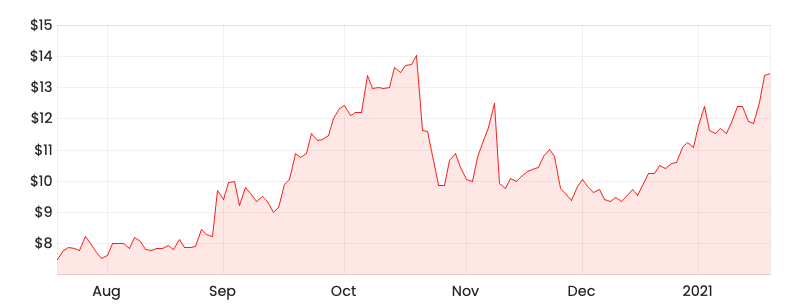

The Temple & Webster Group Ltd (ASX: TPW) share price is close to reaching all-time highs.

The Temple and Webster share price touched $14 back in October last year with its strong run interrupted by the news of the first COVID-19 vaccine.

No announcements have been made by the company recently, but if I had to guess why ASX retailers are doing well right now, it might have something to do with a few articles regarding international travel.

According to the Australian Government’s Chief Medical Officer, Professor Paul Kelly, international travel may be off the cards for the whole of 2021 even if a COVID-19 vaccine is rolled out nationwide this year.

With a current market capitalisation of $1.6 billion, does the current TPW share price present good value as an ASX growth share?

TPW share price chart

The bull case for Temple and Webster shares

Valuation aside, I think it’s worth noting the sheer size of the total addressable market (TAM) this company is trying to get a share of.

In the core furniture and homewares segment, the market is worth roughly $15 billion. Most of these expected sales are attributed to physical stores, but the impact of COVID-19 could accelerate a shift towards online shopping.

Another bigger potential growth opportunity lies in the company’s ability to expand its product offering, which ultimately expands its TAM. With new segments like home improvement as well as B2B (business-to-business) markets such as offices, Temple and Webster believes the TAM is closer to around $30 billion.

Considering Temple and Webster’s capital-light business model and strong first-mover advantage from COVID-19, its fairly lofty valuation may appear to be reasonable given the potential growth opportunity over the long-term.

Potential headwinds

The retail sector is a highly competitive environment, and the erratic nature of COVID-19 will present some challenges for this industry.

The segment has low barriers to entry and it’s often hard to build an enduring competitive moat, forcing retailers to compete on price, which can significantly drag down margins.

I also think it’ll be interesting to see the next set of financial results for retailers that might not record the same results as last year when COVID boosted demand.

As mentioned previously, while a durable moat can be hard to build in retail, I think Temple and Webster has developed a decent first-mover advantage over new competitors.

The company gained many new customers last year and appears to have developed a fairly strong reputation given the solid customer ratings on Product Review and Trust Pilot. This is a form of competitive advantage in my opinion, as it’ll take time for new entrants to attain that same high level of exposure and reputation.

Buy/hold/sell?

Temple and Webster has experienced a really strong run since the COVID outbreak last year, so investors ought to consider whether this is sustainable over the long-run.

If I were to consider investing in Temple and Webster, I would want to get an understanding of what is going to drive continual growth in online homewares sales and what other possible revenue streams will be available.

In light of this, I wouldn’t be opposed to adding Temple and Webster to my own portfolio, but I’d most likely buy a small allocation at first and accumulate shares over time to minimise some risk in the short term.

For some more reading, click here to read: 3 ASX tech shares to add to your 2021 watchlist

.