Struggling to think of new investment ideas? Here are just two ASX growth shares I think are worth looking out for in 2021.

Tyro Payments

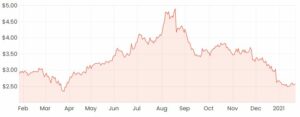

It’s been a rollercoaster ride recently for shareholders of digital payments provider Tyro Payments Ltd (ASX: TYR).

While the company originally claimed a terminal connectivity issue was affecting roughly 15% of its terminal fleet, a subsequent short report published by Viceroy Research suggested the issue was more widespread, causing the Tyro share price to fall steeply.

Shares bounced back up more than 20% after Tyro refuted the claims in a more recent announcement, with the share price currently trading at around $2.50 – still roughly 40% down from its highs in October last year.

TYR share price chart

As it currently stands, the technical issue is yet to be completely resolved, so it’s hard to get an idea regarding the extent of what has happened. For this reason, I wouldn’t personally buy shares right now, but rather put Tyro on my watchlist for the time being.

Customer churn seems likely as a result of this incident, which may be reflected in the company’s next set of transaction values it releases to the ASX. Additionally, the company has received correspondence from a law firm advising of a potential class action, so I’d rather wait on the sidelines for the moment.

With all that being said, I do like the overall thematic of fintechs such as Tyro attempting to disrupt an industry that’s previously been dominated by the big four banks.

Aside from this most recent operational issue, Tyro has demonstrated a strong track record of revenue and transaction growth over the last several years.

Integrated Research

The share price chart for the last year shows a fairly volatile ride for investors of software company Integrated Research Limited (ASX: IRI).

Integrated Research has positioned itself as a global leader in developing enterprise software able to monitor and troubleshoot critical IT infrastructure, payments and communications systems.

The recent downtrend in the Integrated Research share price has partly been due to COVID-19 complications combined with a strengthening AUD, which has resulted in multiple profit downgrades.

Rather than an outright buy, I think Integrated Research is currently one for the watchlist because I’d first want to see how well the company performs in post-COVID conditions to try and identify if there are some structural issues potentially at play.

Like many other software companies, Integrated Research is in the process of transitioning clients from an on-premise model to a more flexible software-as-a-service (SaaS) model. This type of transition often results in lower revenues received upfront, which may partly explain the decreased revenue growth.

On a fundamental level, I like Integrated Research due to its sticky customers and highly cash flow generative business model that typically generates a net profit margin of 22%.

Return on Equity (ROE) is impressive at over 30% and the company has historically maintained a consistent dividend yield, which currently sits at around 2.8%.

For some more reading on Integrated Research shares, check out this article: Why I think Integrated Research could be in the buy zone.