Howdy Rask reader,

You know GameStop (NYSE: GME). It’s the stock everyone is talking about.

Yeah, that one…

In the past 24 hours, I’ve been called for interviews from a radio station, a television channel, and a major news outlet asking one thing:

“Can you explain what’s happened with GameStop?!”

Okay, here goes…

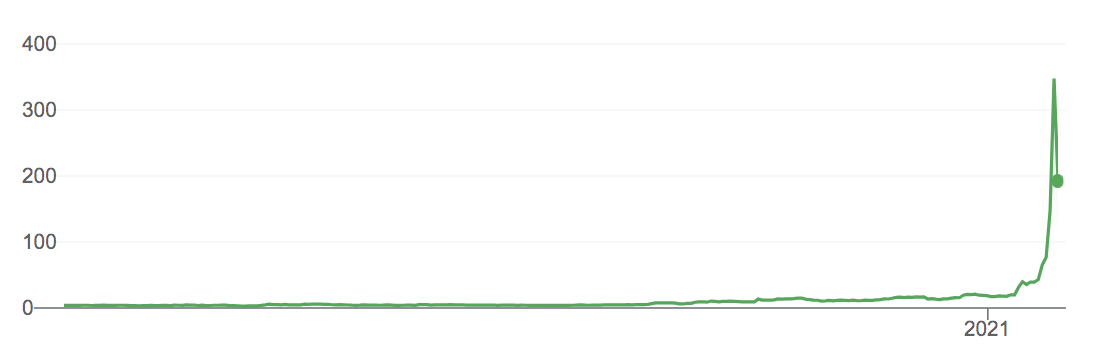

GameStop shares are up ~1,000% this year.

But go back 12 months and the stock is up around 45x – or 4,500%. Meaning, a $2,000 investment in GameStop 12 months ago is worth around $90,000.

Yesterday, when the stock was ~80% higher, meaning that $2,000 investment was worth around $160,000. Down $60k in a day? Ouch!

Is GameStop just a great investment?

No. I don’t think so.

The GameStop share price is up because of something spectacular. And by that I mean I’ve never seen it before…

GameStop is just like any regular video games retailer that you see at your local shopping centre. Think of EB Games. It’s a place where people buy their games for Xbox, Playstation, Nintendo and the like.

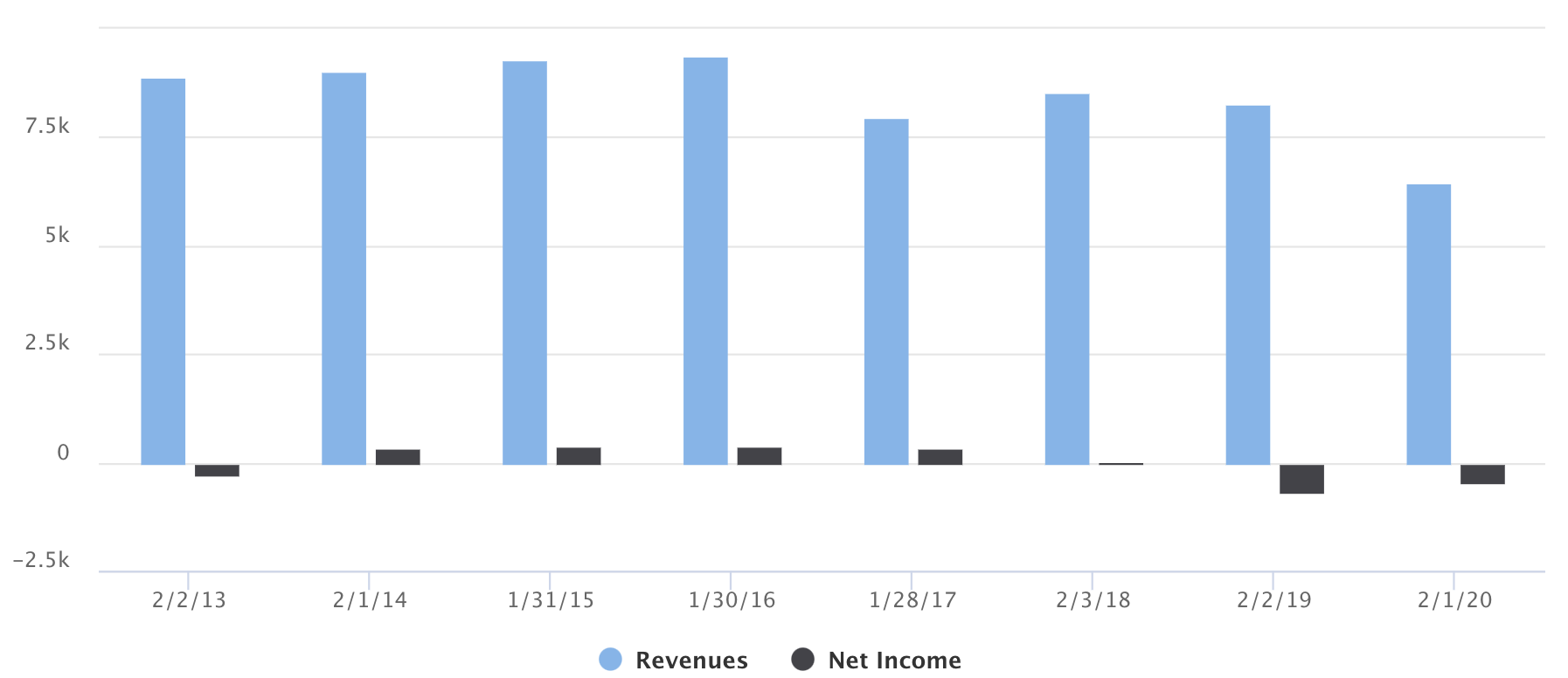

If you ask me, there is nothing spectacular about the GameStop business. Its revenue has steadily fallen since 2013. The once yearly profit has become consistent losses.

Basically, based on the financials alone, GameStop is not a stock the analyst team at Rask would touch.

So, what’s the real reason the GameStop share price is up?

The real reason the GameStop share price has risen ferociously is pretty simple:

- Short sellers – investors who make money when shares fall – have targeted GameStop for a long time.

- A band of Reddit users saw the short sellers’ positions and bought the stock, rallying the share price against the short sellers.

Wait, so what exactly is short selling?

As our video on short selling explains, a short seller can lose more than 100% of their investment but they can never make more than 100%. Meaning, the cards are stacked against them.

Worse still, if a stock price starts going up (the opposite direction of what they want), the short sellers are forced to buy back the shares they shorted – further pushing the price upward. This is called a short squeeze. And it’s vicious.

Imagine someone (the short seller) squeezing a tomato sauce bottle – with the lid off. They see nothing but red.

The short squeeze is the reason GameStop shares have gone up.

How the GameStop party ends

I think the GameStop rollercoaster is a sure sign of too much money sloshing around the system, combined with few good options for investment – and a band of traders artificially propping up a stock.

While it seems like a non-stop party for investors, please mark my words: it will end. The shorts will be squeezed out. Reddit will run out of sauce.

So, before you buy the shares, remember this:

If 99% of long-term investing is doing nothing, and the other 1% changes your life – GameStop could change it for the worse.

As always:

- Only ever buy shares which you understand (the sleep at night factor)

- With a 3-5+ year time horizon (anything less is speculation)

- And keep your emergency cash set aside (enough for 6 months, at least)

- Invest little bits, lots of times (compounding is very powerful, never interrupt it!); and

- Only buy the best investments you can find.

It might sound easy, but it’s not simple.

And just so you know, I’m still fully invested and the Rask Invest team is narrowing in on our next official stock idea for our members (it’s a company with very attractive fundamentals – and it’s been sold down recently).

Onwards & upwards!