Shares in speciality retailer Globe International Limited (ASX: GLB) have gone quietly under the radar up until recently.

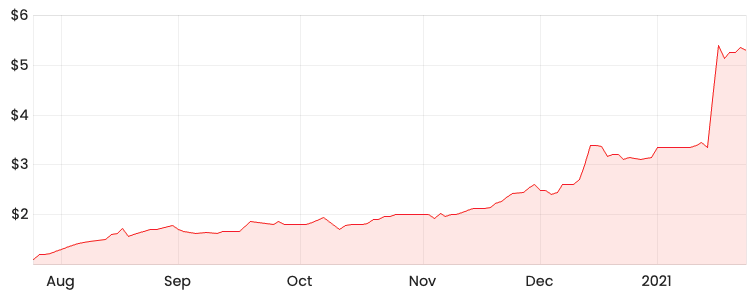

After some impressive recent trading updates, the company has gained significant attention from investors with the Globe share price surging close to 60% since the start of the year.

GLB share price chart

Globe background

Globe originally started out as a skateboard equipment importing business and was founded by three brothers from Melbourne: Stephen, Peter and Matt Hill, who all shared a passion for skateboarding.

Today, the company is a multi-branded success story that operates through a revolving stable of brands across three main product categories: apparel, footwear, and skate hardgoods.

Globe’s proprietary brands include FXD Workwear (Function By Design) – a line of workwear and boots with a slightly more fashionable edge, up against competitors such as King Gee and Hard Yakka.

This segment has done particularly well even prior to COVID-19 and its success has partly been attributed to a hole in the market that failed to cater for a balance between lasting workwear and fashion.

Another key brand is Impala, which offers a range of high-quality roller skates, inline skates and skateboards. This segment is also performing strongly and is being driven by a surge in the popularity of the sport.

The company also sells footwear, apparel and skate hardware through its Globe brand. However, the company has indicated that its emerging brands have been responsible for much of the recent growth despite complications arising from COVID-19.

Recent financial performance

The recent jump in the Globe share price was the result of a much better than expected trading update for the first half of FY21.

The company confirmed that unaudited group revenue is expected to be around $125 million, up 60% on the prior corresponding period (PCP). Additionally, EBIT

is expected to be in excess of $20 million, compared to $4.2 million PCP.

To put these spectacular numbers into context, Globe has had flat annual revenues of roughly $150 million over the last five or so years and annual EBIT of roughly $6 million.

Globe will announce its official half-year results in late February, which will provide further details and a full-year outlook.

Is Globe’s growth sustainable?

While it appears Globe has been a major beneficiary of the COVID-19 retail boom, according to CEO Matt Hill, the Impala brand has been on a strong growth trajectory since 2018.

While stay-at-home orders and social media platforms such as TikTok have certainly provided a boost in the right direction for the business, there has been a rise in popularity of its retro-styled inline skates over the last couple of years, mainly in the USA and Australia.

It seems to me that these sorts of sports go in and out of fashion over the years and it appears that right now is the right time to be in the game. However, what I find more impressive is that Globe started Impala from nothing just a few years ago and has been able to successfully capitalise on the popular trend.

Even if roller skating were to decrease in popularity in five years, hypothetically, Globe would most likely be continually revolving its line of brands to keep up with the structural trends at play.

The Impala brand is female focussed, which appears to make a lot of sense as a way to diversify across different consumer demographics as the core Globe brand has typically been seen as a male-focused area.

The FXD product line is another strong example of the creation of a brand as a result of a gap in the market. It will be interesting to see the detailed breakdown of the performance of Globe’s brands in the audited results to get a clearer picture of the overall trendline.

Summary

It’s been an interesting history for shareholders of Globe. It listed on the ASX back in 2001 and the company had a market capitalisation of over $1 billion at one point ($225 million currently).

Shortly after listing, Globe acquired holding company Kubic Marketing, which held the US skate brand Dwindle Distribution. This acquisition wasn’t received well by shareholders and caused the share price to fall sharply at the time.

Globe has recently divested completely from Dwindle and its focus is now on further growth in its proprietary brands as well as licenced brands and distributed brands.

The founders still have high levels of inside ownership of the company’s shares, with Stephen and Peter both holding over 12 million shares (~30%) each.

There are some obvious concerns facing spending levels in the retail sector more broadly, but based on the growth of some of Globe’s emerging brands even prior to COVID-19, I think there may be a fairly compelling investment case even considering these potential headwinds.

For some more share ideas, click here to read: 2 ASX shares to add to your 2021 watchlist.

Or if you’re interested in becoming a better investor, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.