The share price chart of slot machine and mobile games developer Aristocrat Leisure Limited (ASX: ALL) has been the perfect example of a bottom-left to top-right trajectory over the last 10 years that every investor dreams of being onboard.

Complications arising from COVID-19 have undoubtedly thrown a spanner in the works for the gaming machine manufacturer. However, I believe there’s a fairly compelling investment case underneath the surface.

Here’s how I look at Aristocrat shares at the moment.

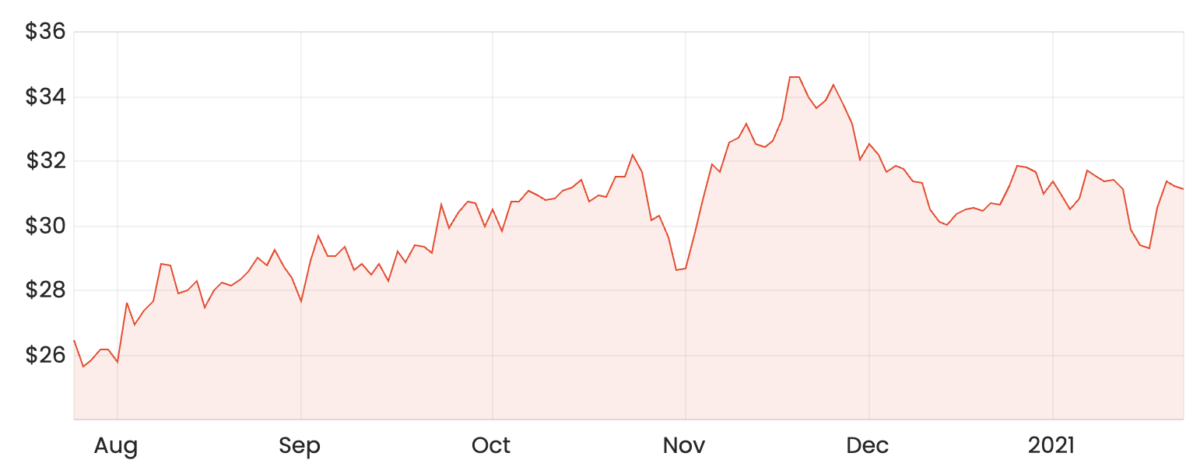

ALL share price chart

Current operating environment

While Aristocrat’s shares have made a strong recovery since March last year, they’ve trended down slightly since November and currently trade for around $30 per share.

In order to get an understanding of the current operating environment for the company, I think it’s important to appreciate how the Aristocrat generates revenue in its land-based segment.

Gaming machines can be sold outright to a venue or gaming operator. Or alternatively, a machine can be installed with a proportion of the revenue generated being paid on a recurring basis back to Aristocrat.

Unfortunately, under both of these pricing models, the effects of COVID-19 and social distancing measures has had a material impact on this segment’s revenue and its recovery is partly contingent on the global recovery from the pandemic.

The US is one of Aristocrat’s biggest markets and given the country’s current situation, it becomes easier to see why the current valuation is priced accordingly.

If venues are short on cash as a result of fewer patrons, I would expect businesses to reduce discretionary spending and focus more on paying down fixed overheads. As such, I could imagine there might be a lower demand for Aristocrat’s machines in some of the worse affected areas.

Additionally, due to social distancing measures, installed machines have been spaced out in accordance with local regulations. As of 30 September 2020, around 26% (~6,300 units) of Aristocrat’s installed machines in North America were not operational.

With no trading updates from the company recently, it’s particularly hard to get a rough idea of the current state of this segment. Judging by last year’s announcements, Aristocrat will likely report its half-year results this coming May.

As a very minor note, I’d also guess that the strengthening Australian dollar against the USD may partly explain the recent pullback we’ve seen in the Aristocrat share price.

Aristocrat’s blue sky case

If you’re willing to look past some of these challenges the company currently faces, Aristocrat has quite a few quality aspects I’d look for in a company with a significant growth opportunity ahead.

Firstly, it’s important to note the past growth trajectory of Aristocrat’s digital segment over the last five or so years.

This segment alone has gone from accounting for 13% of total revenue in 2016 to over 56% of the group’s total revenue in FY20, with equally strong growth in average revenue per user.

Digital growth has been partly driven by higher levels of customer acquisition expenditure and the further development of a diversified portfolio of online games. Increased spending to expand its reach appears to be a sensible decision considering the global estimated total addressable market (TAM) of US$77 billion for digital games and casinos.

With an accelerated shift to online platforms since the onset of the pandemic, I see this as a structural tailwind that the company is likely to benefit from.

It seems likely to me that the overall thematic of gambling will stick around in the long-term. This is somewhat illustrated by a short survey conducted by the Australian government where it found 1 in 3 participants signed for a new online betting account during COVID-19 and young men (aged 18-34 years) were most likely to increase their frequency and monthly spending on gambling (from $687 to $1,075).

If users of slot machines and other games choose to return to physical venues post-pandemic or make the switch online, Aristocrat stands to be a potential beneficiary in either case.

With respect to the ongoing COVID-19 situation particularly in the US, the company has demonstrated its ability to withstand periods of decreased cashflow. This has been partly due to its sturdy balance sheet, with approximately $2 billion in total liquidity as at 30 September 2020.

While the future is inherently unpredictable, analysts from Citi and Macquarie are fairly optimistic about a long-term recovery and expect volumes of US casinos to stabilise into the latter half of this year.

Valuation and summary

I initially thought Aristrocrat’s shares seemed cheap relative to its statutory FY20 profit of just over $1.3 billion, putting shares on a trailing price-to-earnings (P/E) ratio of 14x. However, due to the company recognising a large deferred tax asset during the year, normalised net profit for FY20 was actually $357.1 million, giving a P/E of 54x.

If you’re ever analysing a set of financial statements, in certain circumstances, normalised figures can provide a more realistic view as they exclude once-off items.

Based on FY21 earnings estimates, Aristocrat shares seem fairly valued in my eyes on a forward P/E of around 33x.

My other latest ASX growth share ideas can be found in this article: 2 ASX growth shares to add to your 2021 watchlist. Even better, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.