The Humm Group Ltd (ASX: HUM) share price has languished around $1.15 despite providing investors with a strong trading update last week.

Humm, formerly known as FlexiGroup, missed out on the buy now, pay later (BNPL) hype that took its rivals such as Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P) to record highs last year, despite having a very similar service offering.

HUM share price chart

Humm background

Humm is a diversified payments company, which now primarily focuses on a BNPL product, but also offers revolving credit and small-medium enterprise (SME) financing. It currently operates in Australia, New Zealand, and Ireland, facilitating purchases for over 2.6 million customers.

The company entered the BNPL space back in April 2019 while still operating as FlexiGroup. The rebranding was announced in August last year and according to chief executive Rebecca James, the change was intended to simplify the business and provide a smoother checkout experience for customers.

However, even before Humm was branded as a BNPL player, the company offered point of sale finance for big-ticket items and consumer leasing products. Consumer leasing, which operated under the FlexiRent brand, ceased being offered in 2019.

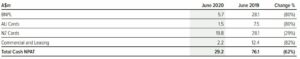

As you can see from the image below, the business operations are split into four operating segments, with BNPL accounting for roughly 35% of total NPAT (net profit after tax) in 2019. This figure took a hit in 2020 as the result of increased marketing spend, greater impairment provisions in the wake of COVID-19 and decreased margins due to a more competitive landscape.

Despite coming off a relatively low base, it’s worth noting that Humm is currently the only profitable BNPL player on the ASX. This makes sense, as it doesn’t seem to be taking the same aggressive international growth strategy like some of its competitors.

Recent developments

In its recent half-year trading update, Humm announced it expects group NPAT of $43.4 million for the first half of FY21, an increase of 25.8% on the prior corresponding period (pcp). This growth has primarily been driven by disciplined cost management practices as well as higher top-line growth in the BNPL segment, with total customers of over 2.6 million, an increase of 40.4% or 750,000 on pcp.

One of Humm’s four products is called Bundll

, which, through a partnership with Mastercard, allows customers to bundle payments together in manageable instalments and make transactions anywhere Mastercard is accepted.

This is actually quite interesting due to its differentiation compared to traditional BNPL products. It’s different because it doesn’t rely on the BNPL provider signing up merchants.

Instead, a customer can simply bundle payments wherever Mastercard is offered, with Bundll providing the BNPL technology while using existing banking systems. To leverage an already established brand seems like an efficient growth strategy, rather than focusing on merchant growth.

On a separate note, Humm also announced a partnership with fintech Douugh Ltd (ASX: DOU) in December 2020.

Through the partnership, Douugh customers will be able to initially borrow up to $1,000 and repay the amount in six weekly instalments. Humm will be tasked with providing the back-end BNPL infrastructure as well as providing warehouse funding and collections services.

Humm: buy/hold/sell?

It’s no secret that the BNPL sector has exploded exponentially in recent times. More players are in the game than ever before and I do wonder what the future will look like given the competitive landscape and the effect this will have on the margins and profitability of some of these companies.

Putting that all aside for a moment, there is a potential investment case to be made for Humm, primarily from a value standpoint, in my view.

For some context, Afterpay’s shares are currently valued at roughly 79x sales. In order words, its market capitalisation is 79x larger than its FY20 revenue.

Zip’s shares don’t come particularly cheap either, at roughly 25x sales (or ~16x based on annualised 4Q20 revenue, including QuadPay).

With Humm’s market capitalisation of around $564 million at the time of writing, this puts shares on a trailing price-to-sales ratio of just 2.5x. This tells me that the market doesn’t have the same high level of growth expectations it might for some of the bigger players.

Given Humm has only recently transitioned from its older products in consumer finance, it might take more time to fully integrate its new offering and execute on its current growth strategy.

Afterpay and Zip are evidently focused on expanding its reach into new markets overseas, which would explain the higher valuations.

I’m holding on Humm shares for the moment. While the valuation is attractive, I would like to see how its BNPL segment continues to perform in a post-COVID world.

Additionally, while it doesn’t have the same level of international presence as its competitors yet, it will be interesting to see how the Mastercard partnership performs over 2021.

My other latest ASX growth share ideas can be found in this article: 2 ASX growth shares to add to your 2021 watchlist. I’d also suggest signing up for a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.