The Nuix Ltd (ASX: NXL) share price shot up last month, since its highly publicised IPO in December last year. Will Nuix live up to the hype?

NXL share price

Why do clients use Nuix?

Nuix develops and distributes forensic software with investigative analytic tools that assist clients to investigate, manage, secure, de-risk, and utilise massive amounts of data they possess. For example, organisations such as the Australia Securities and Investments Commission (ASIC), Westpac (ASX: WBC), and Amazon.com, Inc. (NASDAQ: AMZN) use this software to help them either:

- manage data;

- comply with legal and regulatory obligations;

- reduce losses that result from external and insider data breaches; or

- analyse the data to create value.

Essentially, Nuix equips organisations to process large amounts of unstructured data into a format that can be used for the above purposes. A pretty powerful tool, right? So, how do the financial metrics stack up?

Nuix financial performance

Nuix has the hallmarks of an ASX growth share, considering the impressive results it achieved in FY20. Total revenue increased by 25.9% to $175.9 million and EBITDA (EBITDA explained) rose by a whopping 78% to $55.5 million, reflecting the impact of cost management last FY.

Noticeably, the company reduced its overall employee headcount from 522 in FY19 to 421 in FY20, even lower than the number for FY18.

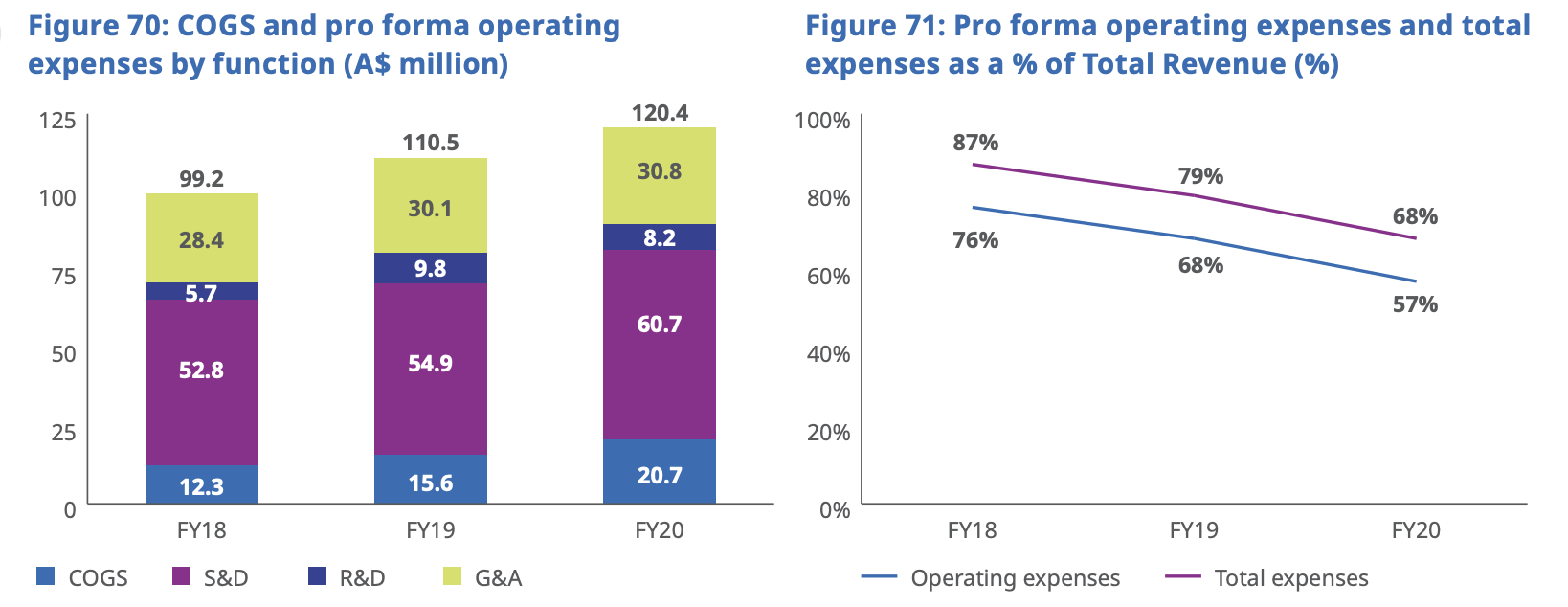

Overall, Nuix appears to be continually improving its control over expenses as illustrated below.

The significant growth in revenue and improved management of expenses resulted in Nuix becoming positive free cash flow (FCF – how to calculate) for the first time in FY20.

Revenue up, positive free cash flow… it would seem Nuix is looking more and more like the next ASX growth share darling. However, before you get ahead of yourself, let’s understand how Nuix managed to get into this position.

Nuix product quality

Nuix discloses in its prospectus that it conducted a survey of 63 of its customers and interviews with 20 customers. The company said this survey was solely conducted by Nuix.

Nuix says 78% of the respondents provided a rating of 8 or higher (out of 10) to the question, “On a scale of 1-10 does Nuix have the fastest eDiscovery processing engine?”.

Also, it noted 66% of customers responded with a similar rating to the question, “On a scale of 1-10, does Nuix have the fastest digital forensics processing engine?”.

Although this a small sample size, the quality of Nuix’s software is also supported by high-profile use cases like the Panama Papers and the Royal Commission into Misconduct in the Banking, Superannuation and Financial Service Industry in Australia.

The product quality, and perception of product quality, might explain why Nuix has a relatively low churn rate, which has hovered between 3.5% and 6% over the last three years. Meaning, it loses 3.5 – 6 customers each year. That’s quite low.

Nuix riding a long industry tailwind

The COVID-19 pandemic has accelerated digital adoption in all facets of our lives. As more businesses and people embrace the digital world, organisations will possess more and more valuable data. This industry tailwind will act as a key revenue driver for two reasons.

The organisations successfully exploiting data to create value will likely force others to carry out a similar approach, potentially adding more demand for its software. Keep in mind, Nuix generates revenue from the volume of data processed by its customers.

Risks

As Nuix notes in its prospectus, there are a number of competitors across its four key product offerings. It appears Nuix relies on the quality and speed of its data processing engines as the point of differentiation to keep and win customers.

This can result in a costly exercise, so pay close attention to its research & development expenditure and/or further acquisitions of leading technologies. Nuix will likely take these approaches to maintain the quality and speed of its signature data processing engine.

Valuation

Software as a Service (SaaS) businesses are often difficult to value due to them often being non-profitable. However, in Nuix’s case it is profitable.

A quick comparison of the Price-to-Sales (P/S) ratios between Nuix and one of its competitors, OpenText (NASDAQ GS: OTEX), shows the ASX market appears quite bullish about Nuix.

The P/S ratio of Nuix stock is around 17.83x, which is much higher than OpenText at around 3.90x. Let’s drill this down to understand what this means.

Nuix currently has a market capitalisation of around a quarter (1/4) of OpenText but its current revenue is one-seventeenth (1/17) of OpenText. In other words, there is a huge amount of optimism priced into Nuix.

Is the hype justified?

There is a lot to be excited about Nuix and I can understand why some people may think this could be the next ASX growth darling.

Nuix has posted stellar financial results, it has a large and reputable client base, and long industry tailwinds lie ahead.

In saying this, I would not invest in Nuix at its current price and rather sit on the sidelines for a price that is more palatable.

Instead of Nuix, I suggest getting a free Rask account and accessing our full stock reports. Click the link below to join for free and access our analyst reports.