The Pinnacle Investment Management Group Limited

(ASX: PNI) share price has rocketed on the back of an impressive H1 FY21 interim report. Will it continue to reach new pinnacles?

PNI share price

What does Pinnacle do?

At first look, Pinnacle seems like your typical active fund management firm. But there’s a slight twist.

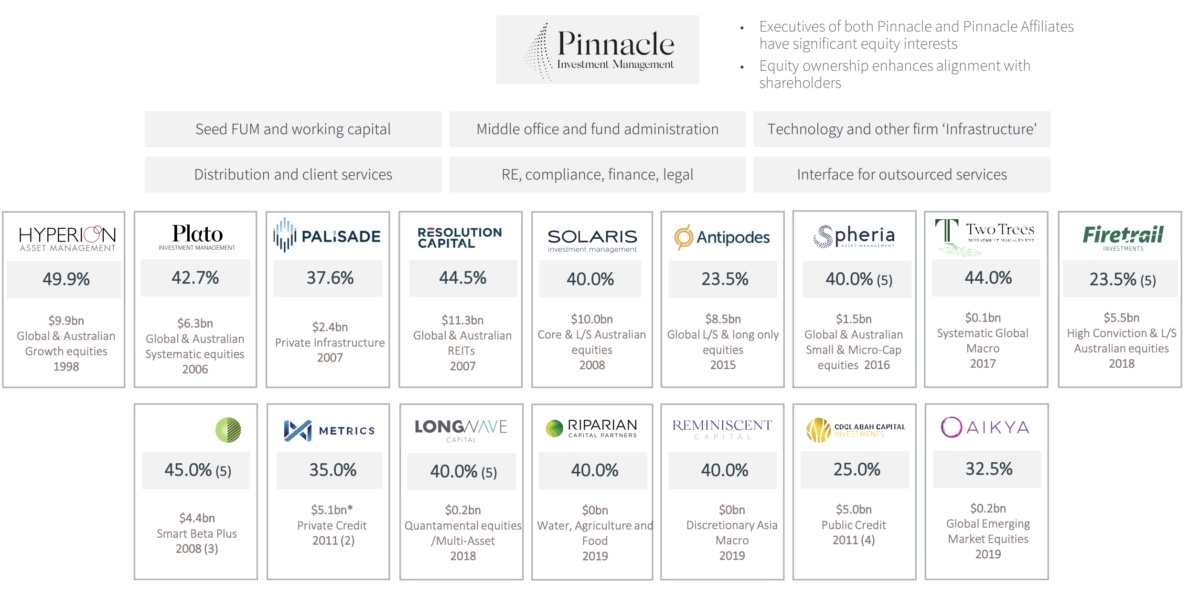

Instead of investing and managing assets directly, Pinnacle invests in other active fund management firms that are coined, ‘Affiliates’. Founded in 2006, Pinnacle currently holds equity/ownership positions in 16 Affiliates and provides the following services in exchange for ownership:

- equity, seed capital and working capital; and

- distribution services, business support and responsible entity services

By partnering with Pinnacle, a fund manager can focus on what they’re good at: delivering investment returns.

As you can see, Pinnacle essentially alleviates the time and resource-intensive burden of business operations for fund managers. Then, when the fund managers start to scale and make lots and lots of free cash flow, Pinnacle shares in those returns.

HY20 financial results

When the company reported results this week, Pinnacle’s bottom line surged 120% from $13.8 million net profit after tax (NPAT) in the Prior Corresponding Period (1H FY20, PCP) to an eye-watering $30.3 million NPAT for 1H FY21. This is an impressive number but how?

Pinnacle earned $14.4 million in services revenue from providing distribution services and business support but the key driver lies with the Affiliates.

The 16 Affiliates, and fund managers in general, normally charge performance fees and management fees to their investors. So, these funds earn more fees as the amount of funds under management (FUM) increases.

Pinnacle’s equity stake in the Affiliates enables it to share in the Affiliates’ profit pie.

This is illustrated by Pinnacle recording a 20% jump in the Affiliates’ total FUM from $58.7 billion at 30 June 2020 to $70.5 billion at 31 December 2020.

The $11.8 billion increase in FUM was attributed to market movements or investment performance of $6.3 billion and net inflows of $5.5 billion ($1.9 billion was from retail investors).

Given interest rates are at all-time lows and alternative asset classes are not offering attractive returns, it’s understandable that a lot of capital is being deployed towards equities focused fund managers.

What drove Affiliates performance?

The rise in FUM contributed to a significant bump in Pinnacle’s share of the Affiliates’ NPAT from $17.7 million in the PCP to a whopping $31.8 million for 1H FY21.

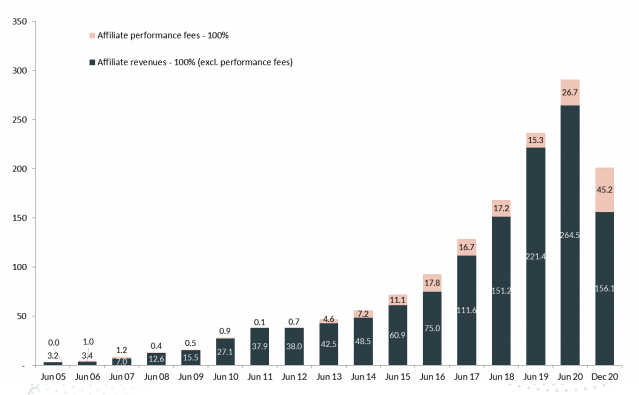

Another key driver was the investment outperformance achieved by the Affiliates, catapulting its performance fee revenue from $0.5 million in 1H FY20 to $45.2M in 1H FY21.

The combination of higher management fees brought on by an ever-increasing inflow of funds and growing performance fees due to outperformance relative to a benchmark boosted the Affiliates’ bottom line. This is illustrated below.

The performance fees generated by Pinnacle’s Affiliates for H1 FY21 almost doubled that of FY20, depicting how well the fund managers performed.

Outlook

Ultimately, the 80% boost in Pinnacle’s share of Affiliates NPAT and 26% surge in services revenue contributed to its great performance. And Pinnacle managed to achieve these results without many additional expenses, which only jumped by 4% for the PCP.

The unit economics of this business model is powerful, especially in such an investing conducive climate.

Pinnacle’s founder and managing director, Ian Macoun is bullish about equity markets in light of the current macroeconomic environment. If such economic conditions remain the same and Pinnacle’s underlying Affiliates continue to execute, the company will likely grow.

Pinnacle’s strong retail distribution network of 17,000 financial advisers, across 7,000 practices, places it in a solid position to not only attract more inflow of FUM, but also the best investment fund managers.

Another ASX growth share that applies a similar business model is covered in Q4 update: Frontier Digital Ventures (ASX: FDV) share price to rise or fall?