In a recent VanEck Vector Insights blog, The waves of a pandemic: Lessons from the past, investors were warned about the waves of a pandemic. Now that the vaccines are being rolled out, the answer to what is on the horizon may have to do with Iceland, Romania and the Seychelles.

What do Iceland, Romania and the Seychelles have in common?

Well, it is not climate.

They are all accepting tourists who have had a COVID-19 vaccine. This is just an initial glimpse of what is to come as economies start to open.

Those that have a ‘half-empty-glass’ view of the world believe that life will never be the same again post-COVID-19. They remain under-invested, shunning opportunities.

Life may not return exactly the same as before, but we think as the vaccine rolls out our lifestyle, and thus the global economy, will be a lot closer to pre-COVID-19 than the current situation.

When it comes to COVID-19, bad news in the press far outweighs good news. Recent stories include the anger and grief as the United Kingdom’s death toll nears 100,000, the EU threatening to impose export controls on COVID vaccines and the US surpassing 25 million cases – a staggering tally.

However, there is good news.

About 80 million vaccination doses have already been administered. While the global population is close to 7.8 billion, it does represent a good start. The vaccines are initially being distributed to those in the healthcare sector and individuals who are more vulnerable to the virus. This should reduce hospitalisations and the death rate. According to modelling posted on the medRxiv database, vaccinating 40% of the US population will reduce the infection rate by 75%.

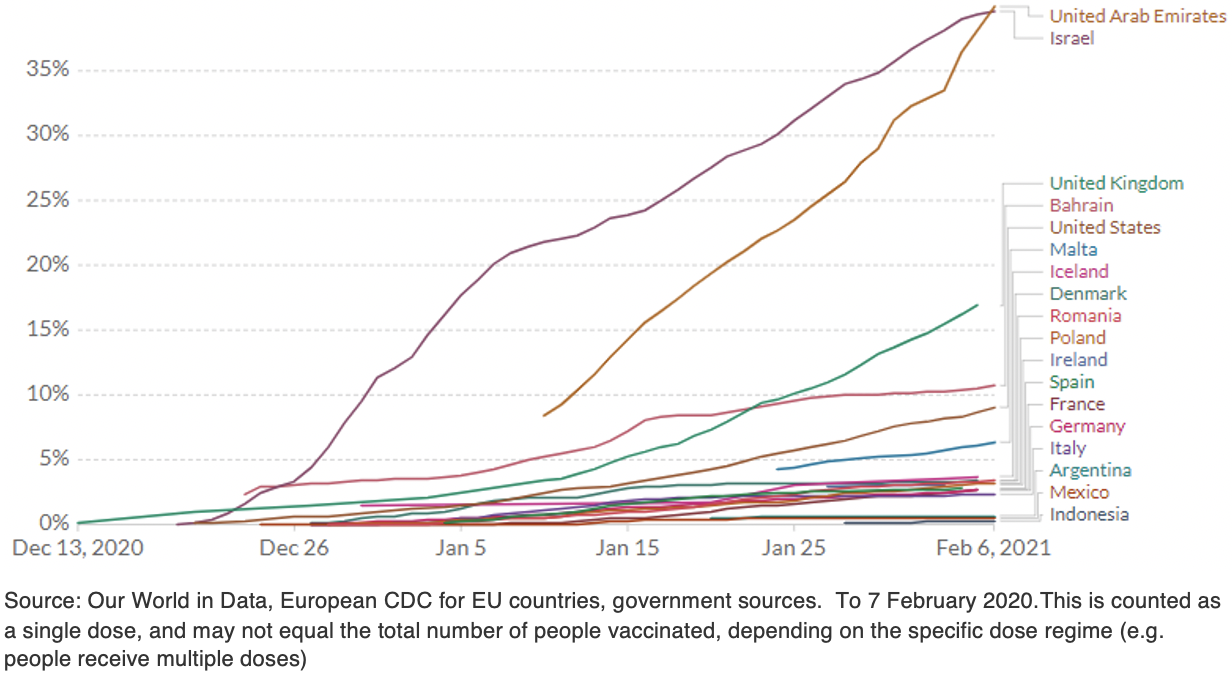

A good practical example is Israel. In Israel, over 60% of the population has received at least one vaccination dose and they lead the world at the moment in terms of percentage of population who have been administered with the vaccine.

Share of people who received at least one dose of COVID-19 vaccine

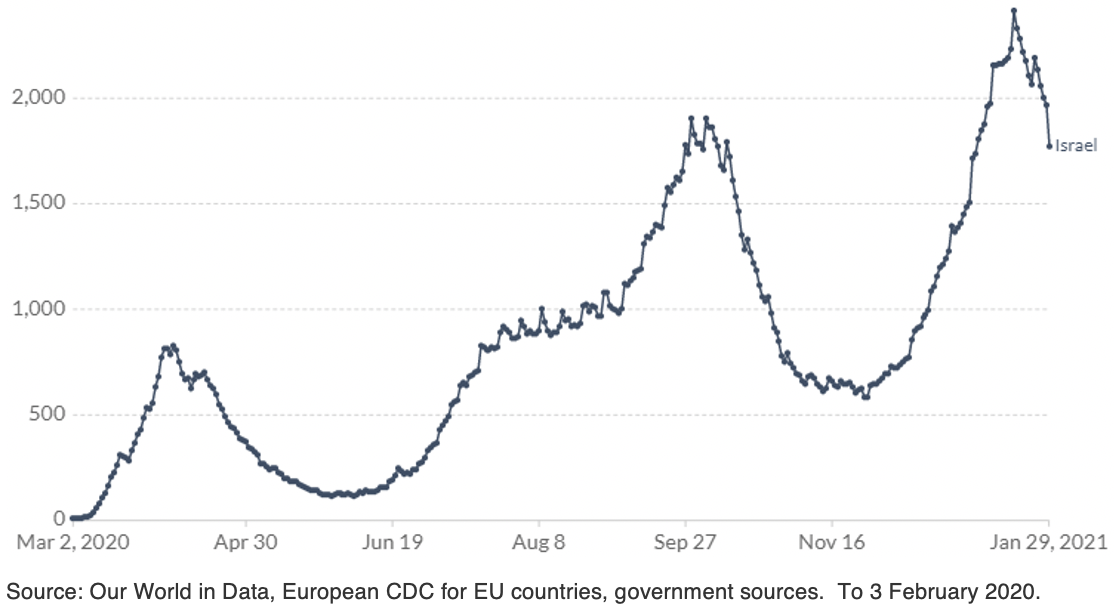

And already, there has been a noticeable drop in hospitalisations:

Number of COVID-19 patients in hospital

As existing vaccine production ramps up and alternative vaccines become available, more countries should follow a similar trajectory. Until a sufficient proportion of a country’s population has been vaccinated, there is still a risk of further waves of infection, especially if measures such as lockdown and social distancing are relaxed too quickly.

We are still in for a ride with some bumps, but a successful vaccine rollout may change the glass to being half full.

This report was written by Russel Chesler

, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.