The AGL Energy Limited

(ASX: AGL) HY21 results depict challenging times ahead. What does this mean for the AGL share price?

AGL’s main business involves electricity generation, gas storage and the sale of electricity and gas to residential, business and wholesale customers.

The company also expanded its activities to retailing of broadband and mobile services through the acquisition of Southern Phone Company in December 2019. Plus, AGL is the country’s largest investor in renewable energy.

AGL’s FY 21 half-year result

AGL recorded a significant net loss after tax of $2.28 billion as a result of the $2.69 billion write-down in its wind offtakes and continual fall in wholesale electricity prices. What’s a wind offtake you may ask?

Wind offtakes are agreements AGL entered into with wind farm developers more than a decade ago. These agreements entitled AGL to sell the electricity from the wind farms and obtain the green certificates to produce renewable energy.

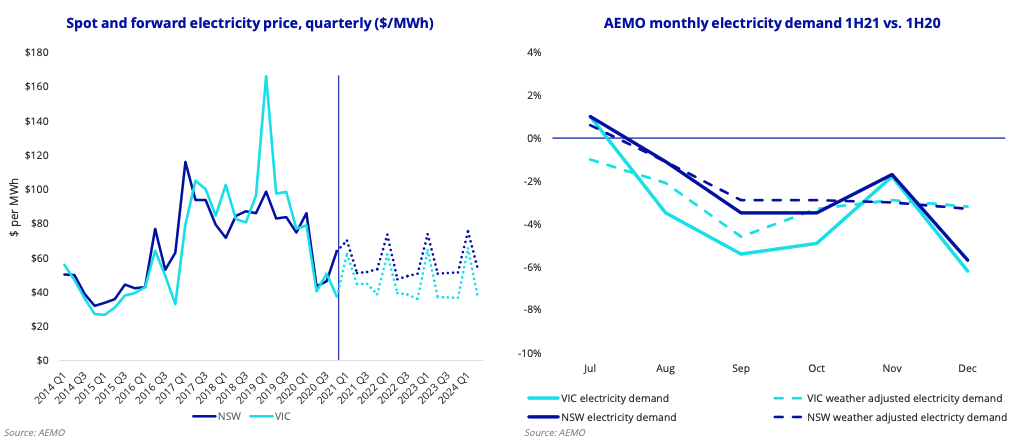

According to the Australian Financial Review, the company has not revealed the electricity prices in its off-take agreements but the AFR understands the average prices paid between 2006 and 2012 may be in excess of $100MW per hour.

The current environment of lower wholesale electricity and renewable energy prices is the reason for the significant write-down.

The severe decline in demand for electricity has resulted in tough operating conditions for AGL, as illustrated below.

CEO outlook

The AGL managing director and CEO, Brett Redman recognises AGL is facing an uphill battle given the current conditions as he said, “AGL’s strategic focus and financial strength create a solid foundation to withstand and emerge stronger after this period of challenging market and operating conditions. While earnings pressures are increasing, we are executing our strategy with discipline, while looking to the future to ensure our business is structured to lead the energy transition and deliver value for shareholders“.

It appears management is focused on reducing operating costs to ride out the downward trend of electricity prices.

Final thoughts

The growing secular trend of adopting renewable energy resources and low electricity prices does not bode well for AGL.

The odds seem to be stacked against AGL and the recent acquisition of a broadband and mobile services provider could be a tell-tale sign. I’m not a fan of businesses that move away from its core competencies, especially into markets that are highly competitive.

If you’re after investment ideas, check out our ASX shares ideas hub where you’ll find lots of ASX stock ideas and analysis. Or, grab a free Rask account

and access our in-depth, analyst-backed stock reports.