The Transurban Group (ASX: TCL) share price may feel the pinch on the back of its HY21 results. But I think there’s more than meets the eye for this ASX blue-chip share.

Transurban owns and operates 21 toll roads across Sydney, Melbourne, Brisbane, the United States and Canada. The company generates the majority of its revenue through toll fares, which is driven by traffic volume. In the HY21 report, around 75% of the total toll revenue was represented by Sydney and Melbourne.

Transurban also derives a small percentage of revenue from constructing roads.

HY21 performance

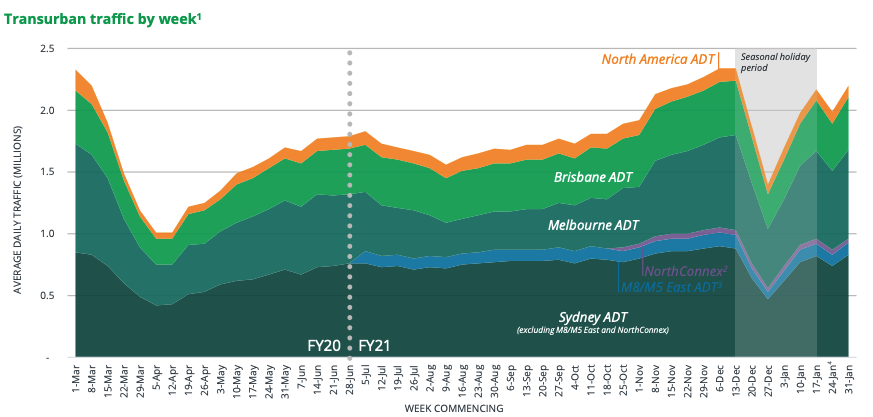

Transurban noted average daily traffic (ADT) fell by 17.8% compared to the prior corresponding period in HY20 (PCP). Let’s zoom out and get a better picture of the underlying trend.

The lower ADT contributed to a decline in toll revenue by 16.5% to $1.06 billion relative to the PCP. Transurban suffered significantly in Melbourne and the Greater Washington Area due to COVID-19 imposed restrictions in early FY21, but traffic in Melbourne managed to improve notably through the half.

Despite the drop in ADT for HY21 compared to HY20, there appears to be a continual rise in ADT since the start of this year. The ADT also appears to be on track to reach pre-COVID-19 levels, which I think is encouraging.

The fall in toll revenue, combined with an increase of $337 million in net finance costs, contributed to a net loss of $448 million.

The big jump in net finance costs was caused primarily by foreign exchange movements ($107 million), remeasurement of shareholder loan note payment profiles ($103 million), and net unrealised loss from the measurement of derivative financial instruments ($88 million). These remeasurements were mainly a result of the appreciation of the Australian dollar relative to other currencies.

Transurban dividends deflated

The toll road operator announced its HY21 distribution back in December, and is set to pay a 15 cent interim distribution to shareholders on 16 February.

This represents a 52% drop compared to the 31 cent distribution declared in the PCP, and puts Transurban shares on an annualised dividend yield of 2.3% at the time of writing.

What happens next?

Transurban’s CEO, Scott Charlton, is cautiously optimistic as he said, “In markets where restrictions have lifted, for example, Brisbane and Sydney, we have seen traffic largely recover to pre-COVID-19 levels, however, it will remain sensitive to government responses and economic conditions.” I share his sentiment as I believe there are a few key drivers

of the continual rise in ADT.

Australia has seen a rise in used car prices as people prefer to travel by vehicle rather than public transport due to COVID-19. Also, the overseas border restrictions will likely continue to force people to go on long driveway holidays.

Scott also highlighted another factor that could contribute to higher ADT. The pandemic has shown that workers can perform their work outside the traditional 9-5 model, which has reduced peak level traffic. Should more organisations embrace the flexibility of working outside 9-5 hours, it will likely make driving a more attractive option.

Transurban may be suffering some short-term pain, but I think there are long-term tailwinds.

If you’re looking for more places to park your capital, check out our ASX shares ideas hub where you’ll find lots of ASX stock ideas and analysis.