The Australian retail sector has had an interesting last 12 months.

As an industry, retail is undoubtedly a tough space to be in. Competition is fierce, switching costs for buyers is mostly non-existent, and businesses quite often compete on price, making it a fairly low-margin environment.

Yet despite the tough environment, various ASX retailers have turned out to be some of the biggest beneficiaries of the COVID-19 pandemic. Of course, I’m talking about some of the market darlings such as Temple & Webster Group Ltd (ASX: TPW) and Redbubble Ltd (ASX: RBL), which, since March last year, have returned nearly 600% and 1100% respectively in regards to their share price.

I don’t think these rallies weren’t justified, but I do think the market might be partially extrapolating past results and assuming that some of these businesses will be able to continue on their rapid upwards trajectory.

This may in fact happen, and I don’t discount growth stocks just because they look expensive using traditional valuation metrics such as Price/Sales (P/S) or Price/Earnings (P/E).

However, another approach may be to find high-quality businesses that also happen to be relatively cheaper using some of these metrics.

If you’re risk-averse, this might be a safer option with less downside risk, as the market doesn’t have overly optimistic expectations about the company’s future performance. Just to be clear, I personally wouldn’t invest in a company purely because it had a low P/E ratio, but if the fundamentals are strong, a fair valuation can make the investment case more compelling.

Here are my two favourite picks at the moment.

Nick Scali

Nick Scali Limited (ASX: NCK) is a retailer of household furniture and related accessories that operates in Australia and New Zealand. The business has 58 furniture showrooms and multiple distribution centres.

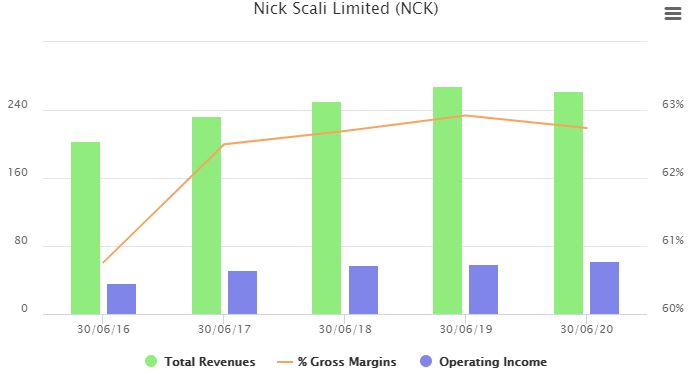

Rather than selling off the showroom floor, orders are imported from multiple suppliers around the world and then delivered to the customer from its distribution centres. This capital-light business model has enabled the company to achieve gross margins of around 63% consistently over the last several years.

Debt is also usually minimal with the exception of the recent addition of capital leases resulting from changes in accounting rules. Still, Nick Scali has consistently boasted an outstanding return on equity of over 50% over the last several years.

Total revenue for 1H FY21 was up 24% compared to the prior corresponding period, 1H FY20 (PCP) to $171.1 million. While this growth wasn’t as explosive compared to its rivals, it’s important to note its order bank was up 146% on the PCP, with this expected to convert into sales revenue in 2H FY21.

Consensus earnings estimates are putting Nick Scali’s shares on a forward P/E ratio of around 14.8, lower than the retail industry average of roughly 20. This seems fairly cheap, considering the earnings growth that you’re essentially paying for.

Dusk

I recently bought shares in Dusk Group Ltd (ASX: DSK) because I think the popularity of the underlying thematic might be misunderstood by the market and as such, the valuation made the investment case much more compelling.

Dusk runs a completely vertically integrated model and is responsible for the in-house design and development, and distribution of candles, ultrasonic diffusers, reed diffusers and essential oils, as well as fragrance-related homewares.

It’s a fairly large player in the Australian market with an estimated 22% market share in a total addressable market (TAM) worth around $461.5 million. While this isn’t as large as some other spaces in retail, the attractive component is the fact that this TAM has the ability to grow significantly.

Products like essential oils and ultrasonic diffusers have gained popularity in recent years and I think it’s fair to assume that over the coming years as trends change, there will be a constant influx of new technology/products that Dusk can use to its advantage.

While the company has only listed recently, limited past financial results indicate the company has been on an upwards growth trajectory prior to the COVID-19 retail boost.

Future growth will be driven by the expansion of its store network from 115 to around 160 stores by 2024. International expansion is potentially on the cards, with New Zealand a likely opportunity for both physical stores as well as an international website.

My rough back of the envelope valuation gives Dusk’s shares a fair price of roughly $3.88 per share using a current P/E ratio of 17 and estimated FY21 earnings of $14.08 million. To learn more about Dusk and how I arrived at that figure, click here to read my analysis: Why I think Dusk could be one ASX share to look out for in 2021.

For more reading, I’d suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports