The Nearmap Ltd (ASX: NEA) share price was on fire today, recovering all of last week’s losses and then some as it surged 19% higher.

The aerial imaging technology company released its half-year results for the six months ended 31 December 2020 and in a separate announcement, responded to the recent claims made by short-seller JCapital.

Let’s first take a look at Nearmap’s financial performance.

Headline results

One of Nearmap’s key operating metrics is annualised contract value (ACV), which represents the annualised value of all active subscription contracts at a particular date.

Group ACV grew by 16% in the first half to finish at $112.2 million, adding net incremental ACV of $10.3 million on the back of record growth in North America.

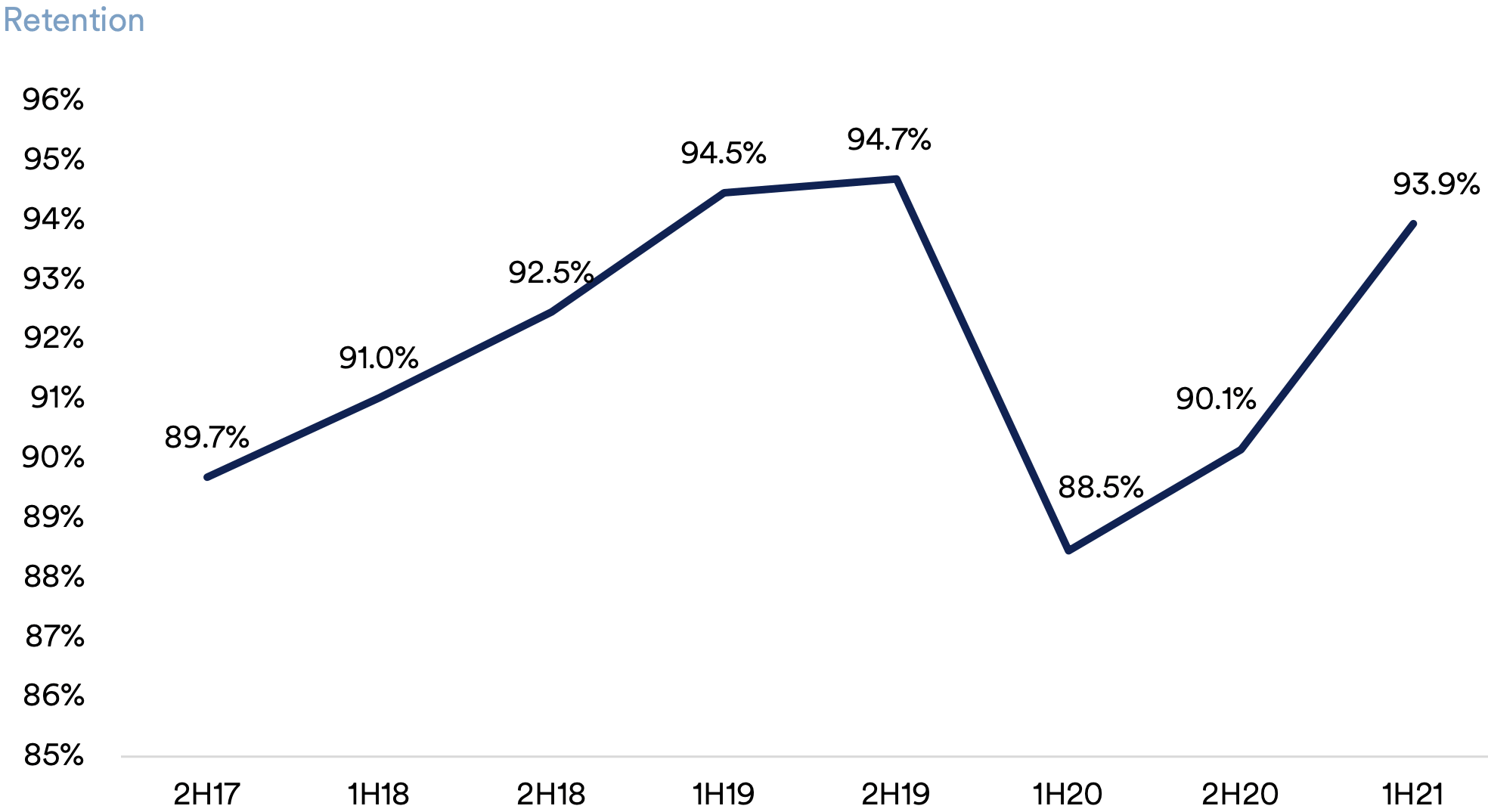

This net incremental ACV comprised $4.9 million of new business (down 43% year-on-year) and $9.2 million of net upsells (up 101%), which was partially offset by churn of $3.8 million (an improvement of 44%). Following Nearmap’s significant churn event in 1H20, its customer retention rates have been heading in the right direction:

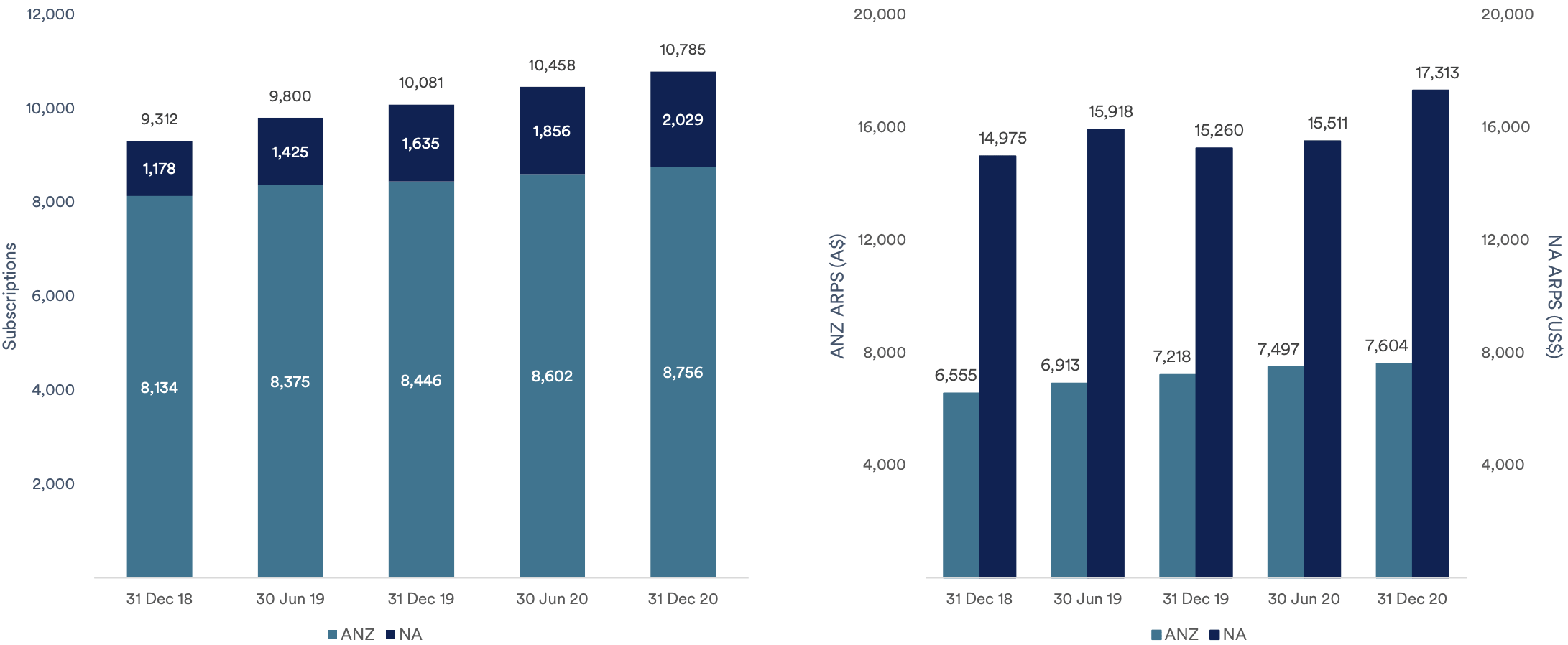

Subscriber numbers and average revenue per subscriber (ARPS) also continued their upward trend, as seen in the charts below. Nearmap reported 10,785 global subscriptions at the end of the half (up from 10,081 in HY20) and ARPS of $10,402 (up 9% from $9,580).

On the top line, group revenue jumped by 18% compared to the prior corresponding period (pcp) to $54.7 million. Revenue in the more mature Australia and New Zealand (ANZ) business grew by 11.4% to $33.0 million, while the North American region achieved 30% growth to reach $21.7 million.

In terms of earnings, Nearmap reported a much-improved EBITDA result of $13.5 million as the North American segment finally teetered on EBITDA profitability. The company reported a net loss of $9.4 million, an improvement from the $18.6 million loss recorded in the pcp.

After completing a ~$90 million capital raising in October 2020 (its third raising in five years), Nearmap has a cashed-up balance sheet boasting $129.3 million cash and no debt.

Despite being known to burn through cash, the business managed to generate free cash flow in the half. However, this was due to the company paying employees 20% of their salary in shares during the period 1 May 2020 until 31 October 2020. What’s more, Nearmap cut back on its cash cost of capture during the half in response to the pandemic, which is expected to bounce back going forward.

Management commentary and guidance

Commenting on the results, CEO Rob Newman said:

“Our 1H21 result represents an early validation of our decision to refine our go-to-market strategy and focus on our core growth verticals in North America, which showed strong growth in 1H21 and where the market opportunity is significantly larger. Our market leading ANZ business continues to grow and we see an opportunity to roll-out a similar go-to-market approach in ANZ to deliver deeper value in this market and further increase our leadership position.”

The company expects its group ACV portfolio to end FY21 at the upper end of its guidance range of $120 million to $128 million.

Broker Goldman Sachs upgraded its price target and rating on Nearmap shares this morning, with the result coming in ahead of its expectations.

Nearmap hits back

On Thursday, the Nearmap share price was rocked by a report released by JCapital, the short seller behind the WiseTech Global Ltd (ASX: WTC) critical report in 2019.

Nearmap summarised JCap’s report into three primary assertions:

- Nearmap’s go-to-market strategy in North America has failed and the company is losing market share;

- Nearmap is losing its technology leadership; and

- Nearmap’s accounting treatment is bringing forward revenue.

Sales strategy

In regard to the first point, one of JCap’s claims is that “Nearmap has failed to succeed in any key sector in the US”. In response, Nearmap highlighted the record half for the North American business and noted that the success of its strategy to focus on three key verticals – insurance, government and roofing – is evidenced by the strong ACV growth rates in these markets in HY21. ACV in the insurance vertical grew by 43% in the half, while government increased by 53% and roofing jumped 198% (off a low base).

Capture inefficiencies

As for the second point, JCap claims that competitor “Eagleview’s camera system captures twice the ground area of Nearmap’s on the same flight” and as a result, “Nearmap’s costs for its aerial images are at least twice those of Eagleview”.

Here’s what Nearmap had to say:

“The camera efficiency claim is based on a hand selected image in one of Nearmap’s older technology patents (dated 2015) which doesn’t enable accurate assessment of the as-built system and its actual method of operation. Nearmap has since delivered a significant new generation of camera technology in 2017 . . . The cameras enable an update frequency of the North American capture footprint of up to 3 times per annum which is unequalled in the industry. It delivers this at a low fixed cost of US$13m per annum, including image processing, enabling strong and growing gross margins. The pre-capitalised gross margin is now above 50% meaning that Nearmap effectively generates US$2 of ACV for every US$1 spent on capture.”

Accounting tricks

Finally, addressing its accounting practices, Nearmap reaffirmed its revenue recognition practices are in accordance with accounting standards, and stressed that it has always received an unqualified opinion from auditor KPMG (the best possible outcome).

“Nearmap initially records the billings for subscription fees as unearned revenue and then recognises revenue over the subscription period. Unearned revenue is impacted by the timing of sales and invoicing,” the company added.

These are just three of eight claims that Nearmap responded to – others include assertions around churn, pricing and the Pushpin acquisition.

Now what?

Nearmap delivered an impressive set of results this morning and it seems as though its North American business is really starting to gather momentum.

With plenty of dry powder in its financial arsenal to invest back into the business, market its solution suite (and cross-sell opportunities) and build out its capabilities, Nearmap is well-positioned to forge ahead in the US market towards sustainable free cash flow.

However, valuation could be a sticking point, with a lot of this potential upside seemingly already priced in.

For a further breakdown of Nearmap’s half-year results, check out this article: Nearmap share price pops but…