The Class Ltd (ASX: CL1) share price is climbing this morning after the software company released its half-year results and announced an acquisition.

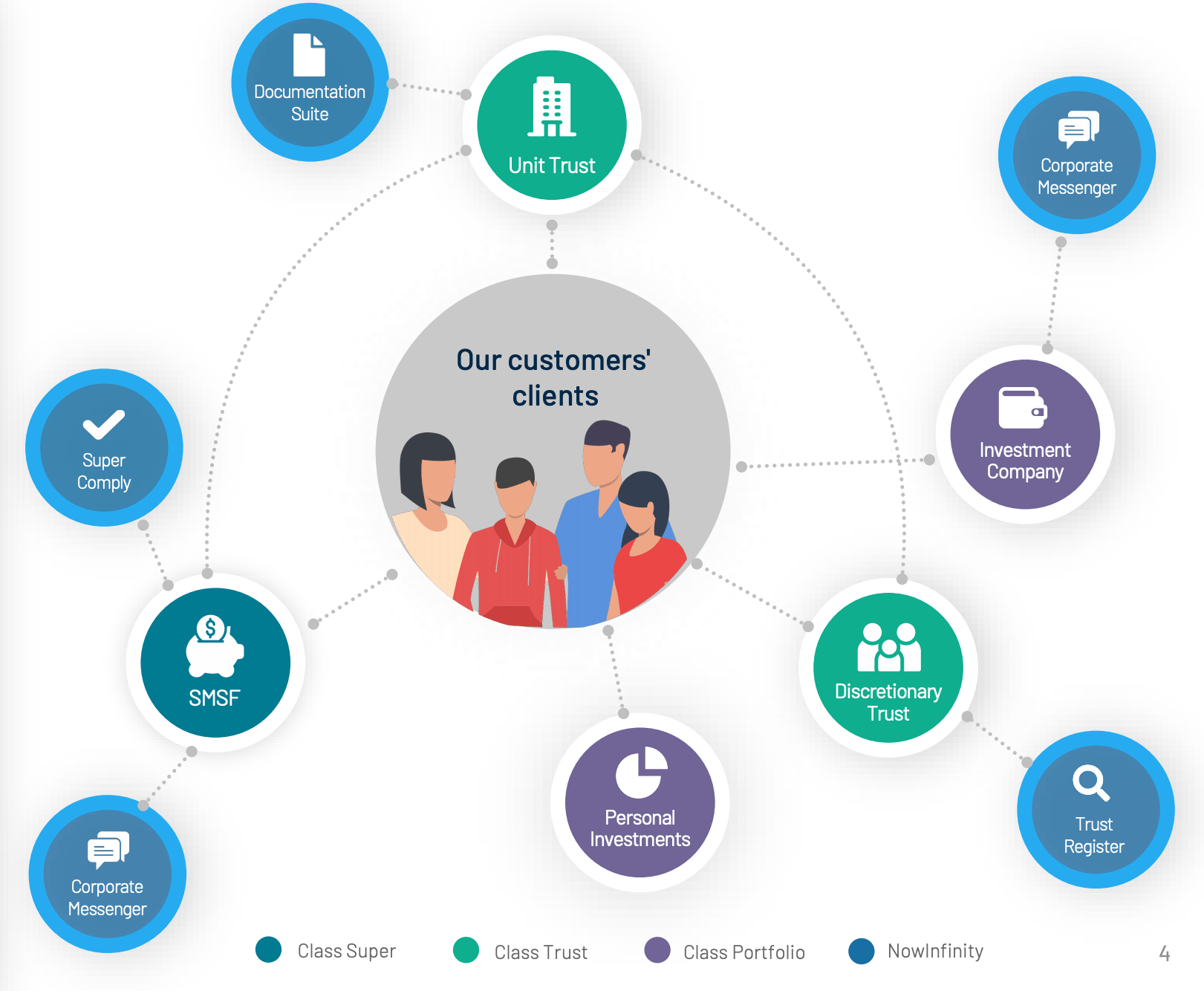

Class provides cloud software solutions to the Australian wealth accounting market. Its software helps accountants, administrators and financial advisers to automate key processes, reduce operating costs for their back office, improve data accuracy and reduce compliance risk.

Class is the leading provider of cloud-based administration software for self-managed super funds (SMSFs), with around 28% of all SMSFs administered on Class Super.

The company also provides software to streamline the administration of investment portfolios outside of SMSFs, such as companies, trusts and individuals.

Unpacking the Class HY21 result

Reimagination strategy takes shape

Class delivered revenue growth of 27% in the first half to $25.8 million, driven primarily by the NowInfinity business (including Smartcorp), which was acquired in 2020.

Annualised recurring revenue (ARR) increased 25% to $48.6 million, while trailing 12-month PAYG revenue jumped to $4.3 million. These two metrics combine to represent roll forward revenue, which grew 30% in the half to $52.9 million.

In line with its reimagination strategy to transform Class into a multi-product software-as-a-service provider, the business continued to invest in its platform. Class spent $7.1 million on product and technology investment in HY21, $4.8 million of which was capitalised, up from the $5.5 million investment in HY20.

Class plans to accelerate its spend in the second half of FY21 to fast-track the transformation and delivery of new features. This investment will focus on platform rejuvenation, acquisition integration, super product compliance and new features across all of Class’ products.

Profits & dividends

Turning to earnings, Class maintained an EBITDA margin of 40% and grew EBITDA by 29% to $10.4 million.

The company also remains profitable, reporting a statutory net profit after tax of $3.2 million for the half, up 5% compared to the prior corresponding period.

With Class being profitable, it continues to pay out a consistent dividend. Shareholders will receive a fully franked 2.5 cent interim dividend, which translates to an annualised dividend yield of 2.4% (or 3.4% grossed-up).

ReckonDocs acquisition

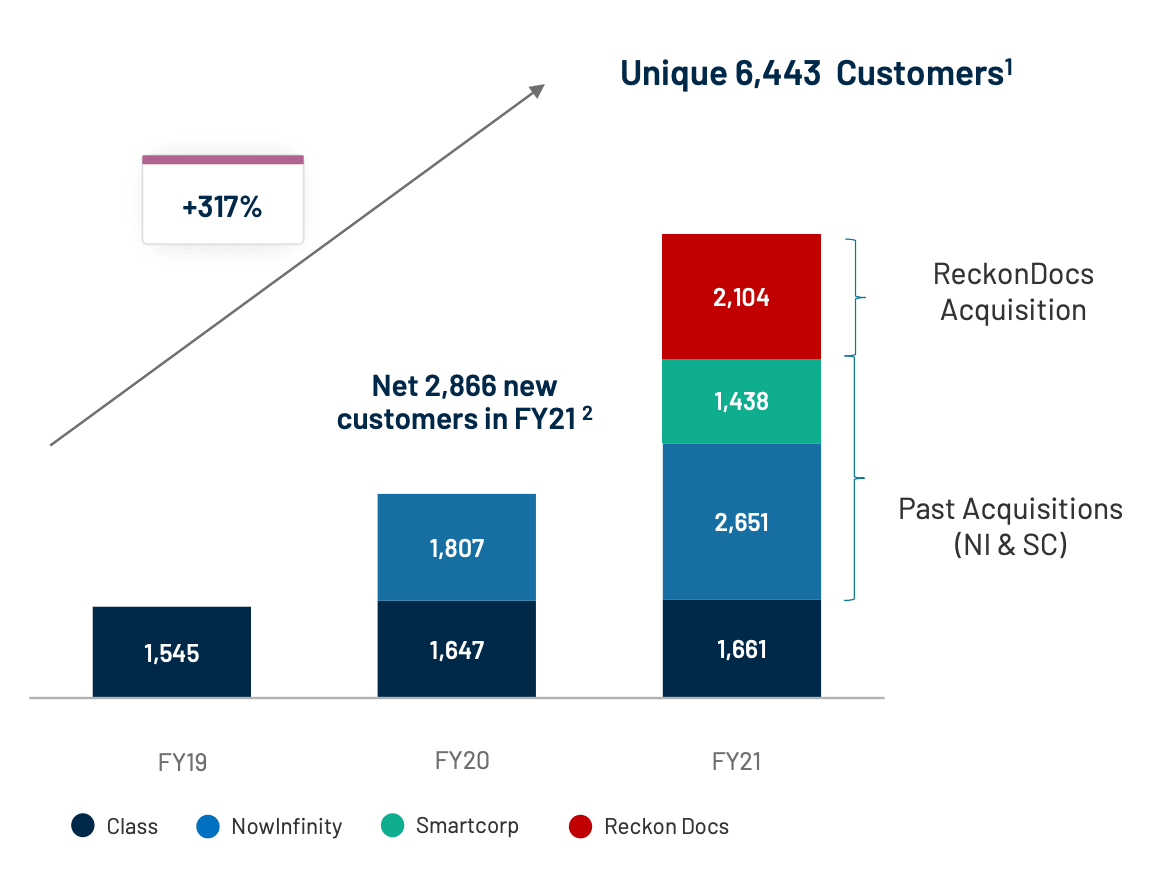

Also announced this morning was the strategic acquisition of the ReckonDocs business from ASX-listed Reckon Limited (ASX: RKN). This marks Class’ third acquisition since January 2020.

ReckonDocs’ product suite provides company registrations, trust deeds and SMSF deeds. It’s currently used by more than 2,000 businesses in Australia, and one in seven Australian companies are registered through the platform. Class said the ReckonDocs business is a “natural fit” and will be incorporated into its NowInfinity platform.

Class will pay $13 million cash for the business and expects the acquisition to be earnings per share accretive in FY22. ReckonDocs is forecast to contribute $1 million of revenue in Class’ FY21 results, and $4 million revenue in FY22 with an EBITDA margin of 60%.

Once the transaction is completed on 1 March 2021, Class will have nearly 6,500 unique customers across its product suite (see below).

Now what?

Looking ahead, Class has maintained its FY21 targets of $53 million full-year revenue and an underlying EBITDA margin of 40%.

Combined with $1 million revenue expected to be recognised from the ReckonDocs acquisition, Class’ new full-year revenue target is $54 million, which represents 22% growth compared to FY20.

On the surface, this appears to be a solid set of results as the company continues along its three-year transformation journey. While it’s not the sexiest tech company, it’s profitable, pays a dividend and is reinvesting back into the business to drive future growth, which could lead to a step-change in profits down the line if management can execute.