I heard the stock market, or S&P/ASX 200 (ASX: XJO), is about to crash; I should wait, right?

This is the question I hear every time I introduce myself at a party, and say “I’m in finance. The stock market. I help people know which shares to buy and how to invest for their future.”

Here’s my honest answer to this question:

Worrying about a potential market crash is absolutely bonkers.

Let me explain…

Firstly, it’s bonkers to think about ‘the next crash’ because it makes people think they can time the market. Successful investing is not about timing the market. It’s about time in the market.

Remember the GFC, Trump’s first election campaign, Brexit, Trump’s second election campaign, COVID-19… these all seemed like fair reasons to not be invested, right? The market should have crashed, right?

- 2016: “Brexit could trigger European stock market crash” – CNN (it didn’t)

- 2016: “US Election 2016: Markets meltdown fails to materialise” – BBC (the stock market rallied)

- 2020: “CBA warns Australia risks 32 per cent house price crash in a ‘prolonged downturn'” – ABC (property prices are up 30% in some suburbs)

- 2021: “A Year on From the Covid Crash, Here’s Where the Market Stands” – Bloomberg (punchline: the MSCI World Index is up 18% since Jan 2020)

I think it’s crazy (and concerning) to think that investors spend more than 30 seconds worrying about “the next market crash”.

Let me show you…

Here is the only thing you need to know about market timing:

- If the market’s up, buy.

- If it’s sideways, buy.

- If it’s going down, buy more!

The four most dangerous words in investing are “buy low, sell high”. Why?

It makes you think you need to time your ‘trades’ (buy low). Second, it makes you think you have to sell a winner (you don’t – and shouldn’t).

Those words should be “buy low, then buy again”. Or, better yet, “accumulate”.

Accumulate assets that pay dividends and grow. That’s it.

I believe you should only ever sell a stock for two reasons:

- Your thesis (the reason for owning a stock) has broken

- The position is too big for you to sleep comfortably at night

That all sounds a bit fluffy, right?

If you don’t believe me, here’s some research to consider:

- Researchers at Massey University tested 5,000 of the most popular technical trading strategies and found none of them worked.

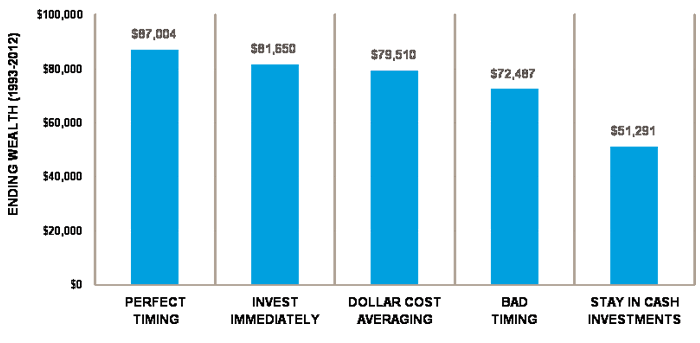

- Researchers at Schwab tested 20 years of data to ask “does market timing work?”. They tested 5 hypothetical portfolios ranging from perfect timing (buying on the lowest day for the market every single year) and the worst possible timing (investing at the market’s peak every year). Even with the worst possible timing, a portfolio would have returned nearly 50% more than the investor who stayed in cash. But what I find most refreshing is this: if you just invested your money immediately (e.g. save $1,000 this month and invest it on the first day of next month) the ‘perfect timer’ was only 6.5% better off than you were after 20 years!

So, yes, if you have perfect timing it can help. Some.

However, instead of using your time and energy worrying about the direction of ‘the market’ this year or next, or getting yourself tangled in some convoluted market timing strategy, why not just do this: invest in the best investments you can find each and every month. Rain, hail or shine. Then hold on.

And if you can’t find a new investment? Buy more of the one you already have (an existing position, an ETF, etc.).

Smart. Simple. Investing.

Reader, pretty please note: this article formed part of a free email series you receive if you join the Rask mailing list. I will send you stuff like this each week. If you get the free stock report (see the button below) you’ll get regular insights just like this one.

Featured image credit: based on the design from behaviourgap.com.