Today the ASX 200 (ASX: XJO) was weighed down by a big sell-off of Zip Co Ltd (ASX: Z1P) shares and Evolution Ltd (ASX: EVN) shares, which sank 14% and 10%, respectively. Z1P shares were particularly hard hit, despite 69,764 trades taking place.

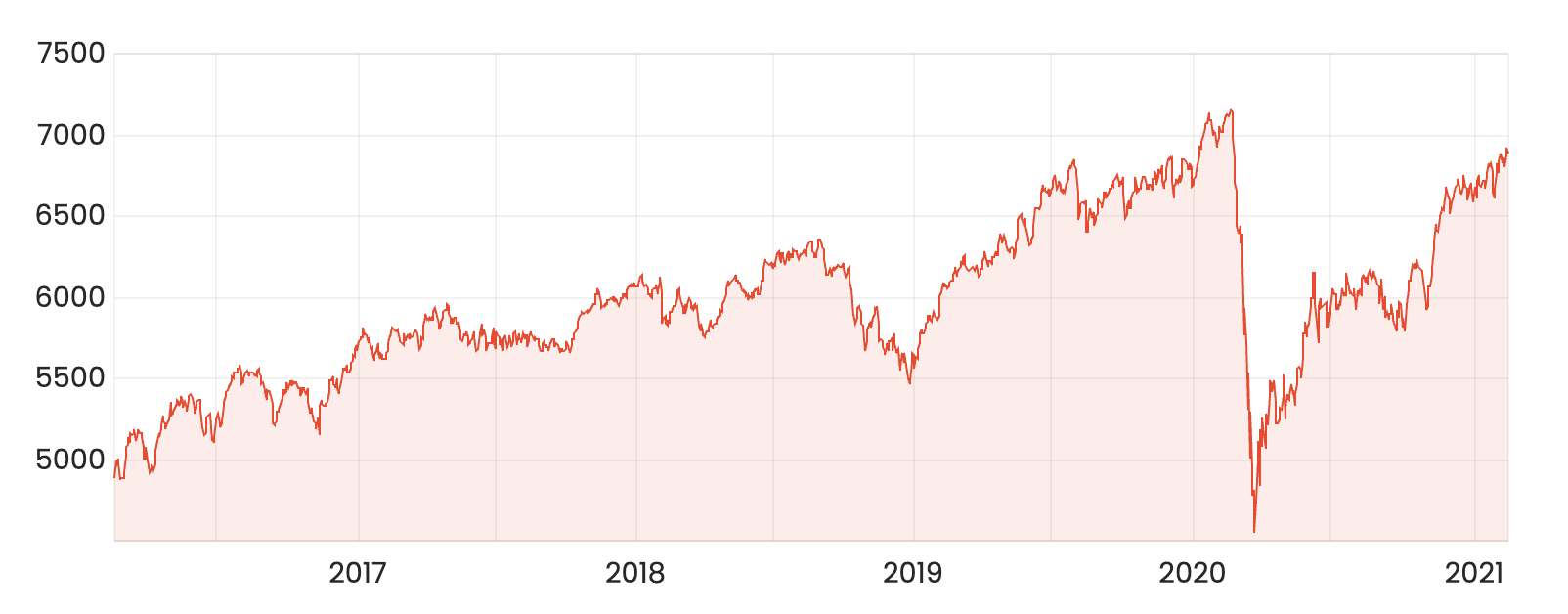

ASX 200 price chart

What happened to Zip?

As reported by Rask Media’s Jaz Harrison today, Zip shares were amongst the worst-performers today on the back of a big run-up in recent weeks. Earlier this week, Zip was pinged by the ASX which asked if there was any significant insider information that could explain the run-up in the Zip share price. It said no.

In truth, the Buy Now, Pay Later (BNPL) sector has experienced significant growth over the past 24 months. Today, fellow BNPL providers Afterpay Ltd (ASX: APT), Sezzle Ltd (ASX: SZL), Splitit Ltd (ASX: SPT) and Humm Group (ASX: HUM) were sold down.

Over in the US, Affirm Holdings (NASDAQ: AFRM), Afterpay’s big competitor, saw its stock price tumble 5%. Following Affirm’s quarterly report, it noted it had around 4.5 million active customers as at 31 December — up 52% year over year.

Zip recently reported its results.

Evolution not so shiny

Gold miner Evolution Mining (EVN) also made headlines today and it shares sank 10%. The company reported its first-half FY21 results (1H21) to the market, showing:

- Profit up 55% to $229 million

- Free cash flow of $218 million, down from $242 million last half

- A fully franked dividend of 7 cents per share

Executive Chairman Jake Klein, explained that these were record results which, “demonstrate the quality of Evolution’s asset portfolio.”

Crucially, the company’s all-in sustaining cost (AISC), which is the critical measure of a gold miner’s profitability, came in at $1,182 per ounce (US$854). That compares to a current gold price of US$1,789 per ounce – a good margin indeed.

Evolution shares have been on a decline recently, falling from around $6 late last year to $4.20 today. With a hefty cash balance and dividend, plus strong free cash flow, at least shareholders may have some fully franked dividends to keep them company.

If you’re looking for further reading, yesterday I answered the all-important question: Is the ASX 200 going to crash? If so, should I wait to buy stocks?