Evolution Mining Ltd (ASX: EVN) released its 2021 half-year financial results today. The market was not impressed, with the share price selling off 9% at the time of writing.

Evolution Mining is one of the largest gold mining companies on the ASX. Let’s dig into the interim results.

What did Evolution Mining report?

Evolution Mining advised it had achieved record first-half underlying net profit after tax (NPAT), which surged 57% on the prior comparable period (pcp) to $234 million.

Revenue increased by 9%, influenced by higher gold prices. However, this was partially offset by a lower volume of gold sold.

Evolution recorded gold production of 350,326 ounces at an all-in sustaining cost (AISC) of A$1,182 per ounce (US$854).

Operations in the half led to the group generating free cash flow of $218.1 million. This, however, was down around 10% on HY20 free cash flow of $242.2 million.

Evolution also reported a significant uplift in resources and reserves. Mineral resources surged 74% to 26.4 million ounces (Moz) and ore reserves increased by 49% to 9.9Moz.

Evolution Mining dividend

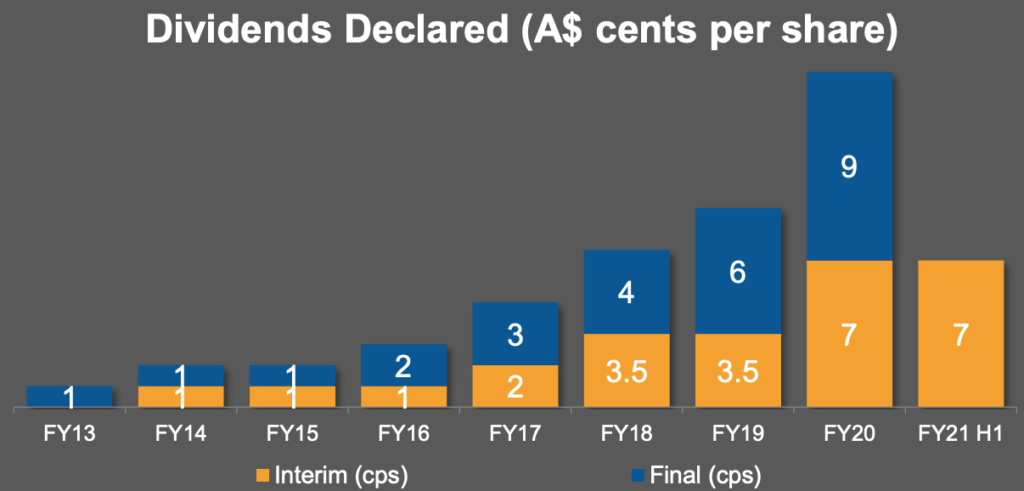

The ASX gold miner declared a fully franked interim dividend of 7 cents per share, which will be paid on 26 March 2021. The ex-dividend date is set for 1 March 2021. This is in line with the dividend declared in the pcp and means Evolution Mining shares trade on a trailing dividend yield of around 3.3%.

Evolution has an enviable record of paying a growing stream of dividends to shareholders. The below chart is sourced from Evolution’s 2021 half-year results presentation.

Outlook for FY21

Evolution’s board provided guidance for FY21 gold production of between 670,000 and 730,000 ounces at an AISC of between AUD$1,240 – $1,300 per ounce.

In FY20, Evolution produced 746,463 ounces of gold at an AISC of $1,043 per ounce (US$700).

In effect, Evolution expects lower production and higher costs in FY21. This likely contributed to the sell-off in Evolution shares today.

Time to invest?

Evolution Mining’s current dividend yield looks tempting given the current low interest rate environment. However, I am not sure if it’s a good time to buy shares given the volatility in the gold price.

According to the Perth Mint, the current spot gold price is AUD$2,321.31 per ounce. Just six months ago, the spot gold price in AUD was above $2,700 an ounce. Since I don’t have a strong view on which way the gold price will move, I will stay away from Evolution shares.