GameStop, Reddit, Robinhood, I’ve heard it all when talking about shares. Have you heard of SelfWealth Ltd (ASX: SWF)? Well if not, grab a drink and enjoy my take on its stellar half-year (HY21) results.

SelfWealth listed in late 2017 and is Australia’s fastest-growing flat-fee ($9.50 per trade) share trading platform. Retail investors are able to invest in both Australian and US shares and use community-driven insights tools to improve their performance.

GameStop frenzy and US trading functionality pushes record customer growth

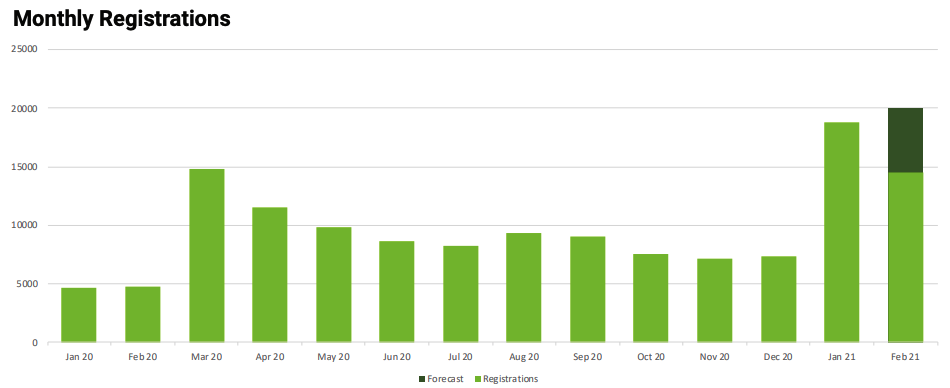

SelfWealth noted new client registrations from the start of 2021 have exceeded the previous peak growth levels experienced at the beginning of the COVID-19 pandemic. Just have a look below and see for yourself.

Stop rubbing your eyes, the above figures are real. The GameStop craze definitely played a big part in the numbers as a record number of daily registrations (2,211) was recorded on 29 January 2021.

The pandemic-driven momentum in customer growth during the half translated to a significant boost in membership subscription revenue from $46,574 for HY20 to $210,081 for HY21. But this is not where SelfWealth makes most of its money.

More customers mean more trading revenue

SelfWealth’s wealth creation machine lies in its trading revenue as retail investors pay $9.50 (inc GST) on every trade. The key driver of trading revenue is trading volume.

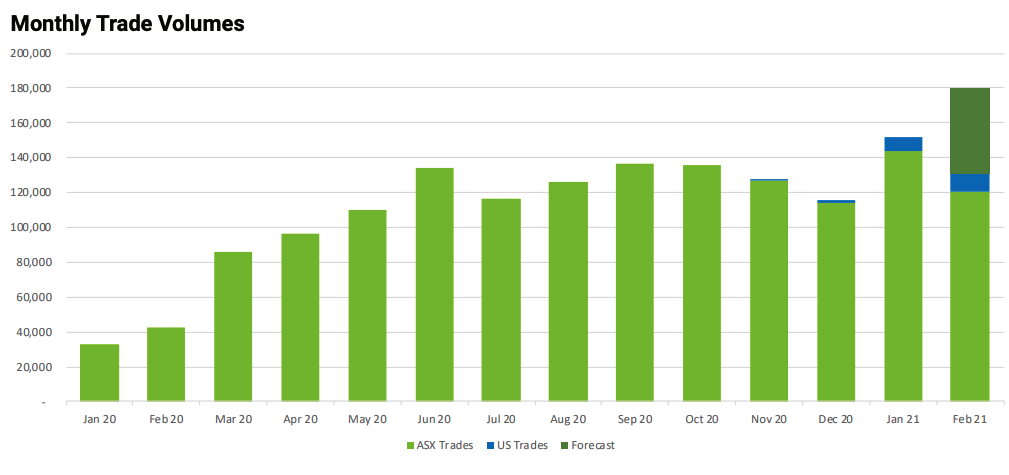

The company continues to experience consistent growth in trading volumes as depicted below.

The rise in trading volumes produced trading revenue of $6.22 million for HY21, compared to $1.23 million for HY20. This represented a major contribution to the total revenue of $8.43 million recorded for HY21.

Even though SelfWealth remains unprofitable, its loss after tax improved from -$1.45 million for HY20 to -$0.43 million for HY21.

Management outlook

SelfWealth’s Managing Director, Rob Edgley was pleased with how the company has executed and is excited about the much-anticipated new iOS app for SelfWealth clients.

Rob Edgley said, “The decision to focus our resources during 2020 on the development and launch of our US trading capability has proven to be the correct move. Interest in the US share market from Australian retail investors is at an all-time high. By providing simple access to this market at a reasonable price, we have seen unprecedented interest from new clients to join the SelfWealth trading platform. On top of this growth, we will be launching our much-anticipated iOS app for SelfWealth clients. The app will be launched next week and will enable clients to trade effortlessly on both domestic and US markets. The Android app will follow in the coming weeks. We expect the new app will increase trading velocity and assist in further growth for the Company.”

Is SelfWealth a name to remember or forget?

SelfWealth is causing major disruption among the traditional share trading platforms like CommSec operated by Commonwealth Bank of Australia (ASX: CBA) and Nabtrade of National Australia Bank (ASX: NAB).

It’s important to understand why the company is wreaking so much havoc. It appears SelfWealth offers a cheaper and more user-friendly platform with access to an online community.

I think the community aspect of SelfWealth’s platform has been a hidden driver of growth, especially since the pandemic. Investing journeys can often be overwhelming and lonely, so a platform that provides a network can empower investors.

Investors should be mindful that the record growth was a result of an unprecedented event, so one must question the sustainability of this wave of DIY investors over the long-term.

If SelfWealth continues to strengthen the community aspect of its business, I think it could be a name to remember.

Before you consider SelfWealth, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.