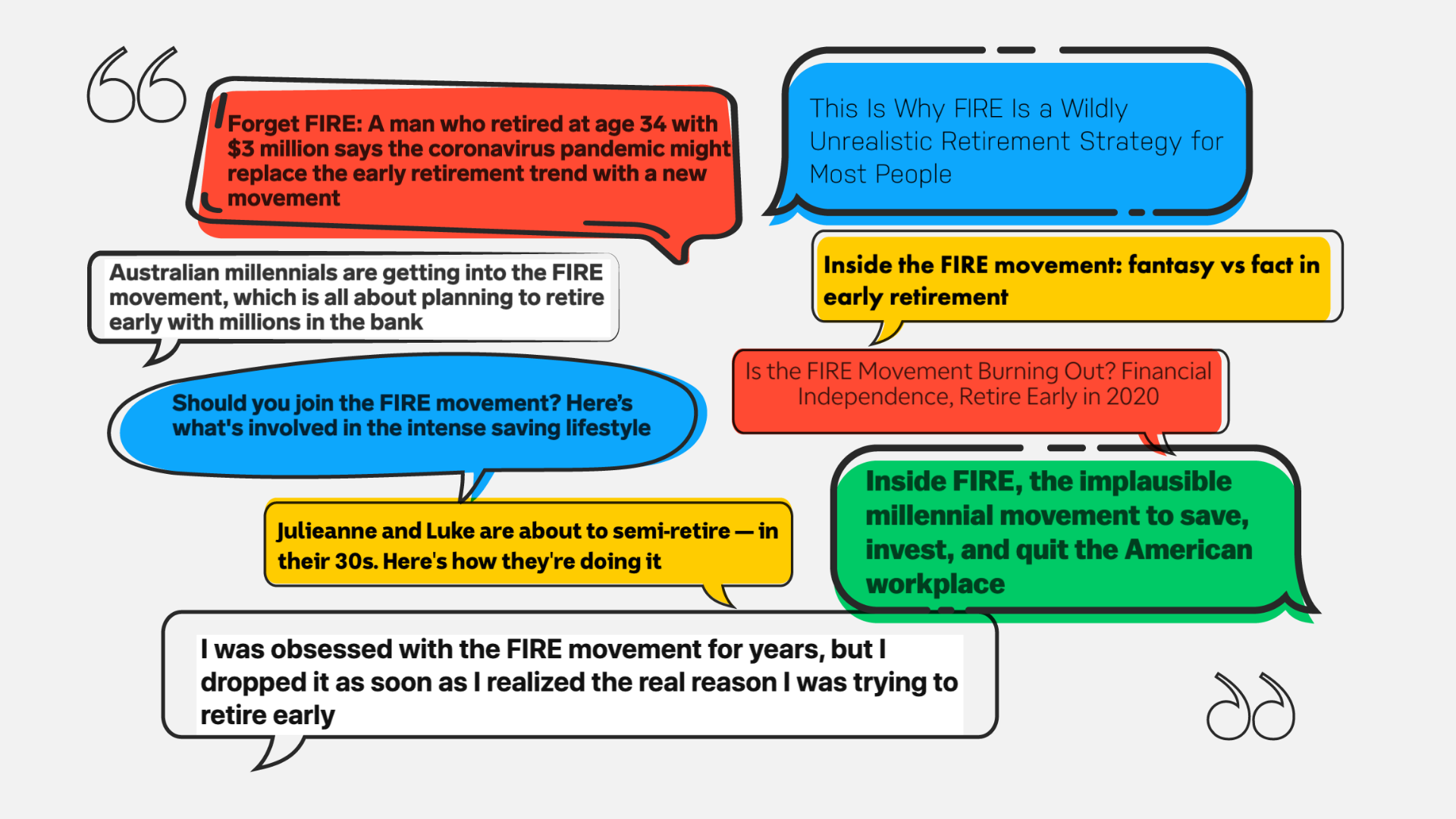

The FIRE movement is often criticised in the media by skeptics and financial professionals alike. Often the reasons they put forward aren’t coming from a place of reason or experience, and aim to tear the movement down with shock statements. For this exact reason, I want to dive into some key myths around reaching financial independence and retiring early.

FIRE is just about quitting your job and watching Netflix all-day

When I talk to people about wanting to achieve FIRE, a lot of people say “retire and do what?” In my mind it’s to retire and do anything!

Everyone’s working towards FIRE for different reasons, whether that be freeing up time to spend with family, starting a business, volunteering or traveling. Generally those who are motivated and dedicated enough to achieve FIRE are not going to be lazing around all day once they quit the rat race!

Frugality and deprivation is the only way to achieve FIRE

Absolutely not! There are so many paths to FIRE and if you start looking online there are many people sharing their journeys with the world. Achieving FIRE is not something restricted to the wealthy or the frugal, and it’s a goal that people from all walks of life have achieved.

It does require a plan and hard work, it does require sacrifice and it may take you much longer to achieve than the person next door. The good thing is that whatever the outcome, the earlier you start saving and investing your income the better you’ll be down the track, regardless of whether you reach your FI number in 5, 10 or 30 years!

You’ll have no identity without work

Think about all the components of your job that you enjoy outside of the steady paycheck – is it people you work with, the chance to get out of the house, the challenges you face and the problems you get to solve, the networking opportunities or the feeling of control?

These are all areas of your life you can fulfill without a job (unless you stay on the couch watching Netflix all day!).

Having the freedom to pursue your interests and develop new skills should be something that empowers you, and enables you to find happiness and fulfilment outside the workplace.

You need to know a lot about finance to achieve financial independence

Funnily enough we aren’t born with an innate knowledge of the global financial system, and unfortunately personal finance isn’t a topic commonly covered in school.

Luckily for us, personal finance is simple (as you’re about to discover). And you already know that these days the internet (and Rask Education) provides you with everything from budgeting to buying shares online.

It will take some trial and error to work out the financial strategies and products that suit you, but don’t let your lack of a PhD in Economics stop you from starting your financial education journey today (as it’s definitely not necessary)!

It goes without saying that you can’t pull $1 million out of your hat. And it’s something that needs to be planned and actioned over 10-30 years. People in the FIRE community start working towards financial independence at all ages, and the time frame to achieving their goals differs.

It’s important while working towards FIRE that you balance your life, and don’t neglect your family, friends, hobbies and personal goals. Yes, you may approach your life differently now, but it shouldn’t take away from the best parts of life.

Everyone’s path towards FI looks different but for most people some changes will be required in your life to reach this goal.

What could some of these changes look like?

Here are some ideas:

- Putting solid financial habits in place, building an accountability system, making sure your income exceeds your expenses, knowing where your money is going

- Putting more money towards investments (aka your future self) and less towards your present self

- Cutting down on expensive items

- Starting a side hustle or getting a second job

- Investing in yourself and increasing your income

- Learning to cook well and cutting down on takeaway

- Not buying brand new and expensive cars

- Buying more second-hand goods and getting out of the consumerism mindset

- Catching up with friends and family in less expensive ways (dinner party, picnic, camping, hiking, local travel, etc.)

- Moving to a low cost-of-living area and decreasing housing and utility expenses

Have a think about what changes could you make in your life to make your FI/RE goal a reality?