Despite recording strong growth, the market responded negatively to the Mydeal.ComAu Pty Ltd (ASX: MYD) half-year results (HY21). With shares finishing the day more than 6% lower, is the current MyDeal share price a good or a bad deal?

MyDeal is an Australian online marketplace that focuses on household goods like furniture and homewares. It was founded in 2011 and listed on the ASX in October 2020.

The company earns its main revenue from charging commission fees to sellers on every product and service sold on the marketplace. It also generates a small percentage of revenue from transaction fees and advertising fees.

Aussies keep buying more household goods online

Similar to Temple & Webster Group Ltd (ASX: TPW), MyDeal has been a big beneficiary of the pandemic. The money that people have saved from border closures has led to record growth in expenditure on household goods.

MyDeal posted record revenue of $21.2 million, a jump of 248% compared to the prior corresponding period, HY20 (PCP).

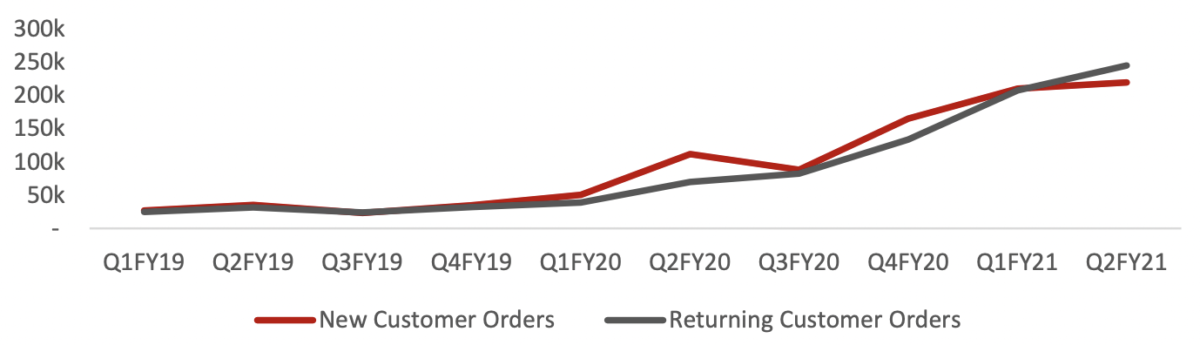

Returning customers contributed significantly towards this jump as it represented 52.7% of total transactions in the second quarter of HY21, an improvement on 38.5% for the same period in HY20.

MyDeal’s returning customer orders is also outpacing new customer orders, as illustrated below.

Customers keep growing

The number of active customers reached a record high of 813,764, growing by 205% year-on-year. The company notes active customers are those who purchased a product in the last 12 months prior to 31 December 2020.

It appears the significant rise in advertising expenditure has worked its magic as it increased from $3.3 million (8.3% of gross sales) in HY20 to $13.8 million (11% of gross sales) in HY21.

Management focused on customer acquisition

MyDeal’s Founder and CEO, Sean Senvirtne aired his optimism about the future, as he said, “Building on the continued growth in our active customer base and increasing transactions from returning customers we will continue to focus on customer acquisition as our technology, marketing, and product range evolves and we add new partnerships to increase our seller base.

“We will continue enhancing a seamless customer experience. We’re launching mobile apps for iOS and Android, implementing one-to-one real-time AI and machine learning into all interactions, and increasing our private label offer while optimising promotional support to realise the higher-margin potential of this product range.”

Deal or no deal?

Investors should bear in mind that MyDeal is currently unprofitable, recording a net loss after tax of -$2.3 million. This is because the company is focused on scaling and acquiring more customers.

I do have some concerns about the slowdown in the growth of new customer orders, especially given MyDeal incurred significant advertising expenditure to acquire new customers. This may be an indicator that demand for household goods may be slowing down.

This would be a key reason why I think MyDeal may not be a good deal at the moment and it might explain the negative reaction from Mr Market.

If you are interested in other ASX growth shares, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.