The Scentre Group (ASX: SCG) share price is in the spotlight today after the shopping centre group released its full-year FY20 results. In afternoon trade, Scentre shares were down nearly 2% to $2.82.

Scentre owns and operates 42 Westfield shopping centres in Australia and New Zealand.

The group noted that every Westfield Living Centre remained open, every day throughout the pandemic, with more than 450 million customer visits translating to $22 billion spent at its centres in 2020.

Scentre caught in COVID crunch

Scentre reported property revenue of $2,275 million, down 7% from $2,455 million in the prior corresponding period (pcp) of FY19.

Net operating income came in 9% lower at $1,770 million, while operating profit dropped 40% to $763 million on the back of a $304 million expected credit charge related to COVID-19.

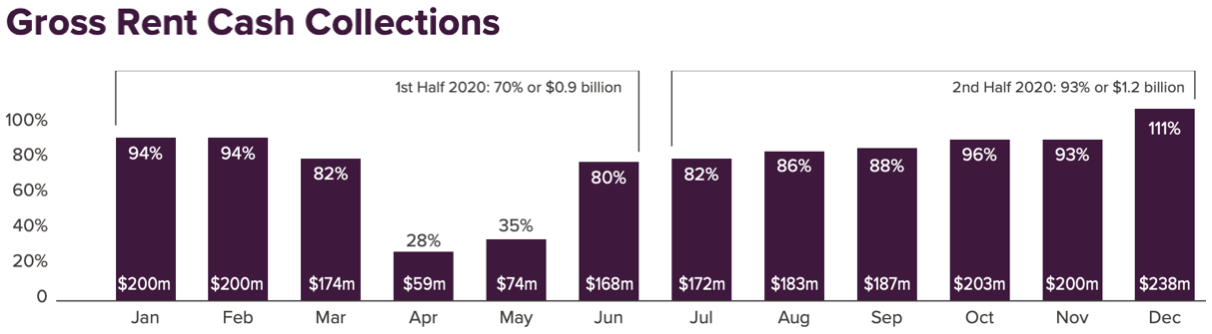

The group collected $2,059 million in gross rent cash collections for the year, including $641 million during the fourth quarter, equivalent to 100% of gross billings.

It was a tale of two halves, as Scentre bounced back in the second half of FY20 as COVID restrictions eased and retail spending improved.

Scentre reported a statutory net loss after tax of $3,731 million, dragged down by property revaluations to the tune of -$4,254 million.

The group highlighted it did not receive any financial support from the Australian and New Zealand governments, including JobKeeper.

It continues to make progress on COVID-related deal negotiations, reaching commercial arrangements with 3,398 of its 3,600 retail partners.

Scentre finished the year with cash and short-term deposits of $2,601 million, and around $15,676 million of debt.

Distributions reinstated

After not paying a distribution in the first half of FY20, Scentre declared a final distribution of 7 cents per security, down from the final distribution of 11.3 cents in FY19.

Management stays agile

Scentre accelerated its customer initiatives during the year, with the highlight being its Westfield Plus membership program. It also trialled a number of new initiatives like aggregated click and collect.

After successfully launching Westfield Plus in New Zealand in 2019, Scentre brought this membership platform to Australia in 2020, which now has more than 1.2 million members.

Westfield Plus is a mobile-based membership program designed to remove friction for customers while shopping at Westfield centres and reward members with benefits.

Shoppers can access exclusive promotions and events, explore the centre map, activate digital gift cards and even check their parking time at selected centres within the app.

Anecdotally, I remember checking the App Store last year and being surprised to see the Westfield app rocket up the rankings in spite of COVID.

Looking ahead

Commenting on the outlook, chief executive Peter Allen said: “We remain customer obsessed and focused on delivering what the customer wants. We will continue to innovate in how Scentre Group provides the best and most efficient platform for retail and brand partners to connect with the consumer.”

Unless conditions materially deteriorate, Scentre expects to distribute at least 14 cents per security to shareholders for 2021.

The group also plans to retain earnings to cover operating and leasing capital expenditure, fund strategic initiatives and reduce net debt.

If you’re interested in generating passive income, check out Rask Media’s ASX dividend shares hub for all the latest news, share ideas and analysis.