Investors may smell a value play as Nanosonics Ltd (ASX: NAN) showed signs of recovery in its half-year (1H21) report. The results failed to meet the market’s expectations, sending the Nanosonics share price tumbling by more than 6%.

Nanosonics manufactures and distributes its flagship product, trophon ultrasound probe disinfector, along with related consumables and accessories. This product disinfects ultrasound probes with rapid efficiency.

The company also researches, develops, and commercialises other infection control and decontamination products, and related technologies.

Consumables/services revenue remains resilient but capital sales fall

Nanosonics’ revenue dropped by 11% compared to the prior corresponding period, 1H20 (PCP). It was dragged down by the expected fall in purchases from one of its biggest customers, GE Healthcare, due to the impact of COVID-19 on its inventory.

Capital sales revenue fell by 35% relative to the PCP. Nanosonics notes it experienced the majority of this downfall in Q1 FY21.

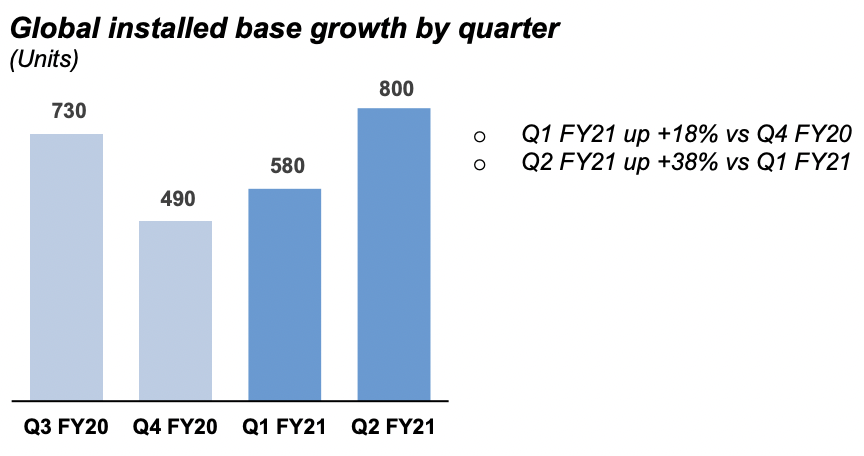

Even though capital revenue declined, the company notes the number of installed units has recovered to pre-COVID levels, as seen below.

Once these units are installed, Nanosonics earns the majority of its revenue from consumables and services attached to the usage of the unit.

It is encouraging to see that consumables and services revenue remain relatively stable as it only dropped by 1% relative to the PCP. This revenue is primarily driven by the volume of ultrasound procedures.

The second quarter of FY21 saw ultrasound procedures ramp up as COVID restrictions on surgeries were lifted. As a result, the consumables and services revenue for Q2 FY21 outperformed revenue achieved in Q3 FY20 and Q4 FY20.

The subdued performance of capital revenue along with a slight drop in consumables and services revenue resulted in a lower EBIT and net profit after tax (NPAT), decreasing by 100% and 74%, respectively, over the PCP.

Management is positive about the future

Nanosonics CEO, Michael Kavanagh seems quite positive about the future, as he said, “Based on current market improvements the Company is anticipating ongoing growth in total revenue and profitability into the second half, driven by increasing installed base growth and increased usage of consumables across all regions. With COVID-19 vaccination programs underway, the Company is optimistic that overall market conditions, in particular access to hospitals, are likely to continue to improve.”

Michael Kavanagh also highlighted Japan will become a key contributor to growth in installations, as well as further expansion into the Asia Pacific.

My take on Nanosonics’ result

It seems the pandemic highlighted how resilient Nanosonics’ consumables and services revenue is when faced with headwinds.

Despite the significant drop in capital revenue since COVID, the company has already managed to reach pre-COVID levels, showing how important its solutions are for hospitals.

If the world continues to contain COVID, and vaccinations prove to be effective, I think Nanosonics could be a solid long-term investment.

In saying that, Nanosonics continues to focus on global expansion and research and development, so operating expenses should be monitored.

Before you consider Nanosonics, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.