Shares in fashion retailer Universal Store Holdings Ltd (ASX: UNI) have soared over 10% today after releasing half-year results which have come in slightly above previous guidance.

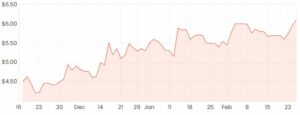

Since listing on the ASX late last year at $3.80, the Universal share price has delivered a 75% return.

UNI share price

What did Universal report?

Across the board, sales were up 23.3% on the prior corresponding period (pcp) to $118 million. Like-for-like sales growth was up 26.2% and online sales jumped 128.3%, which now account for roughly 12% of total sales.

Gross profit came in at $67.9 million, an increase of 24.5%, with the gross profit margin edging slightly higher to 57.6%.

Universal’s cost of doing business (CODB) decreased as a proportion of revenue to 29.2%, compared to 35.7% in 1H FY20.

Underlying EBIT was $31.5 million, up 69.4% on the pcp, and underlying net profit after tax (NPAT) was $21.1 million, up 63.6% on the pcp.

A fully franked dividend of 5 cents per share was declared, which will be paid on 4 May 2021. The company has also announced it will pay back the net JobKeeper benefit of $3 million.

Unlocked operating leverage

Universal’s impressive gross profit margin is partly the result of accelerated growth in private brand expansion, a continued direct sourcing shift, and disciplined promotional activities.

Tighter cost controls were an additional factor, which significantly boosted store profitability on a like-for-like basis.

Underlying EBIT of $31.5 million includes the JobKeeper payment of $3 million that will be repaid. However, even omitting this line item, there’s still a significant increase in underlying cash flows.

No new stores were opened in the first half of FY21, however, online growth continues to deliver strong results, evidenced by higher conversions, traffic and basket size resulting in online penetration up 12% compared to 6% in 1H FY20.

Universal finished the half-year with a net cash balance of $22.5 million and a slightly depleted inventory balance, which it plans to rebuild to around $17-18 million (currently $15.4 million).

Future outlook

Like other ASX retailers, no full-year guidance will be provided due to the uncertainty around COVID-19. However, management seems optimistic about 2021 and beyond.

Management expects to open three new stores and expand two existing stores in the second half of FY21. The company is additionally undertaking a review of its current distribution centre, however, Universal believes that there will be no significant changes to the centre until 2022.

Further growth in 2021 will be driven by the new store rollout, continued investment in its online capabilities and the optimisation of its product mix that will introduce new brands in addition to its private brand categories.

For more reading on Universal, check out this article: Universal Store debuts on the ASX… Time to buy shares?.