4DMedical Ltd (ASX: 4DX) shares emerged from a trading halt on Thursday after the company announced a material grant and a subsequent capital raise.

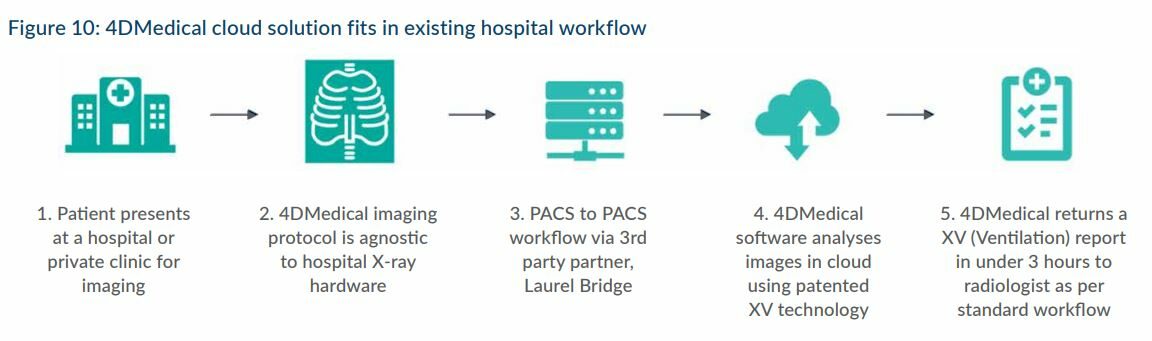

4DMedical is a health technology software-as-a-service (SaaS) business that operates in both Australia and the US. Its XV Technology is able to accurately scan a patient’s lung function as they breathe, resulting in better-informed diagnoses and ultimately, a better outcome for the patient.

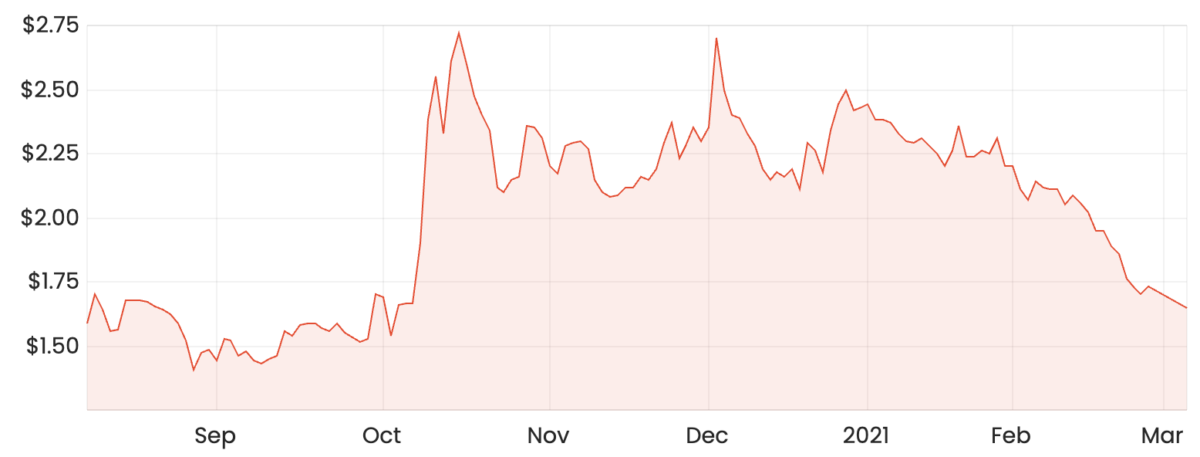

4DX share price

Grant funding

On Tuesday, the company announced that the Australian Lung Health Initiative (ALHI) – a consortium that is both founded and led by 4DMedical – had been awarded a grant worth $28.9 million from the Australian Federal Government’s Medical Research Future Fund (MRFF), which will be paid out in tranches over the next five years.

Proceeds from the grant will be used to accelerate the development by ALHI of two next-generation XVD scanners, which are the world’s first dedicated lung function scanners.

These scanners will integrate with 4D’s XV VLAS software, which claims to provide safe and effective lung analysis for both adults and children.

4DMedical taps the market for $40 million

In addition to the grant, 4DMedical received commitments for $40 million through a placement at $1.55 per share, representing roughly a 10.4% discount to the previous closing price.

A share purchase plan (SPP) will also be offered, allowing eligible shareholders an opportunity to buy shares at the same price of $1.55 per share.

The proceeds will be partly put towards the development and eventual commercialisation of the scanners, but will also provide some balance sheet flexibility to pursue other potential growth opportunities.

4DMedical reported a fairly strong cash position of $43.04 million as of 31 December 2020, so it appears to be fairly well capitalised for at least the short-term.

However, as the company continues to accelerate the development of its technology and increase spending on sales and marketing, further capital raises and shareholder dilution could be on the horizon.

Given 4D’s current stage of its growth story, it’s burning cash at a fairly rapid rate. In the six months to 31 December 2020, net cash outflows from operating activities were a little over $9 million. This was propped up by its IPO last year, which raised $50 million at 73 cents per share.

Is the 4DMedical share price attractive today?

Its recent rally late last year which saw the 4DMedical share price hit upwards of $2.70 was far too optimistic in my view. And I think the recent downtrend could be the market accounting for the fact that it might be quite sometime before 4DMedical starts generating the type of revenue to support such a valuation.

That being said, the potential market opportunity is large (US$31 billion per year) and with no direct competitors, the amount of time 4D has spent in the research process (>15 years) could offer a significant first-mover advantage. It’s also worth noting that Dr Sam Hupert, the CEO of Pro Medicus Limited (ASX: PME), is on 4D’s advisory board.

Interview: Dr Sam Hupert, the future of medical imaging

The first generation XVD scanner is anticipated to be placed in hospitals for clinical trials by early 2022 and will be commercialised in 2023. This is two years before the second generation version which is then expected to be commercialised in 2025.

Keep in mind, however, that these dedicated lung scanners will not be 4D’s only source of income. 4D’s XV technology is a SaaS platform that has been designed to fully integrate with existing infrastructure such as X-ray machines, resulting in a fairly capital-light business model charged on a per-scan basis.

Even still, with just over $100,000 in customer receipts in the first half of FY21, 4DMedical commands a fairly large relative market capitalisation of roughly $400 million. Given this stretched valuation, the potential downside could be significant at these levels.

For shares to be attractive at current levels (~$1.65), I’d want to see some clear evidence of progress towards the adoption of its XV technology in hospitals, which can take a significant amount of time.

Doctors need to be certain that the XV technology is safe and effective prior to completely changing their diagnostic process. Ideally, it needs to have a demonstratable track record that will further boost its credibility in the industry.

Therefore, I think the distribution of 4D’s platform will likely be a drawn-out process, so I’m happy to wait on the sidelines for the time being hoping to pick up some shares at a lower price than what they are today.

For some other share ideas, check out this article: 2 ASX tech shares I’m watching in March.