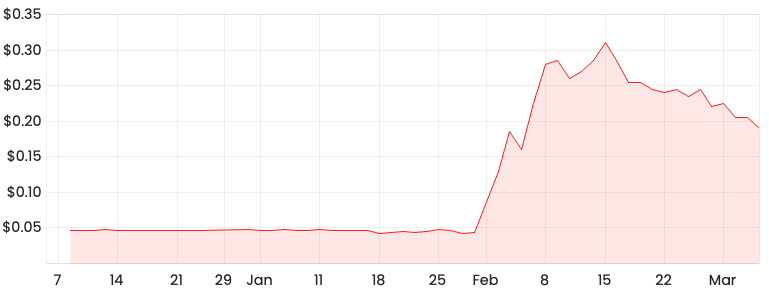

Secure your buckle as the Rent.com.au Ltd (ASX: RNT) share price continues to descend from its February heights. What triggered the ascent and why is the Rent.com.au share price falling?

RNT share price

How does Rent.com.au make money?

Rent.com.au aims to provide a digital rental marketplace equipped with products and services that simplify the renting process for renters, landlords and agents in Australia. The company is focused on becoming Australia’s number one site for rental properties. Think of Airbnb Inc (NASDAQ: ABNB) but for Australian rental properties.

Rent.com.au generates income primarily from one-off and periodic fees related to renter products, such as RentCheck, RentBond, RentPay and RentConnect. On the flip side, the company also receives fees from agents and landlords from products like RentCheck, RentReports, RentQuotes, RentBond and RentPay. On top of this, advertising revenue is the remaining source of income.

The Bevan Slattery effect

On 2 February 2021, Rent.com.au announced that Australian technology entrepreneur, Bevan Slattery invested $2.75 million into the business. Bevan Slattery believes the company has a disruptive platform that has the ability to scale.

It seems like Bevan Slattery has the golden touch as the Rent.com.au share price rocketed subsequent to this announcement. This also occurred in his previous investments like IntelliHR Ltd (ASX: IHR), and Pointerra Ltd (ASX: 3DP).

So, what does Bevan Slattery see in Rent.com.au?

RentPay a possible game-changer?

Investors should note that revenue from renter products currently represent around 58% of total revenue and continues to be the key driver of growth. At the time of the Bevan Slattery investment announcement, Rent.com.au flagged it was preparing to launch RentPay.

I think Bevan Slattery sees a lot of potential in this new renter product as Rent.com.au aims to provide renters more control and flexibility over their payments and managing their housing expenses.

On Rent.com.au’s website, it notes RentPay has a monthly membership fee of $3.00 charged in the first week of each month via direct debit. However, this fee does not apply if the renter opts to pay only by credit card.

Still early days

As Bevan Slattery said, Rent.com.au has the potential to become a scalable disruptive platform and I share his sentiment. One key reason is that Rent.com.au still managed to record decent growth in a challenging rental property environment due to a drop in migration and lower interest rates making home ownership more appealing.

It will be interesting to see how much revenue Rent.com.au generates from RentPay given renters can choose to pay by credit card without incurring a monthly fee. On the flip side, this new product could result in greater customer retention as renters may enjoy the greater flexibility and control they have over rental expenses.

This new product could enhance Rent.com.au’s strong customer satisfaction as evidenced by the 4.9-star rating on the Apple App Store and Google Play.

If the share price continues to slide, I think Rent.com.au could be a solid long-term investment, especially once the borders open.

If you are interested in other ASX growth ideas, I suggest getting a free Rask account and accessing our full stock reports. Click the link below to join for free and access our analyst reports.