The Zip Co Ltd (ASX: Z1P) share price has been pulling back recently, similar to other BNPL players like Afterpay Ltd (ASX: APT) and Sezzle Inc (ASX: SZL).

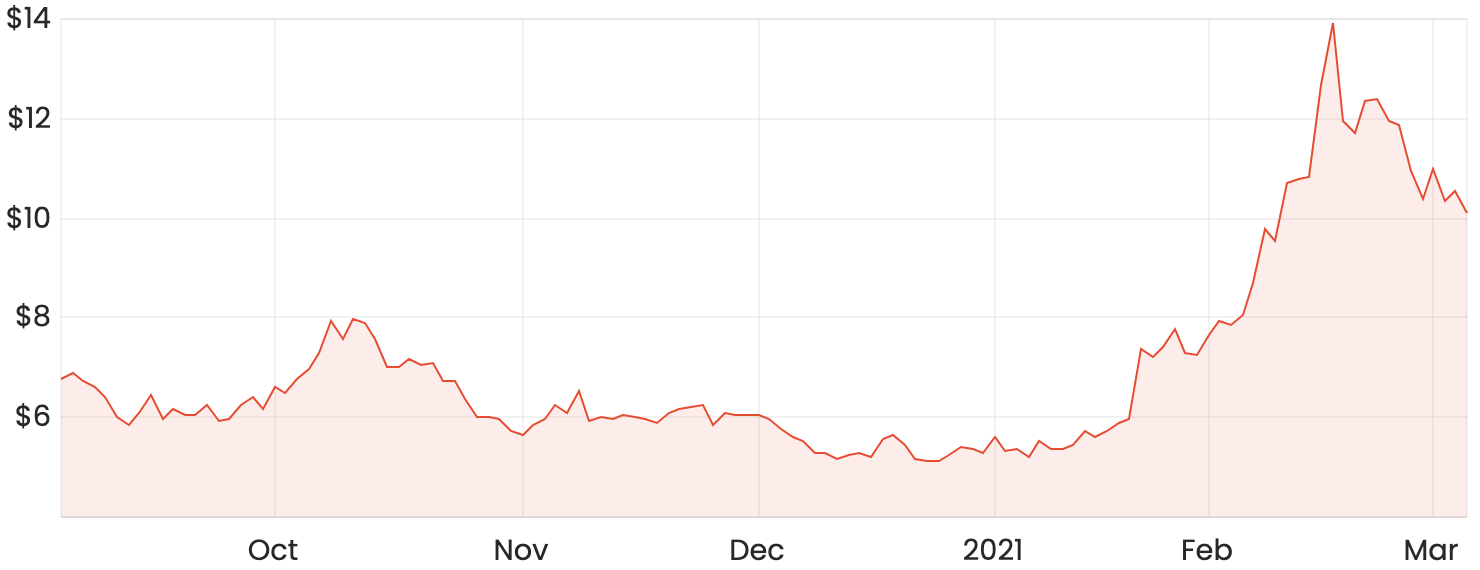

Since reaching an all-time high of $14.53 in intra-day trading in mid-February, the Zip share price has slid roughly 30% to hover around the $10 mark.

With falling share prices, is there anything to be concerned about Zip’s business?

Z1P share price

How did Zip reach its peak last month?

The Zip share price rocketed up in late January due to a fantastic set of results for the second quarter of FY21, being October to December 2020. The company achieved stellar growth rates across all metrics as it reaped the benefits from the successful acquisition of the US-based BNPL company, Quadpay (now Zip US) in August 2020.

Quadpay proved to be a game-changer for Zip as it contributed $59 million to the Zip global segment revenue of $60.8 million in the company’s most recent HY21 results. Prior to the Quadpay acquisition, the Zip global segment only generated $597,000 in revenue for HY20.

Given Zip only acquired Quadpay in August 2020, it is difficult to assess Zip’s performance in managing the US business. And more importantly, the Zip Australia segment still generates the majority of its revenues, as it contributed to 59% of the total HY21 revenue of $159.8 million. So, let’s turn our focus to Zip’s organic segment.

Zip’s organic growth remains strong

Zip recorded strong growth in its primary segment, Zip Australia where revenue jumped by 42% compared to HY20 and direct costs of sale reduced by around 4% for the same period. Direct costs include expenses like interest, bad and doubtful debts, and bank fees and data costs. However, operating expenses increased as a percentage of Zip Australia revenue, from 47% in HY20 to 57% in HY21.

The significant boost in gross margins resulted in an improvement in a net segment loss before income tax of -$14.1 million in HY20 to -$9.9 million in HY21.

Zip Australia continues to take market share, as it secured a record number of new customers to the platform, as well as adding new merchants like Harvey Norman Holdings Ltd (ASX: HVN), Pizza Hut, and Priceline. The number of new merchants is a key driver of growth in revenue. The more retailers that offer Zip, the more choices for a customer, resulting in a more favourable offering for a customer and in turn, for merchants as well. Like other BNPL companies, Zip enjoys the benefit of network effects.

Zip also secured a licence with Visa Inc (NYSE: V), enabling it to offer Zip Pay users the ability to shop anywhere that accepts Visa.

My thoughts on Zip shares

Even though Zip is lagging behind its direct competitor, Afterpay in terms of web traffic and number of users, there are still strong signs of growth. Zip advised that the Zip App was the most downloaded BNPL app in Australia for December 2020.

The rising number of merchants and customers suggest that there is still a long runway for growth. Investors should monitor the rate of growth in both new merchant and customers to gauge how well Zip is penetrating key markets.

It’s promising to see that Zip’s organic segment is strengthening, showcasing its ability to potentially replicate this across its global segment.

The Zip App is highly rated by users based on the Apple App Store and Google Play Store, so it appears Zip is developing a strong brand and position within the BNPL space. If the Zip management team can execute in the global market, Zip will likely continue its strong momentum in growing BNPL industry.

For more reading on Zip’s recent financial results, you can read Jaz’s article: Zip share price drops after strong HY21 results. If you are interested in getting some exposure to the BNPL sector in an ETF instead, I suggest checking out some articles on Best ETFs.