Looking for ASX dividend share ideas? Here are two I think are worth considering for income right now.

Magellan

Magellan Financial Group Ltd (ASX: MFG) is an investment manager that has funds under management (FUM) of $100.9 billion as of 31 December, which was up 9% on the prior period.

Magellan’s ability to pay dividends to shareholders is partly contingent on the amount of management fees it collects, which are higher when it has more funds under management. Over the last several years, Magellan has been able to steadily grow its FUM and increase its dividends accordingly.

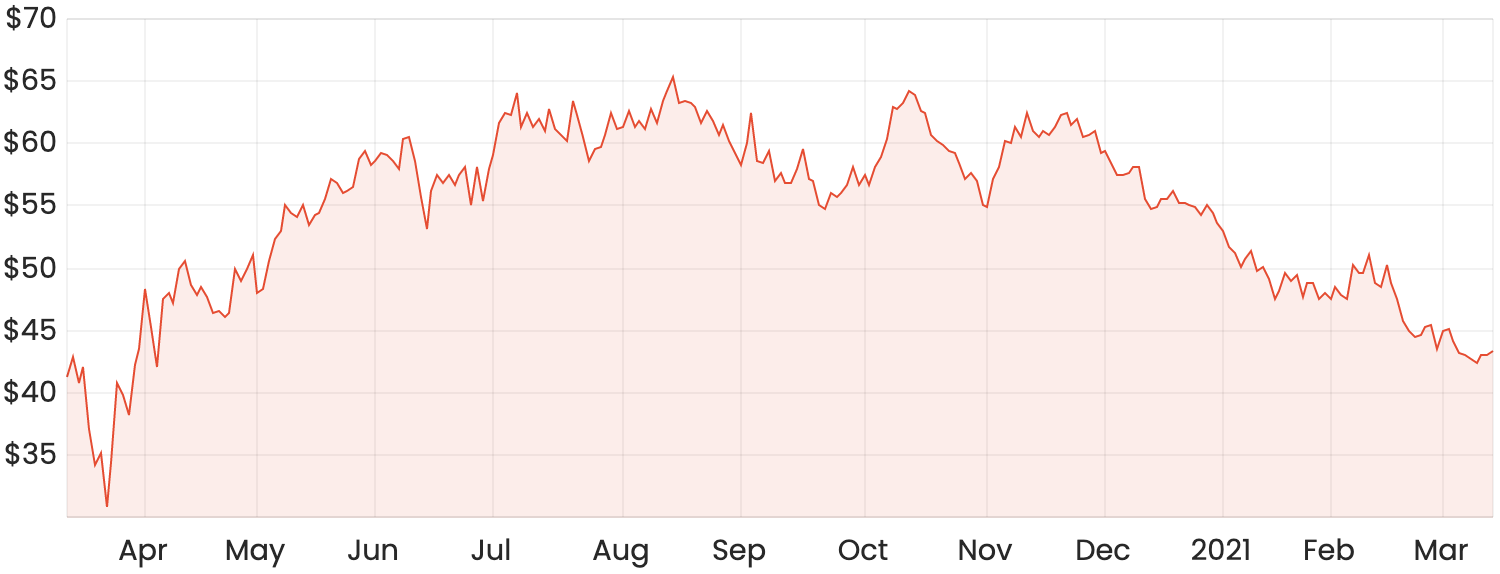

MFG share price chart

Past performance doesn’t always guarantee future results, but there are a few reasons why I think Magellan might be able to keep up the momentum.

Depending on who you talk to, returns from passive investing may be compressed in future years, as much of the past outperformance has been from a small selection of winners, and a reversal of this performance might mean passive styles of investing may produce less attractive returns.

This could give active fund managers a chance to outperform and attract more funds from outside investors, allowing Magellan to continually grow its FUM and maintain the same level of fees.

For more detail on why I like Magellan shares, check out this article: These could be 2 of the best dividend-paying stocks on the ASX.

Accent Group

Accent Group Ltd (ASX: AX1) is the leader in the distribution of performance and lifestyle footwear in Australia and New Zealand. It has a well-diversified and popular range of brands including The Athletes Foot, Hype DC, Platypus, Vans, DrMartens and Timberlands, amongst others.

In Accent Group’s HY21 results, the retailer announced it will pay a fully franked interim dividend of 8 cents per share, which works out to be a yield of roughly 3.4%. Including the company’s final dividend in FY20 of 4 cents per share, this puts shares on a trailing dividend yield of 5.1%.

Accent Group didn’t repay its JobKeeper payments to the Australian Government, but it indicated the funds have been used to keep staff employed and were not used for the payment of management bonuses or dividends.

Accent’s growth strategy remains underway and the retailer expects to open 90 new stores in FY21 across its various brands. COVID-19 saw many customers shop at Accent Group’s outlets for the first time. As such, it now has a contactable database with over 7.6 million customers and a chance to continue to expand its product offering.

While COVID-19 might have accelerated a shift to e-commerce, I think Accent Group might be more immune than other retailers, as trying on shoes in person is a consumer preference that seems unlikely to change any time soon.

For an in-depth take on Accent Group shares, check out this article: This ASX retail share could be one of the best on the market.

Or for more ASX dividend share ideas, click here to read: 2 ASX dividend shares I’d buy with $2,000.