Infratil Ltd (ASX: IFT) has confirmed its support for the acquisition proposal of its stake in Tilt Renewables Ltd (ASX: TLT).

The Infratil share price finished the day more than 2% higher on the news, while Tilt Renewables shares surged by 15%.

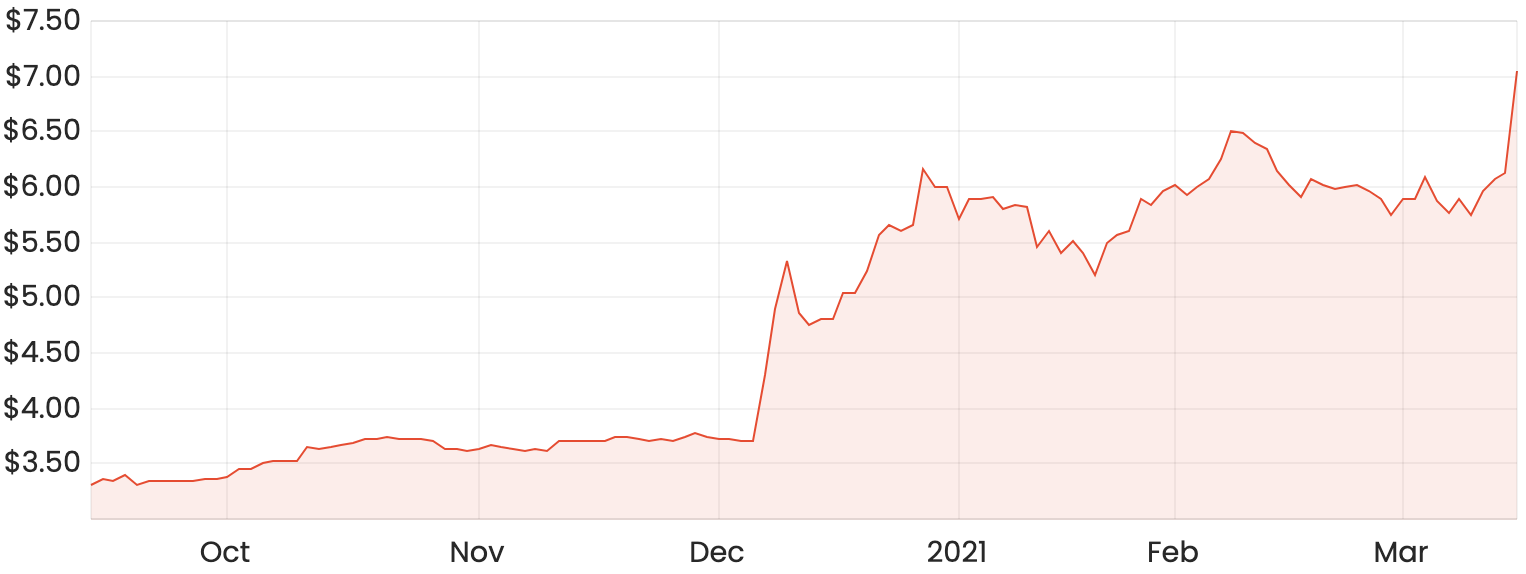

IFT share price chart

Infratil is a New Zealand-based infrastructure investment company that primarily invests in renewable energy, airports, data & connectivity and social infrastructure businesses in growth areas.

Infratil currently holds a 65.5% stake in Tilt Renewables, which owns wind farms across Australia and New Zealand.

Sale details

Under the scheme agreement, Powering Australian Renewables

(PowAR) will acquire Tilt’s Australian business, while Mercury NZ Ltd (ASX: MCY) will buy Tilt’s New Zealand windfarms. Tilt shareholders will receive NZ$7.80 per share as part of the transaction.

Infratil expects to receive gross proceeds of roughly NZ$1.9 million from the sale, which would mean pocketing around NZ$1.2 million after adjusting for its current carrying value of Tilt shares.

In early December 2020, Infratil announced it had commenced a strategic review of its shareholding in Tilt. The sale price unveiled today represents a near 100% premium to the Tilt share price prior to this announcement.

TLT share price chart

Shortly after the announcement in December, AustralianSuper made a $4.5 billion takeover bid for Infratil, valuing its shares at NZ$7.43 each, a 22% premium to the current share price at the time. Infratil turned down the offer, with management stating that the deal materially undervalued Infratil’s high-quality portfolio of assets.

What’s to like about Infratil?

Infratil has investments in various sectors that could play a critical role in years to come, such as energy decarbonisation, data storage and healthcare.

If you’re familiar with NextDC Ltd (ASX: NXT), Inftail has a 48% stake in Canberra Data Centres (CDC), which provides a similar range of services to government clients through six data centres across Canberra.

One of Infratil’s more recent investments was a 60% stake in Qscan Group, a comprehensive diagnostic imaging practice.

This acquisition plans to capitalise on a growing social need driven by an ageing population with an increasing prevalence of chronic disease. Qscan owns over 300 machines that provide diagnostic imaging services predominately across the eastern seaboard of Australia. Over 85% of this industry’s revenue is funded by Medicare, so it appears to be a very reliable and defensive play.

Summary

Infratil is an interesting company that seems to be invested in some really important and potentially high growth areas. It remains on my watchlist for now and I look forward to seeing how it performs in 2021 and beyond.

For a more in-depth look at Infratil, check out this article: Why I think Infratil is one ASX share to look out for.