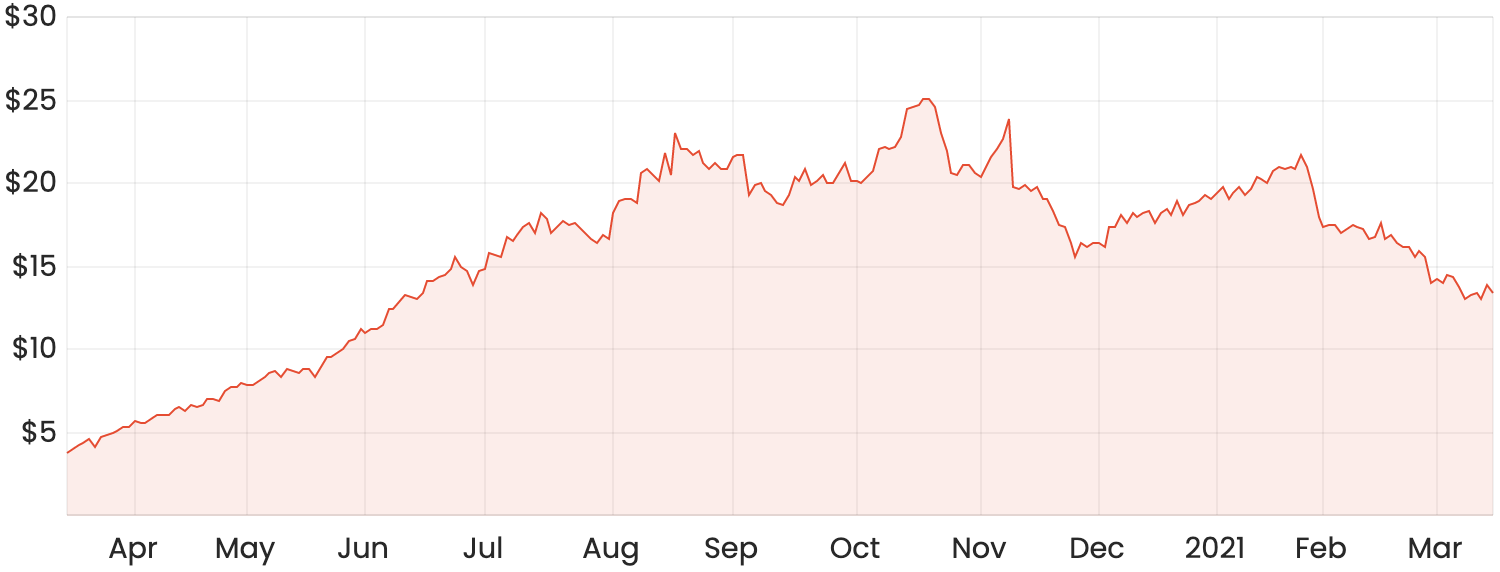

Retailer Kogan.com Ltd (ASX: KGN) has proven to be one of the biggest retail beneficiaries of COVID-19, with the stock returning over 500% when it hit a peak of around $25 per share late last year.

Rising bond yields and the subsequent rotation into value stocks has seen the Kogan share price come down around 30% in the past month alone. Is it time to buy Kogan or will it fall further?

KGN share price chart

Given Kogan’s sensitivity to rising bond yields, it seems likely that it could fall further from here if we do see a continued rotation into some of the COVID-hit sectors like travel and tourism. Valuation aside, what’s to like about Kogan?

Growth story continues

Kogan appears to be experiencing some significant scale benefits as it continues to grow. Compared to the prior corresponding period in H1 FY20, total revenue grew 89% to $414 million, but a higher fixed cost base meant its gross profit margin could expand by nearly 4.6%, resulting in a 132.4% jump in earnings before interest, tax, depreciation and amortisation (EBITDA) for H1 FY21.

Although the company only achieved a slim net profit margin of roughly 5% in FY20, you can see from the image below that Kogan’s operating margins have been trending upwards over the last few years. In other words, its costs are rising at a slower rate than its revenue growth, resulting in higher net profit.

A large growth driver for Kogan has been its line of exclusive brands, which recorded revenue and gross profit growth in H1 FY21 of 114.9% and 174.9%, respectively. These products made up 55.9% of total gross profit across the period, and its high popularity seems to indicate Kogan offers a compelling product offering and is building a trusted brand.

Another impressive metric has been its growth of active customers, which was up 76.8% in H1 FY21 to over 3 million customers. Customers across its recently-acquired Mighty Ape platform was up to 719,000.

The expansion of Kogan’s product range will cater to more customer interests, potentially encouraging more repeat purchases. This, combined with growing customers, will likely widen its total addressable market.

Summary

I think Kogan is starting to look quite good at these levels and that the market might’ve overreacted on this recent downturn.

This overreaction is likely due to the growing shift towards value shares in light of rising bond yields.

Kogan has a lot of good qualities I’d typically look for in an investment, including scale advantages, increasing profitability and a growing customer base. Its recent acquisition of Mighty Ape appears to make a lot of sense, and the company may enjoy some more cost benefits as it’s further integrated.

For more share ideas, click here to read: 3 more “buy the dip” shares to buy in a market crash.