The ASX 200 (ASX: XJO) is set to fall when the market opens on Thursday according to the latest ASX futures. Here’s what’s making headlines across local and global sharemarkets.

ASX 200 weakens, CBA makes a splash in BNPL

The S&P/ASX 200 fell 0.5% on Wednesday, following a confluence of global factors. It was a mixed day with six of the 11 key industry sectors falling, but energy and materials remaining under pressure.

The iron ore price has remained strong, however, both BHP Group Ltd (ASX: BHP) and Rio Tinto Limited (ASX: RIO) fell as other commodity prices including copper weakened.

Despite forecasts for the oil price to reach $100 per barrel once again, the domestic industry remains a small player on a global scale, with OPEC ultimately determining profitability; Santos Ltd (ASX: STO) fell 0.8%.

The biggest news on an otherwise quiet day was another new entrant into the buy now, pay later space (BNPL), something I’ve highlighted many times in recent years. This time the Commonwealth Bank of Australia (ASX: CBA) has decided to throw its hat in the ring, launching an instalment payment option for its 4 million retail customers.

Some analysts are suggesting this may be the beginning of a thinning out of margins for the likes of Afterpay Ltd (ASX: APT), with CBA announcing its merchant fees would be no higher than the current transaction fees paid by its retail partners. A key plank of revenue for BNPL has and will remain the fees paid by merchants for the pleasure of using their service.

Paladin raising again, Corporate Travel share price tumbles

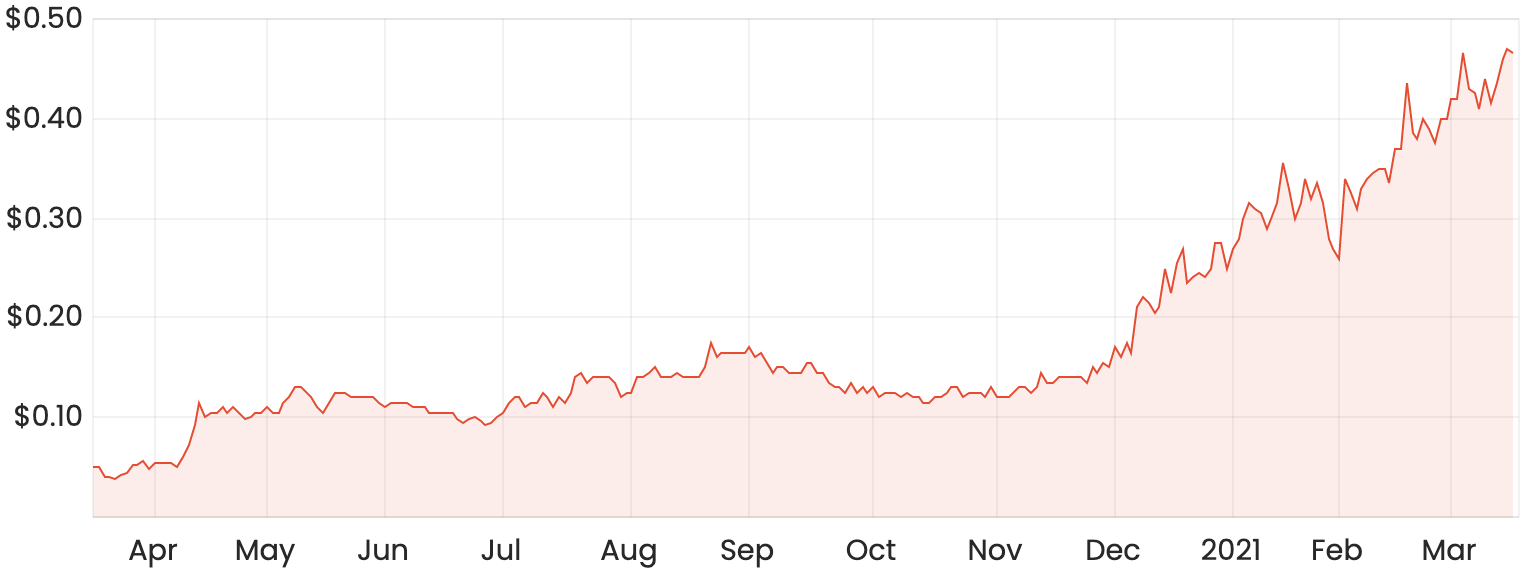

Uranium miner Paladin Energy Ltd (ASX: PDN) has staged a remarkable recovery in recent months, rallying from just 5 cents in 2020 to 46 cents today. Those with a long memory will remember Paladin traded as high as $9 before the Fukushima disaster put a slowdown on nuclear energy.

The company is now seeking to raise another $218 million as part of a business ‘reset’, paying off legacy debt and preparing to restart its Langer Heinrich mine; the offer is at 37 cents per share.

Paladin share price

Corporate Travel Management Ltd (ASX: CTD) has been the subject of significant short selling and fell heavily yesterday, down 5.6%, after the company announced Managing Director Jamie Pherous had sold 1 million shares.

The RBA’s roadshow also continued, with Assistant Governor Christopher Kent highlighting the risk to small business that lies ahead of the JobKeeper cliff, stating “Overall smaller businesses have suffered significantly from the economic hardships caused by the pandemic,” he said. “Business failures are expected to rise as some of the pandemic support measures are phased out.”

It is abundantly clear that the fastest and sharpest recession in history has been a bad one for smaller businesses, with consumers flocking to well-known names.

Federal Reserve joins the RBA, Samsung faces shortage

US markets moved higher overnight after the Federal Reserve ultimately delivered the same playbook as the Reserve Bank and most other central banks. Jerome Powell informed the market that the Federal Reserve Board do not intend to raise interest rates until 2023.

More importantly, however, they confirmed that bond purchases would remain at current levels and that whilst they expect a short-term spike in inflation, they do not expect it to last. The Nasdaq moved 0.4% higher, the Dow Jones 0.6% and the S&P 500 0.3%.

The first signs of inflation may be coming from the semi-conductor chip sector, with Samsung Electronics (KS: 005930) flagging a significant shortage of the important inputs into everything from car manufacturing to smartphones and other devices.