The Flight Centre Travel Group Ltd (ASX: FLT) share price continues to fly on an upward trajectory. Can investment in technology help further spread its wings?

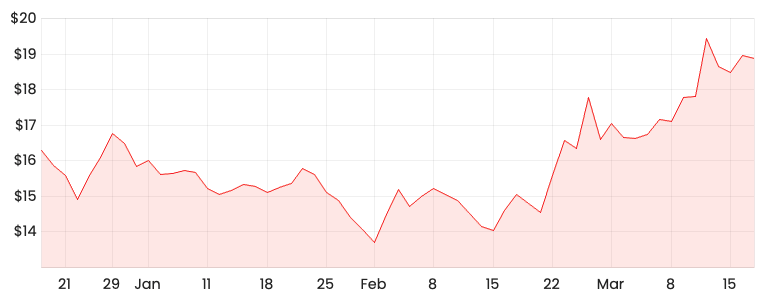

Flight Centre’s share price has risen by around 40% since the start of February 2021.

FLT share price

Despite headwinds, Flight Centre continues to invest in tech

Understandably, Flight Centre recorded lower results due to the COVID lockdowns but the company does not seem too fazed. The company advised analysts in the half-year (HY21) results hearing that strong investment in technology will enable it to launch new global platforms with a focus on personal customer experience.

In HY21, Flight Centre spent $20.9 million mainly on technology improvements to make travel safer and more efficient. The business will start to see the benefits from this expenditure as it rolls out its leisure platform Helio, small business digital platform Melon and online booking engine SOAR.

The most exciting piece of technology appears to be Melon. It uses mobile technology, including robotics and artificial intelligence to provide customers with the best experience and is expected to launch in April.

Flight Centre CEO, Chris Galanty expressed his excitement about the ground-breaking technology as he said, “It means for the first time we’re moving from just having transactional and financial data to behavioural data, which enhances our ability to give a better experience, better savings and better commercial returns.”

Flight Centre’s corporate brand also begun investing in health passports for easier travel.

My thoughts

As The Oracle of Omaha, Warren Buffet once said, “Be fearful when others are greedy and be greedy only when others are fearful”. I think Flight Centre has taken a leaf out of Warren Buffet’s playbook by being offensive in a challenging environment.

It is encouraging to see that Flight Centre is being proactive and focusing on what matters the most, being the end customer experience.

Travel is going to become more difficult in the new world of COVID, so any improvements to the overall travel booking experience will likely ensure Flight Centre returns to its former heights.

If you want in-depth analysis and valuation of Flight Centre, please read Rask Media’s Patrick Melville’s article, Is now a good time to buy Flight Centre (ASX: FLT) shares?

Before you consider Flight Centre, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.