The Westpac Banking Corp (ASX: WBC) share price trended downwards on news of a miscalculation identified by the Reserve Bank of New Zealand (RBNZ). What’s going on with the Westpac NZ unit?

The Westpac share price has fallen flat the last few weeks and the findings by the RBNZ will not help.

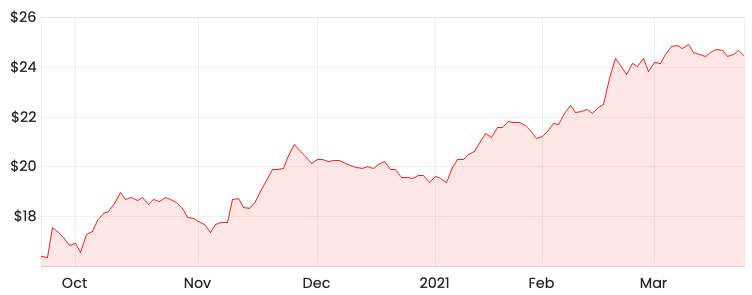

WBC share price

RBNZ discovers a mistake

The RBNZ identified concerns relating to Westpac New Zealand’s (Westpac NZ) risk governance processes and has requested the bank to provide two independent reports to address them.

The concerns are around material failures to report liquidity correctly, in line with the RBNZ’s liquidity requirements. Banks are required to do this to ensure they are accurately disclosing their capacity to handle financial stress.

It’s similar to how some large organisations are required to report their financial position to their loan providers to ensure they are not at risk of defaulting. In this case, Westpac NZ is the large organisation reporting to the regulatory authority.

RBNZ punishment

So, one report will cover an assessment of Westpac NZ’s risk governance processes and practices applied by the Westpac NZ Board and executive management.

The other report will be separate and focuses on Westpac NZ’s explanation and assurance that actions taken would be effective in improving the management of their liquidity risks.

Until both reports are completed and the RBNZ is satisfied, it is increasing the bank’s required holding of liquid assets. Liquid assets include cash or assets that can be easily converted into cash.

My takeaway

The requirement to hold more liquid assets means Westpac will need to increase interest rates in New Zealand, to maintain its profitability.

Westpac is caught in between a rock and a hard place because if it raises interest rates, this would likely weaken demand and make it less attractive relative to its big competitors.

Shareholders of Westpac should monitor this situation closely as it may consider exiting the NZ arm and instead focus on its Australian operations.

If you are interested in how to value Westpac, take a read of Owen Raszkiewicz’s article, Are Westpac Bank (ASX:WBC) shares worth watching?

Otherwise, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.