Is it a plane? Is it a bird? No, it’s the Airtasker Ltd (ASX: ART) share price dropping from its lofty peak. I will be monitoring the following key drivers and data points.

The Airtasker share price closed at a peak of $1.75 yesterday but it’s dropped quite a bit today.

Airtasker is Australia’s leading online marketplace for local services, connecting people and businesses who need work done (Customers) with people and businesses who want to work (Taskers).

Key drivers of revenue growth

Airtasker has experienced rapid levels of growth in customers and revenue over the last few years. What’s been driving this?

In my previous article, I noted the rising average task value contributing to revenue growth. Whilst this is important, I think the number of unique paying customers and frequency are more integral.

Airtasker customers seem to only use it for difficult and infrequent tasks e.g. cutting down a tree, setting up a trampoline. So, it appears the company relies heavily on new users.

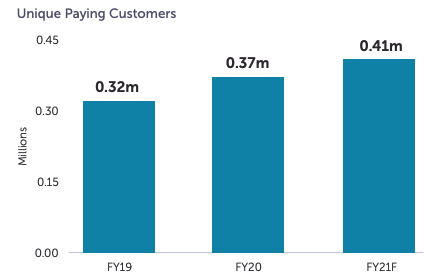

I would monitor the level of unique paying customers, which has been steadily growing as shown below.

Before I delve into the frequency aspect, my colleague Patrick Melville highlighted a loophole in Airtasker’s business model (i.e. if a customer and tasker are satisfied, they could continue their relationship outside the platform).

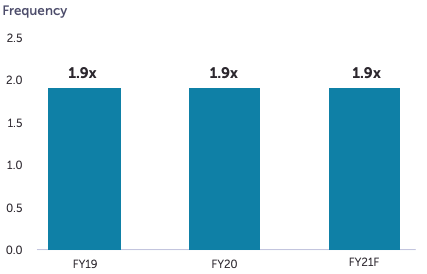

You see, a customer and tasker could save paying the associated fees, which adversely impacts Airtasker’s power to increase repeat usage of its platform. I think this is reflected in the static movement in the level of frequency illustrated below.

Frequency represents the average number of times a unique paying customer assigns a task in a given financial period. It has stayed the same in the past two years and management expects this to remain the same.

The fact that management has forecasted the same level of frequency reinforces the big loophole in its business model.

Given the low repeat usage, Airtasker will likely rely on a high volume of new customers. Some ways to monitor this include checking the number of reviews on the App Store or Google Play, as well as the volume of web traffic.

Web traffic and reviews of the Airtasker app can provide a picture of the rate of engagement. If the number of reviews or web traffic declines, it may indicate existing users are either exploiting the loophole or using a different platform.

Key strengths

I compared Airtasker with Freelancer Ltd (ASX: FLN) in my previous article. I believe the main difference between these two is Airtasker has done a better job in marketing and building its brand, and optimising its mobile app.

It appears Airtasker has executed well in promoting its brand and empowering everyday people by using the term, ‘Taskers’. Not to mention, the constant advertisements of people wearing the Airtasker shirt made it hard for me to forget its brand and logo.

The company may also be benefitting from the choice of name, as it resembles another renown marketplace brand, Airbnb.

The reason why I think Airtasker has a better mobile app is that it has a higher rating and much more reviews in total across the App Store (115,000 vs 481) and Google Play (8,229 vs 50,899). Freelancer has a solid rating on the App Store albeit still lower than Airtasker but it has a much lower rating on Google Play.

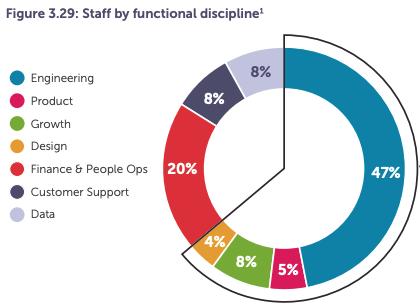

Airtasker’s high rating across both mobile app markets is potentially reflected by the breakdown of staff discipline. Engineering represents 47% of Airtasker’s workforce as depicted below.

Will Airtasker keep flying?

A key pillar of Rask’s investment philosophy is, ‘the stock market is a vehicle for transferring wealth from the impatient to the patient‘. This is the approach I plan on adopting as I monitor the above drivers and data points.

Airtasker is building a strong brand as evidenced by the growing customers and revenue. The key question is whether this growth is sustainable given the low repeat usage levels.

Another reason why the above drivers are important to monitor is the potential network effect. As marketplaces get more buyers, this makes it more attractive for sellers, ultimately creating a fly-wheel effect.

If Airtasker can continue to optimise its platform and attract more users, then it could potentially become a dominant marketplace.

Before you consider Airtasker, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.