Shares in financial services company AMP Limited (ASX: AMP) fell 3.6% before being placed in a trading halt towards the end of trading Thursday.

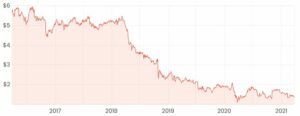

The long-term share price chart below paints a fairly sad yet accurate picture of the challenges faced by the embattled company.

While shares have been in a downtrend for quite some years, the situation worsened around the time of the Hayne Royal Commission. Since then, AMP’s shares have lost around 74% of their value.

CEO resigns? Not so fast?

According to an article from the Australian Financial Review, chief executive Francesco De Ferrari was believed to have stepped down from his position. According to the reporting, CEO of AMP Australia Scott Hartley would take over as the acting chief executive while a replacement was found.

However, after the ASX’s market hours, at around 6:25 pm AEST Thursday, AMP did make an announcement to the market to say:

“AMP Limited notes the media reports today and confirms that Francesco De Ferrari remains as

Chief Executive Officer of the group.”

So, it seems, De Ferrari is still at the helm.

It was easy to see why De Ferrari’s potential resignation could be an issue for investors. After a string of investigations last year into the conduct of AMP Capital leader Boe Pahari, this eventually led to the resignation of chairman David Murray and AMP Capital chairman John Fraser, as well as Pahara from his position.

Are AMP’s shares a buy at these levels?

I can certainly appreciate the steps the company is trying to take to turn the company around by cutting costs and simplifying its portfolio of businesses.

Even though shares appear to cheap relative to where they once were, I wouldn’t want to invest in such a challenging space where further downside seems like a real possibility.

If you’re interested in buying AMP’s shares, it might be a safe idea to wait on the sidelines until further trading updates would indicate that operating conditions are improving. Even if the share price had jumped 10% by that point, it can be a much safer option compared to trying to catch a falling knife.

If you’re looking for more share ideas in the financials space, we write about Magellan Financial Group (ASX: MFG) here at Rask quite a bit. You can read about Magellan here: Here are 2 ASX shares I’d buy for dividends.

I’d also recommend signing up for a free Rask account to get access to our stock reports.