Seems like some people are leaving the hub as the Hub24 Ltd (ASX: HUB) share price dropped by 14% yesterday. Is it time to take advantage of a less crowded hub?

Hub24 provides an investment and superannuation platform for all types of investors whether it be individuals or self-managed super funds.

Hub24’s share price tumble coincided with a similar share price drop for its main competitor, Netwealth Group Ltd (ASX: NWL) yesterday. Is it a coincidence? I think not.

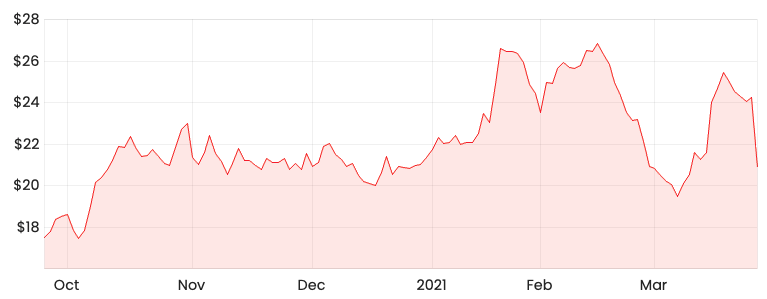

HUB share price

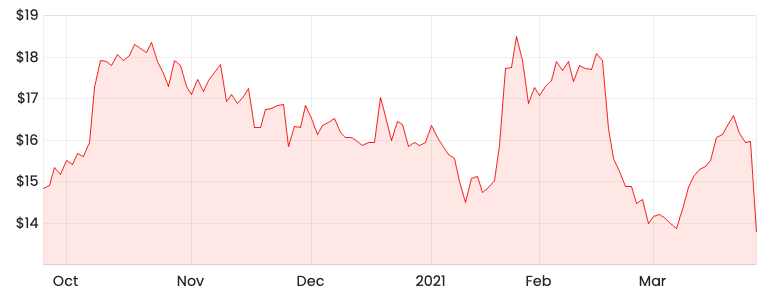

NWL share price

Why has the HUB and NWL share price fallen?

The main reason for the fall in Netwealth’s share price is the termination of its agreement with Australia and New Zealand Banking Group Ltd (ASX: ANZ) on interest payable pooled cash accounts in 12 months. Wait, what’s a cash account?

So, similar to Hub24, when you subscribe to an investment or superannuation platform, a cash account is established for you. This cash account is an interest-earning account.

Like Netwealth, Hub24 also uses ANZ as its authorised deposit-taking institution or bank custodian to hold these cash accounts. Netwealth and Hub24 pool all the cash accounts together so all clients earn the same interest.

So, back to the ANZ termination, why has this happened?

The interest income received on the existing cash balances in the cash accounts of Hub24 and Netwealth is determined by the interest rate set by ANZ, which is indexed to the Reserve Bank of Australia’s cash rate. Given the RBA’s cash rate has fallen to historically low levels, it appears ANZ wants to reduce its interest exposure by negotiating a lower rate with Netwealth.

It’s a similar concept with everyday term deposit accounts as banks often offer lower interest rates as the RBA cash rate decreases.

Lower interest rates mean lower income for HUB and NWL

The current official RBA cash rate is at 0.10%, which is evidently low. So, you might think any decrease would have little impact on the bottom line for Hub24 and Netwealth right?

Well, both businesses administer a significant amount of funds, otherwise known as funds under administration (FUA). The FUA for Hub24 is $22 billion and for Netwealth, it’s a staggering $40.7 billion.

In Netwealth’s most recent update on its half-year results (HY21), the balance of its cash account was 7.2% of FUA. Unfortunately, it appears Hub24 doesn’t provide a similar breakdown. In any event, I imagine it would be similar to Netwealth.

Revenue for both companies is mainly driven by the amount of FUA. So, any drop in interest rates on the cash accounts will ultimately reduce income and hence the bottom line.

My final thoughts

I think the recent sell-off is an over-reaction given it is based on cyclical macroeconomic conditions.

Investors should note the low-interest rate environment has also been a driving force behind the rise in FUA as active asset classes like equities have been more attractive.

I prefer to focus on the business fundamentals, which remain sound for both Hub24 and Netwealth. Both companies continue to enjoy the growing shift towards independent specialist platform providers brought about by the banking royal commission.

Also, both companies have strong balance sheets, so I am not too concerned about the impact of the low-interest rate environment on cash income for Hub24 and Netwealth.

If you are interested in other ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.